At Pro Hockey Advisors, we often get asked: Why do most investors hold diversified portfolios?

The answer lies in the fundamental principles of risk management and long-term financial growth.

Diversification is a powerful strategy that can help protect and grow your wealth, even in uncertain economic times.

What Is Portfolio Diversification?

The Essence of Diversification

Portfolio diversification is a strategy investors use to spread their money across various assets. It’s like not putting all your eggs in one basket. This approach applies to both financial investments and career decisions.

The Historical Roots

The concept of diversification traces back to 1952 when Harry Markowitz introduced Modern Portfolio Theory. This groundbreaking idea demonstrated that risk-averse investors can build portfolios to maximize expected return based on a given level of risk.

The Mechanics of Diversification

Diversification works because different assets react differently to market conditions. For example, when stocks drop, bonds might rise. Owning both can potentially smooth out your overall returns.

In practice, this might mean investing in:

- Stocks from various sectors

- Bonds with different maturities

- Real estate

- Commodities

The 5% Rule: A Practical Tip

A useful guideline is the 5% rule. This suggests investors should not put more than 5% of their total portfolio in any single investment on a platform. It’s a simple way to avoid overexposure to any one asset.

Real-World Impact

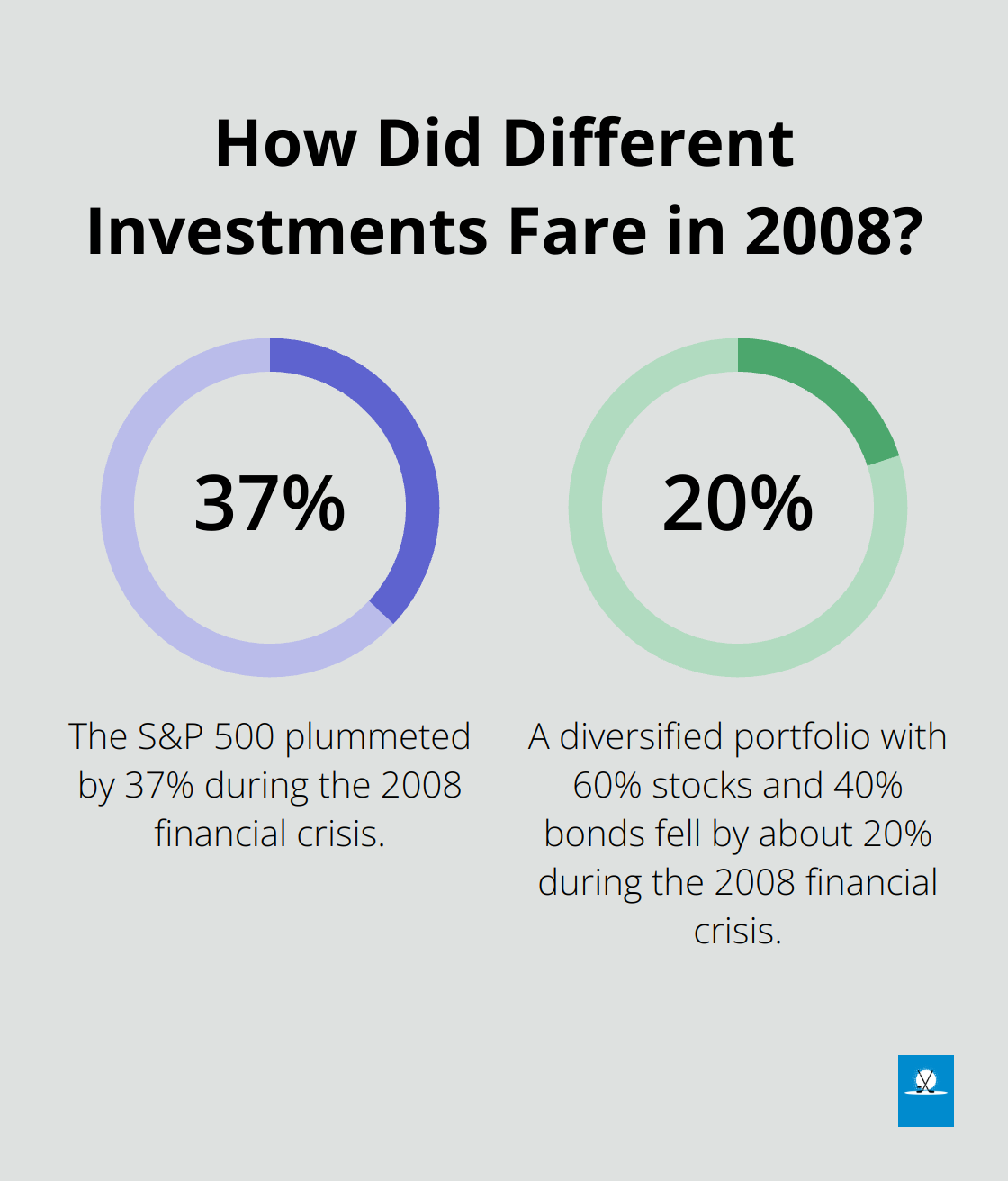

Let’s examine a real-world example. During the 2008 financial crisis, the S&P 500 plummeted by 37%. However, a diversified portfolio (with 60% stocks and 40% bonds) only fell by about 20%. This illustrates how diversification can protect wealth during turbulent times.

Beyond Financial Markets

Diversification extends beyond just financial markets. For professionals in specialized fields (like athletes), it can mean diversifying income streams through endorsements, investments, and post-career planning.

As we move forward, let’s explore the specific benefits that make diversified portfolios so attractive to investors.

Why Diversified Portfolios Are Investor Favorites

Consistent Returns Over Time

Diversified portfolios provide more consistent returns over time. Vanguard’s model portfolios are strategies that help investors choose how much to invest in stocks or bonds based on their goals and risk tolerance. This stability appeals to investors who need reliable income streams, such as professional athletes with shorter career spans.

Protection During Economic Downturns

Different asset classes often react differently to economic conditions. During the COVID-19 pandemic in 2020, many stocks plummeted while government bonds rallied. This inverse relationship protects overall wealth during market downturns. A BlackRock report highlighted that during the 2008 financial crisis, a diversified portfolio lost significantly less than a pure stock portfolio.

Global Growth Opportunities

Geographic diversification allows investors to tap into worldwide growth opportunities. While U.S. markets have outperformed recently, international markets have taken the lead in the past. From 2000 to 2009, international stocks outperformed U.S. stocks by about 3% annually (according to Morningstar data). This global approach resonates with professional athletes who often have an international fanbase and global brand potential.

Risk Management Through Asset Allocation

Diversification optimizes opportunities across various market conditions. Investors can tailor their strategies to balance risk management and growth potential. For example, a mix of stocks, bonds, real estate, and commodities can provide a buffer against market volatility while still offering growth prospects.

Adaptability to Changing Market Conditions

A diversified portfolio allows investors to adapt to changing market conditions without making drastic changes. As different sectors or regions perform well or poorly, the overall portfolio maintains stability. This adaptability proves particularly valuable in today’s fast-changing global economy.

The benefits of diversified portfolios extend beyond just risk reduction. They offer a strategic approach to wealth management that aligns with various financial goals and risk tolerances. In the next section, we’ll explore practical strategies for implementing effective diversification in your investment portfolio.

How to Build a Diversified Portfolio

Spread Investments Across Asset Classes

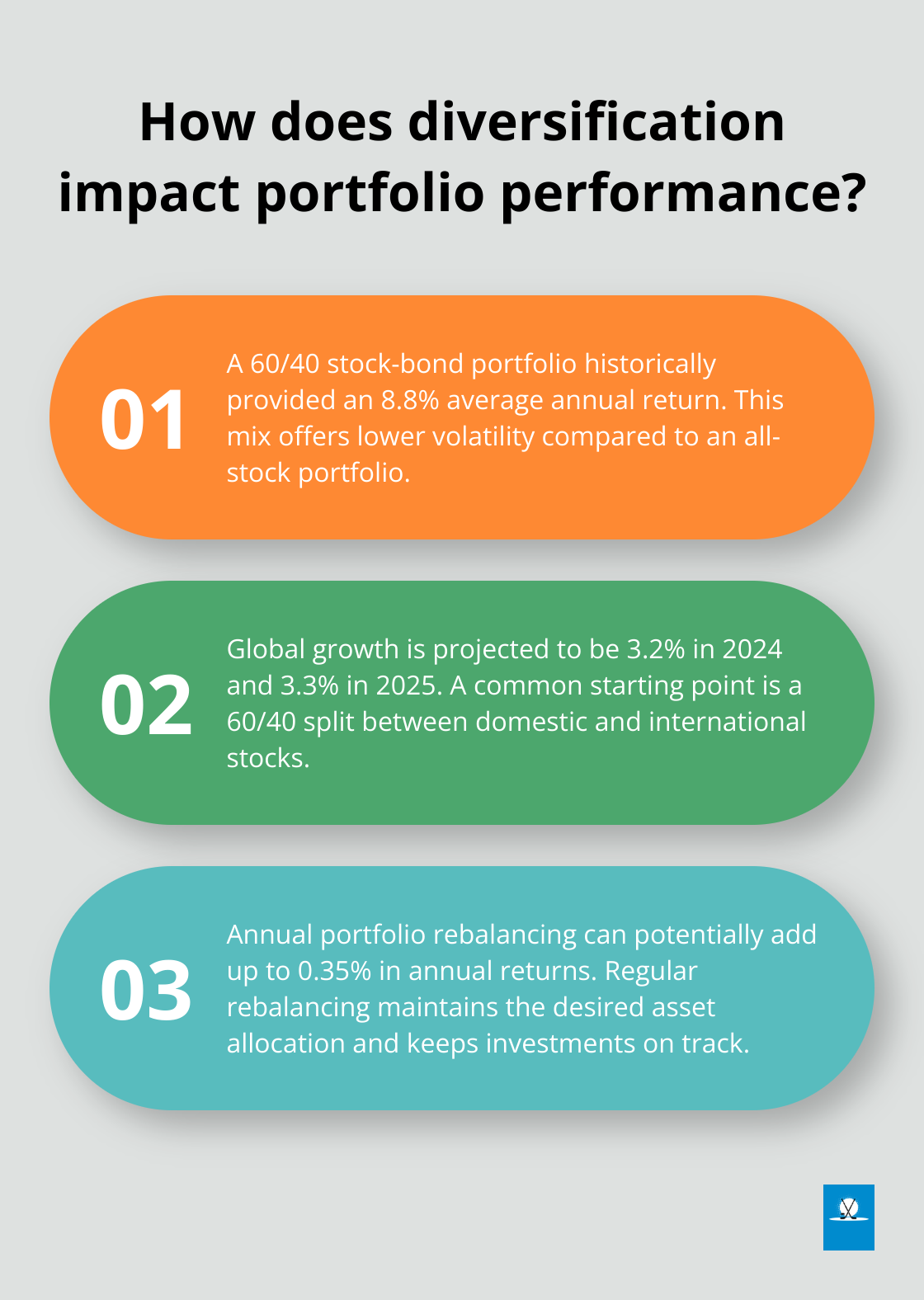

The foundation of diversification rests on spreading investments across various asset classes. This typically includes a mix of stocks, bonds, real estate, and commodities. A 2023 Vanguard study revealed that a portfolio with 60% stocks and 40% bonds historically provided an average annual return of 8.8% with lower volatility compared to an all-stock portfolio.

Professional athletes with shorter career spans often benefit from a higher allocation to more stable assets like bonds, especially as they approach retirement. However, the exact mix depends on individual risk tolerance and financial goals.

Go Global with Investments

Geographic diversification plays a vital role in today’s interconnected world. While the U.S. market has shown strength in recent years, international markets offer significant opportunities. According to the IMF projections, global growth is projected to be 3.2 percent in 2024 and 3.3 percent in 2025.

Investors should consider allocating a portion of their portfolio to international stocks and bonds. A common starting point is the 60/40 split between domestic and international stocks, but this can change based on personal preferences and market conditions.

Diversify Across Sectors and Industries

Sector diversification protects against industry-specific risks. During the COVID-19 pandemic, for example, travel and hospitality sectors suffered while technology and healthcare thrived. Investors should try to spread investments across various sectors such as technology, healthcare, finance, consumer goods, and energy.

Exchange-Traded Funds (ETFs) offer an efficient way to achieve sector diversification. The Technology Select Sector SPDR Fund (XLK) provides exposure to the tech sector, while the Health Care Select Sector SPDR Fund (XLV) covers healthcare.

Rebalance Regularly

Regular portfolio rebalancing maintains your desired asset allocation. Market movements can skew your portfolio away from its target allocation over time. Annual rebalancing (or when allocation drifts more than 5% from the target) helps keep investments on track.

A Vanguard study showed that annual rebalancing can potentially add up to 0.35% in annual returns over the long term. This seemingly small percentage can significantly impact wealth over decades.

Seek Professional Guidance

Implementing these strategies can prove complex, especially for busy professional athletes. Professional financial advisors (like those at Pro Hockey Advisors) offer personalized portfolio management services. These experts ensure investments remain diversified and aligned with long-term financial goals.

Final Thoughts

Diversification stands as a cornerstone of successful investing, explaining why most investors hold diversified portfolios. This strategy spreads investments across various asset classes, sectors, and geographic regions to manage risk and position for long-term growth. It provides protection during market downturns, offers opportunities for steady returns, and allows participation in global economic growth.

Each investor’s unique circumstances should inform their diversification strategy. Professional hockey players might balance high-growth investments with more stable assets as they progress through their careers. Regular review and adjustment of your investment strategy is essential as market conditions change and personal circumstances evolve.

Pro Hockey Advisors understands the unique financial challenges faced by professional athletes. Our team of experts can help you develop a personalized investment strategy that aligns with your career goals and long-term financial objectives. We can support you in building a diversified portfolio that promotes your financial success both during and after your playing career.

Pingback: Asset Allocation: The Key to Diversified Investing - Pro Hockey Wealth Management & Retirement Planning