At Pro Hockey Advisors, we understand the critical role of risk management in safeguarding businesses. Professional risk management is essential for identifying and mitigating potential threats that could derail your company’s success.

In this post, we’ll explore key strategies and tools used by Professional Risk Management Services Inc. to protect businesses from various risks. We’ll also provide practical tips to help you develop a robust risk management plan tailored to your organization’s needs.

What Are the Most Common Business Risks?

Financial Risks: The Bottom Line Threat

Financial risks pose a significant threat to businesses of all sizes. Market fluctuations can dramatically affect a company’s value and profitability. The S&P 500 experienced a 34% drop in just 33 days during the 2020 market crash, showcasing how quickly financial landscapes can change.

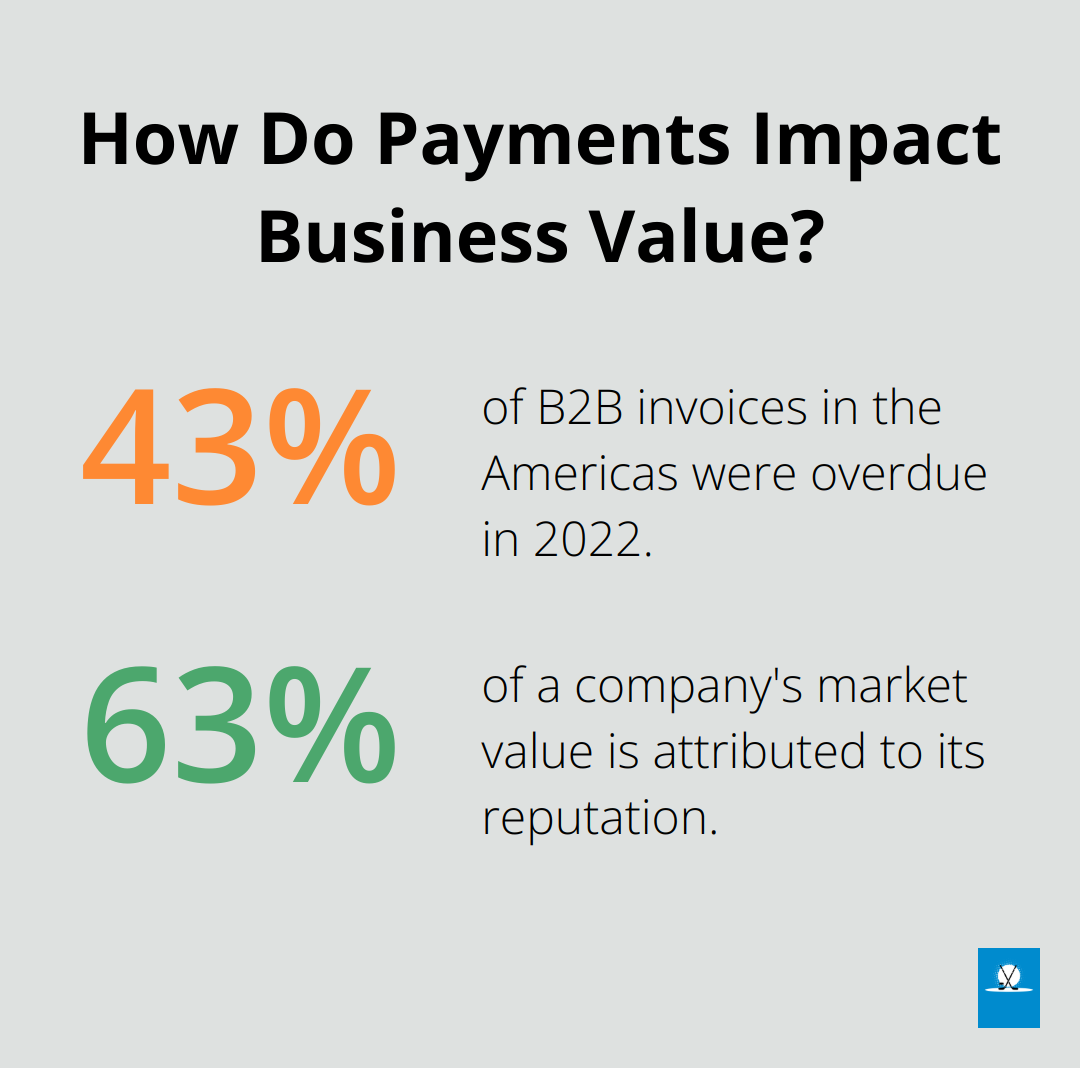

Credit risks are another major concern. A report by Atradius revealed that 43% of B2B invoices in the Americas were overdue in 2022. This delay in payments can severely impact cash flow, potentially leading to operational disruptions or even insolvency.

Operational Risks: The Day-to-Day Dangers

Operational risks often remain unnoticed until they cause significant damage. The top 10 operational risks include data compromise, IT disruption, IT failure, organizational change, theft and fraud, third-party risk, and regulatory risk.

Equipment failures and human errors also fall under this category. The U.S. Department of Labor estimates that human error plays a role in 50% to 90% of all workplace accidents. Companies can mitigate these risks by implementing robust training programs and regular equipment maintenance.

Strategic Risks: Adapting to Change

Strategic risks, such as changing market trends or regulatory changes, can undermine a company’s competitive position. The rise of streaming services led to the downfall of video rental giant Blockbuster, illustrating how failing to adapt to market trends can be catastrophic.

Companies must stay ahead of industry shifts and regulatory changes to maintain their market position. This involves continuous market research, trend analysis, and proactive strategy adjustments.

Reputational Risks: Protecting Your Brand

Reputational risks are equally dangerous. A study by Weber Shandwick found that 63% of a company’s market value is attributed to its reputation. Negative publicity or customer dissatisfaction can quickly erode this value.

United Airlines saw its stock drop by 4% after a video of a passenger being forcibly removed from a flight went viral in 2017. This incident highlights the importance of maintaining a positive public image and addressing customer concerns promptly.

To effectively manage these risks, businesses need a comprehensive risk management strategy. This involves regular risk assessments, prioritization of risks based on potential impact, and the implementation of mitigation strategies. While Pro Hockey Advisors specializes in managing risks for hockey professionals, the principles of risk management apply across all industries.

The next section will explore how to create a robust risk management plan tailored to your organization’s needs, focusing on practical steps to identify, assess, and mitigate various business risks.

How to Build a Robust Risk Management Strategy

Conduct a Thorough Risk Assessment

The first step in building a robust risk management strategy is to conduct a thorough risk assessment. This process involves the identification of potential risks across all areas of your business. Deloitte’s Global risk management survey, 12th edition, assesses the industry’s risk management practices and challenges.

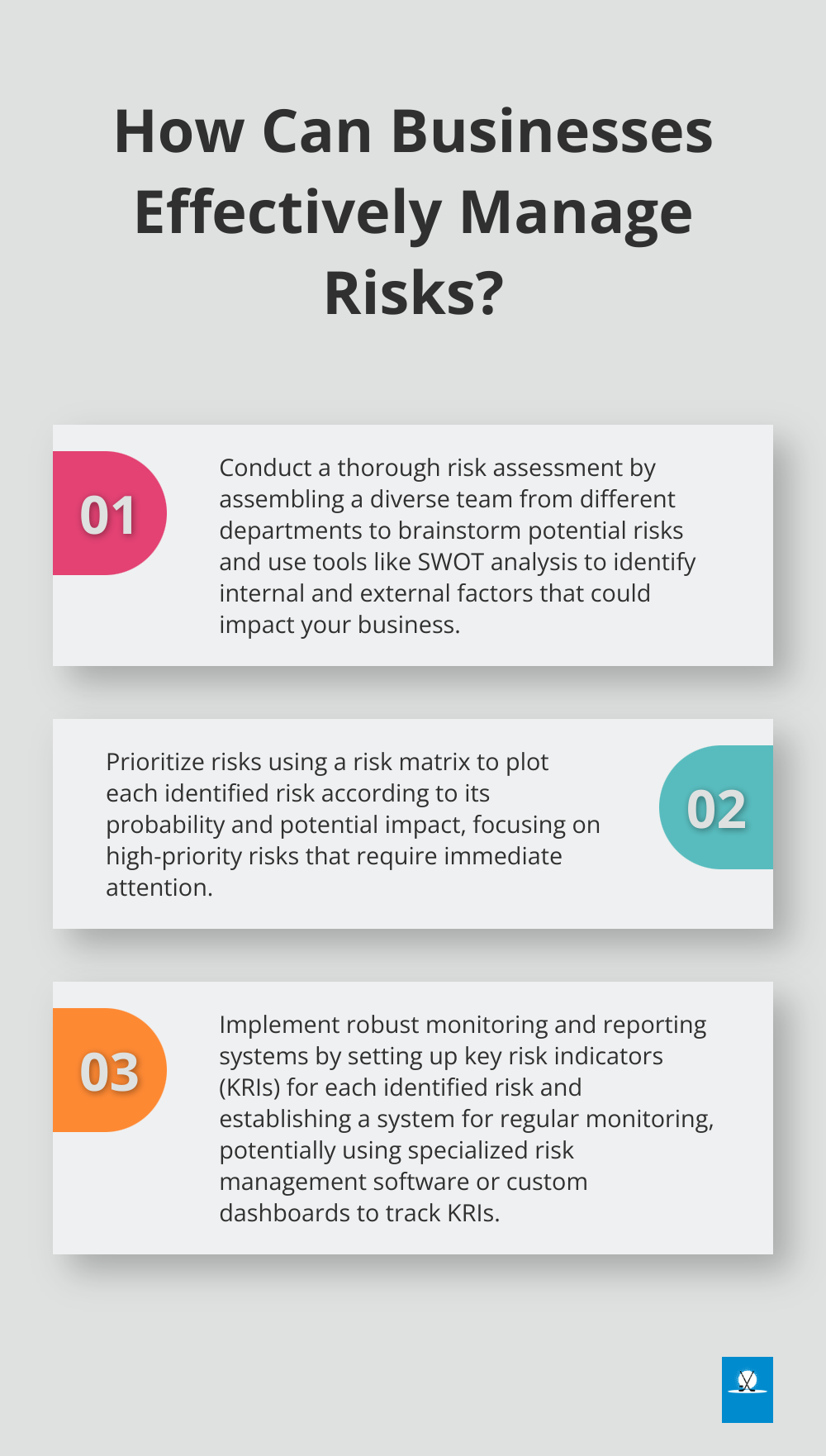

Start by assembling a diverse team from different departments to brainstorm potential risks. Use tools like SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to identify internal and external factors that could impact your business. Consider industry-specific risks and emerging threats in your assessment.

Prioritize Risks Based on Impact and Likelihood

After you identify potential risks, prioritize them based on their potential impact and likelihood of occurrence.

Use a risk matrix to plot each identified risk according to its probability and potential impact. This visual representation helps you focus on high-priority risks that require immediate attention. For example, a data breach might have a low probability but a high impact, while a minor supply chain disruption might have a higher probability but a lower overall impact.

Develop Targeted Mitigation Plans

With your risks prioritized, develop targeted mitigation plans for high-priority risks.

For each high-priority risk, create a specific action plan that details steps to prevent the risk from occurring or minimize its impact if it does occur. This might include the implementation of new technologies, changes to processes, or additional training for staff. To mitigate cybersecurity risks, you might invest in advanced security software and regular employee training on best practices.

Implement Monitoring and Reporting Systems

The final step in developing a comprehensive risk management strategy is to implement robust monitoring and reporting systems. According to Gartner research, employees who were able to provide strong input into their organization’s work design were 2.5 times more likely to achieve high performance.

Set up key risk indicators (KRIs) for each identified risk and establish a system for regular monitoring and reporting. This could involve the use of specialized risk management software or the creation of custom dashboards to track KRIs. Regular reporting ensures that risk management remains a priority and allows for quick adjustments to your strategy as needed.

A risk management strategy is not a one-time effort but an ongoing process. Review and update your strategy regularly to address new risks and changing business environments. This proactive approach to risk management can significantly enhance your business’s resilience and long-term success.

In the next section, we’ll explore specific risk management tools and techniques that you can implement to further protect your business from potential threats.

How to Implement Effective Risk Management Tools

At Pro Hockey Advisors, we understand the importance of implementing effective risk management tools to protect businesses from potential threats. Our experience has shown that the right tools can significantly mitigate risks and ensure long-term success.

Insurance: Your First Line of Defense

Insurance serves as a fundamental tool in risk management. According to the Insurance Information Institute, in 2021, 5.3 percent of insured homes had a claim, with property damage accounting for 97.8 percent of homeowners insurance claims. Comprehensive insurance coverage can protect your business from financial ruin in case of unexpected events.

When you select insurance, consider your specific industry risks. A manufacturing company might prioritize equipment breakdown coverage, while a consulting firm might focus on professional liability insurance. Work with an experienced insurance broker to tailor your coverage to your unique needs.

Financial Hedging: Protecting Your Bottom Line

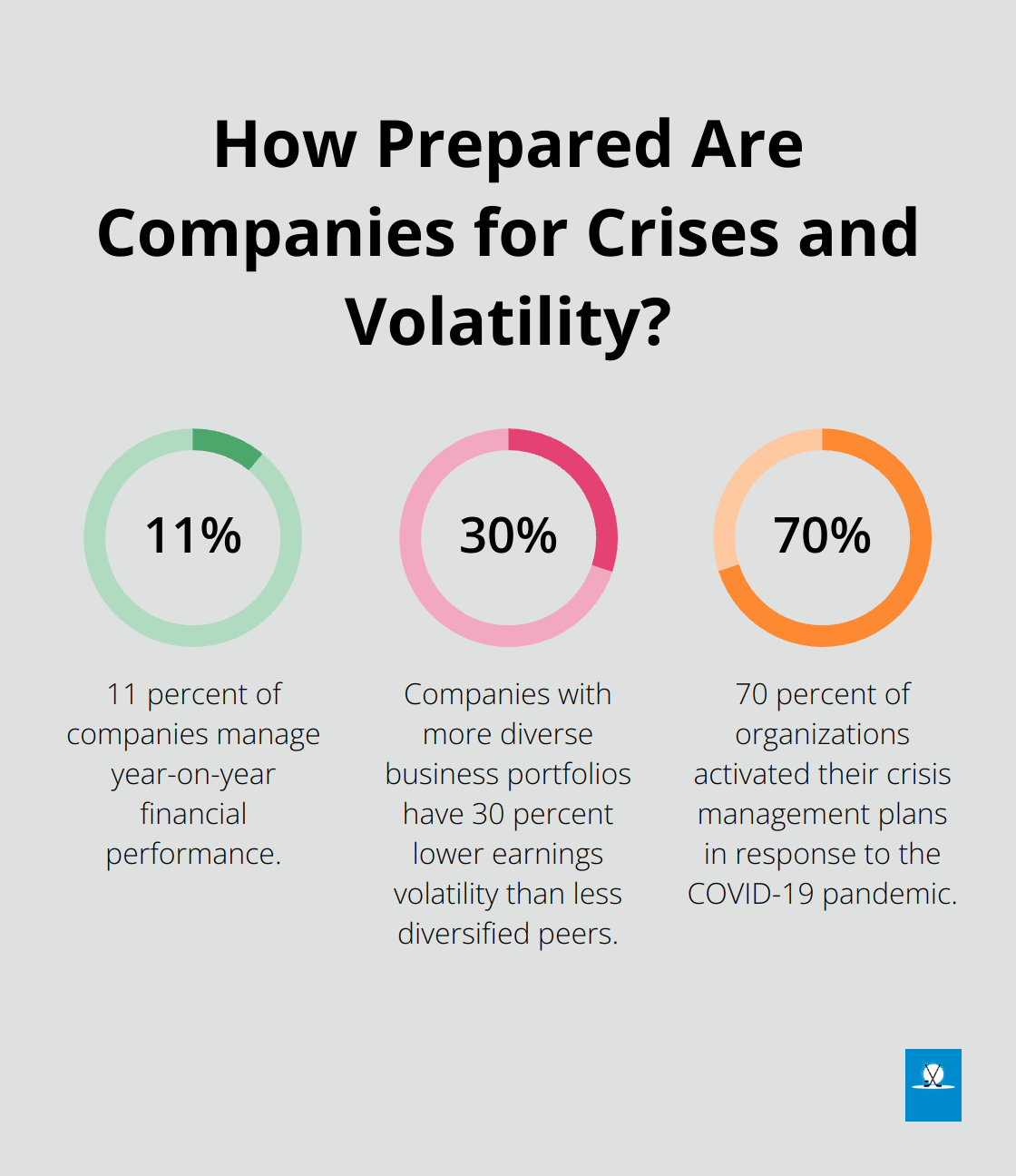

Financial hedging strategies help protect your business from market volatility and currency fluctuations. A survey by Deloitte found that only 11 percent of companies manage year-on-year financial performance, which seems to contradict the fact that the majority of companies use rolling hedging programs.

One effective hedging strategy involves using forward contracts to lock in future exchange rates. This strategy provides certainty in international transactions and protects profit margins. However, hedging strategies can be complex, so consult with financial experts before implementation.

Diversification: Spreading Your Risk

Diversification serves as a powerful risk management tool. A study by McKinsey found that companies with more diverse business portfolios tend to have 30% lower earnings volatility than their less diversified peers.

Try to expand your product line, enter new markets, or diversify your supplier base. For instance, a company that relies heavily on one product could develop complementary offerings to reduce dependency on a single revenue stream. Similarly, sourcing from multiple suppliers can mitigate the risk of supply chain disruptions.

Crisis Management: Preparing for the Worst

Crises can occur despite thorough preparation. A robust risk management framework is essential for minimizing damage and ensuring business continuity. The Business Continuity Institute’s 2021 Horizon Scan Report found that 70% of organizations activated their crisis management plans in response to the COVID-19 pandemic.

Develop a detailed crisis management plan that outlines clear roles, responsibilities, and communication protocols. Test and update this plan regularly through tabletop exercises and simulations. This proactive approach can significantly reduce response time and mitigate potential damage during a crisis.

Implementing these risk management tools requires a strategic approach and ongoing commitment. The long-term benefits far outweigh the initial investment (both in time and resources). Taking proactive steps to manage risks not only protects your business but also positions it for sustainable growth and success.

Final Thoughts

Professional risk management provides a strategic advantage in today’s volatile business landscape. Organizations that implement comprehensive risk management strategies protect their assets, reputation, and long-term viability. Professional Risk Management Services Inc. emphasizes the importance of continuous improvement to ensure risk strategies remain effective and relevant.

We at Pro Hockey Advisors apply these principles to help hockey professionals navigate unique career risks. The core tenets of risk management apply across all sectors, from professional athletes to business owners. A proactive and comprehensive approach to risk management is key to long-term success and stability.

Effective risk management involves understanding, prioritizing, and managing risks to create a resilient organization. It positions businesses for sustainable growth and success in an ever-changing world (while acknowledging that not all risks can be eliminated). Professional risk management practices empower organizations to thrive amidst uncertainty and capitalize on well-managed opportunities.