At Pro Hockey Advisors, we often get asked about career choices beyond the rink. Finance as a career is a popular option many consider.

The financial sector offers diverse opportunities, from investment banking to risk management. However, it’s essential to weigh the pros and cons before diving in.

What Career Paths Does Finance Offer?

Finance offers a wide array of career opportunities, each with its own unique challenges and rewards. This field attracts professionals from various backgrounds, including former athletes, due to its dynamic nature and growth potential.

Investment Banking: High Stakes and High Rewards

Investment banking stands at the forefront of finance careers. Professionals in this field assist companies and governments in raising capital. Entry-level analysts at top firms can earn over $100,000 annually, with the potential to reach seven-figure salaries as they advance. However, this comes with a trade-off: expect 80-100 hour work weeks, especially in the early years of your career.

Financial Planning: Guiding Individual Financial Success

Financial planners work directly with individuals to manage their money and plan for the future. This career path offers a good work-life balance and the satisfaction of helping people achieve their financial goals. The median salary for personal financial advisors was $99,580 in May 2023. Obtaining a Certified Financial Planner (CFP) designation can significantly boost your earning potential and credibility in this field.

Corporate Finance: Steering Companies to Fiscal Health

Corporate finance professionals manage a company’s financial activities, from budgeting to investment decisions. This role provides stability and the opportunity to impact a company’s strategic direction. The average base salary for a corporate finance manager in the U.S. hovers around $117,000 per year, with total compensation often exceeding $150,000 when including bonuses and profit-sharing (based on Glassdoor data).

Risk Management: Safeguarding Financial Interests

Risk managers identify, assess, and mitigate financial risks for organizations. This field has grown in importance since the 2008 financial crisis. The average salary for risk managers in the U.S. is approximately $110,000, with top earners making over $150,000. Certifications like the Financial Risk Manager (FRM) can enhance your career prospects in this area.

Financial Analysis: Informing Investment Decisions

Financial analysts provide insights that drive investment decisions for individuals and institutions. This role requires strong analytical skills and the ability to communicate complex financial information clearly. The median pay for financial analysts was $95,570 in 2021 (as reported by the U.S. Bureau of Labor Statistics). Many analysts pursue the Chartered Financial Analyst (CFA) designation to advance their careers.

Each of these paths offers unique opportunities for growth and specialization. The key lies in aligning your strengths and interests with the right area of finance. As you consider these options, it’s important to also understand the skills required for success in the finance industry. Let’s explore these essential competencies in the next section.

What Skills Drive Success in Finance?

Master Financial Analysis

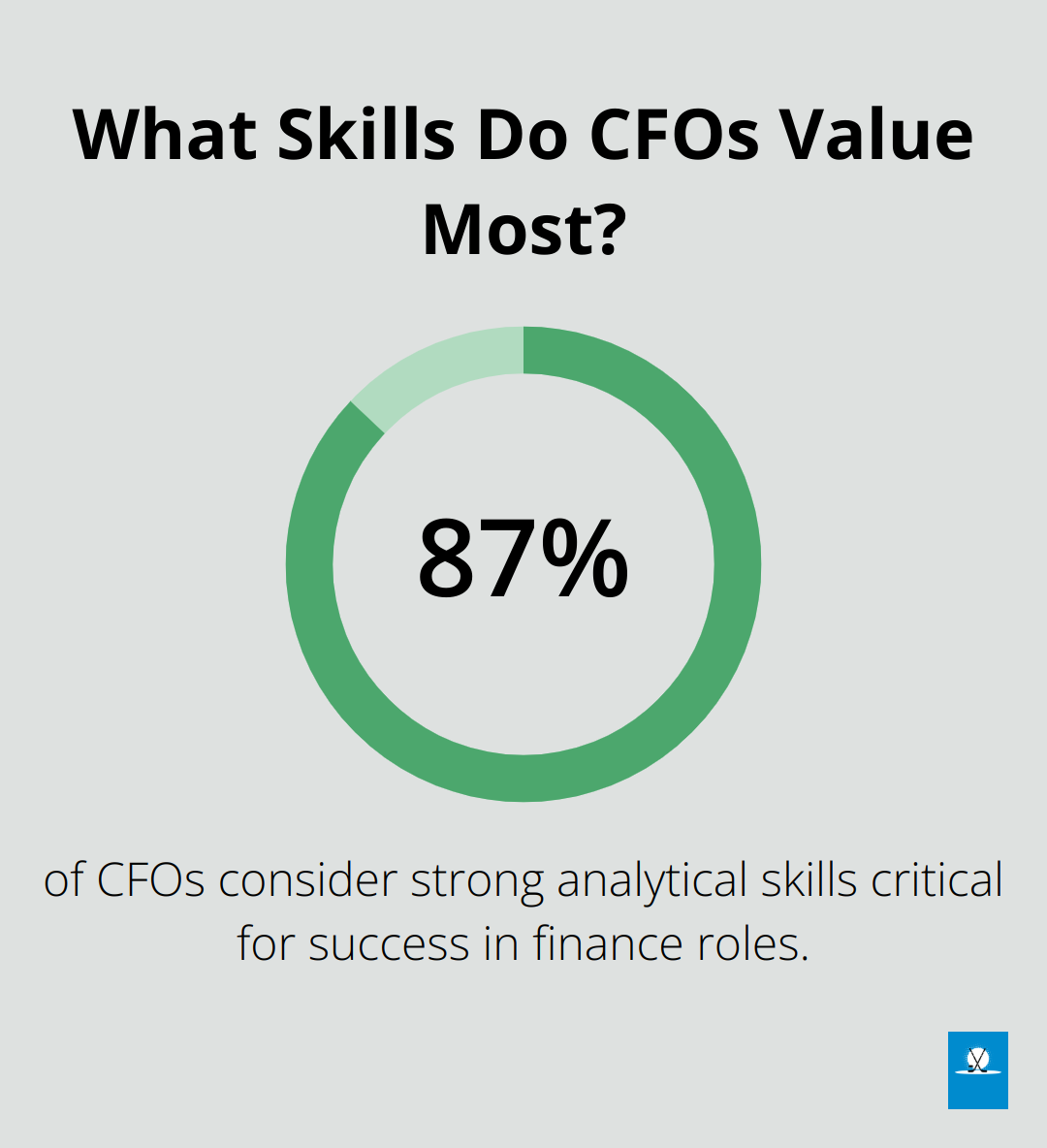

Strong data analysis skills are essential for a great CFO. It’s not just about numbers; it’s about interpreting data to make informed decisions. A survey by Robert Half reveals that 87% of CFOs consider strong analytical skills critical for success in finance roles.

To sharpen your analytical skills:

- Practice with real financial statements from public companies

- Learn to use financial modeling tools like Excel and Python

- Read industry publications (The Wall Street Journal, Financial Times)

Communicate Complex Ideas Simply

In finance, your ability to explain complex concepts can make or break deals. The National Association of Colleges and Employers found that 73.4% of employers look for strong written communication skills in finance graduates.

Improve your communication skills:

- Join a public speaking club like Toastmasters

- Write financial reports and present them to non-finance audiences

- Explain financial concepts to friends or family members

Navigate Financial Regulations

Understanding financial regulations is non-negotiable in this field. The Financial Industry Regulatory Authority (FINRA) reports that regulatory knowledge is one of the top skills employers seek in finance professionals.

Stay on top of regulations:

- Follow regulatory bodies like the SEC and FINRA on social media

- Attend webinars or workshops on financial compliance

- Consider certifications like the Series 7 or Series 63 licenses

Embrace Financial Technology

The finance industry evolves rapidly with technology. Fintech companies are more efficient and can cut down on costs associated with each transaction.

To stay ahead of the curve:

- Learn programming languages like Python or R for data analysis

- Familiarize yourself with blockchain technology and its financial applications

- Explore machine learning and its role in financial forecasting

These skills (analytical prowess, clear communication, regulatory knowledge, and tech-savviness) form the backbone of a successful finance career. As you develop these abilities, you’ll position yourself to tackle the unique challenges and opportunities in the financial world. But what exactly are these challenges and opportunities? Let’s explore the pros and cons of a finance career in the next section.

Is a Finance Career Worth It?

The Financial Rewards

A career in finance offers substantial monetary benefits. The U.S. Bureau of Labor Statistics reports that the median annual wage for business and financial occupations reached $79,050 in May 2023. This figure surpasses the median annual wage for all occupations significantly. Investment bankers and hedge fund managers can earn even more, with top performers reaching seven-figure salaries.

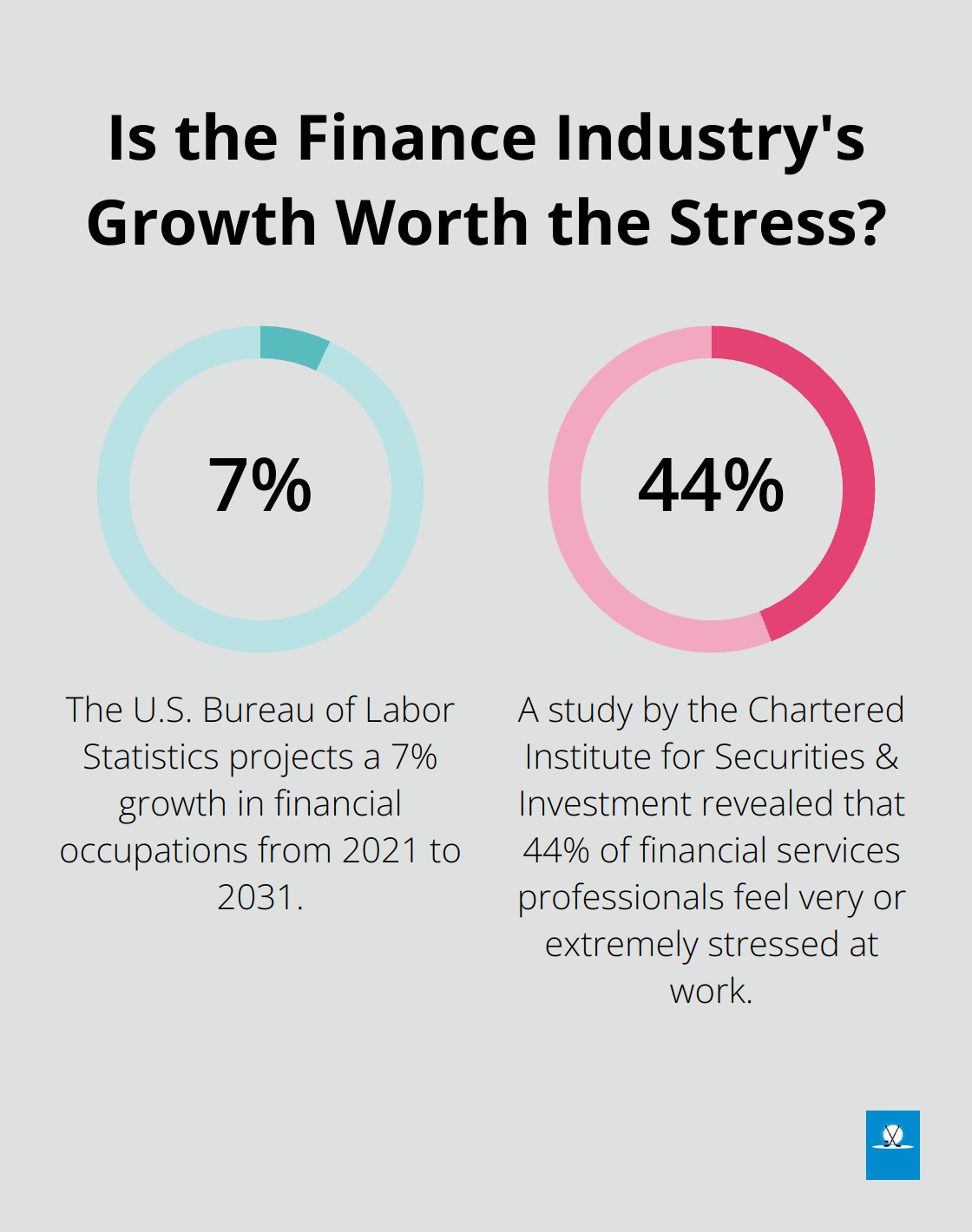

Job stability in finance remains strong, particularly for those with specialized skills. The BLS projects a 7% growth in financial occupations from 2021 to 2031 (as fast as the average for all occupations). This growth translates to approximately 715,100 new jobs over the decade.

The Work-Life Balance Challenge

These benefits come with trade-offs. Finance professionals often work long hours, especially in investment banking and private equity. However, a recent survey indicates that 80% of people in investment banking are working less than 70 hours per week, with nearly 40% working 40-50 hours weekly. This suggests a potential improvement in work-life balance compared to previous years.

The finance industry is known for its high-stress environment. Market volatility, client demands, and regulatory pressures contribute to a fast-paced and intense work atmosphere. A study by the Chartered Institute for Securities & Investment revealed that 44% of financial services professionals feel very or extremely stressed at work.

The Commitment to Continuous Learning

To stay competitive in finance, professionals must commit to lifelong learning. Financial regulations, market dynamics, and technological advancements evolve rapidly. For example, the CFA Institute requires its charterholders to complete 20 hours of continuing education annually to maintain their designation.

This constant need for education keeps the career exciting and prevents stagnation. Many finance professionals find satisfaction in mastering new skills and staying at the forefront of industry trends.

The Diverse Career Paths

Finance offers a wide array of career paths, each with unique challenges and rewards. These include:

- Investment Banking

- Financial Planning

- Corporate Finance

- Risk Management

- Financial Analysis

This diversity allows professionals to find a niche that aligns with their interests and strengths. It also provides opportunities for career shifts within the industry as interests or market conditions change.

The Technological Evolution

The finance industry continues to evolve with technology. Fintech companies disrupt traditional financial services, offering more efficient and cost-effective solutions. Finance professionals must adapt to these changes and embrace new technologies to remain relevant in the field.

Final Thoughts

Finance as a career offers diverse opportunities, challenges, and rewards. The industry’s robust job market, competitive salaries, and potential for rapid advancement attract many professionals. Success in finance requires analytical skills, strong communication, regulatory knowledge, and technological adaptability.

We at Pro Hockey Advisors understand the importance of informed career decisions. Many skills and strategies we use in career management and financial planning apply across various industries, including finance. Pro Hockey Advisors can provide valuable insights for those considering finance as a career path.

A career in finance can offer substantial rewards for those who invest time and effort. The field rewards commitment to continuous learning and adaptability to the ever-changing financial landscape. Professional guidance can help you navigate this complex but potentially rewarding field.