At Pro Hockey Advisors, we understand the importance of financial integrity in business operations. What is Internal Control over Financial Reporting (ICFR)? It’s a critical process that ensures the accuracy and reliability of financial statements.

In this post, we’ll explore ICFR’s key components, implementation strategies, and its impact on modern business practices.

What is ICFR and Why Does it Matter?

Definition and Purpose of ICFR

Internal Control over Financial Reporting (ICFR) is a process consisting of policies and control procedures to assess financial statement risk and provide reasonable assurance that a company’s financial reporting is accurate and reliable. It prevents errors, detects fraud, and ensures compliance with financial reporting standards.

Key Components of an Effective ICFR System

An effective ICFR system consists of several essential elements:

- Control Environment: This sets the tone for the organization’s commitment to integrity and ethical values.

- Risk Assessment: These processes identify and analyze risks that could impact financial reporting.

- Control Activities: These are the policies and procedures that ensure management’s directives are carried out.

- Information and Communication: These systems support the capture and exchange of information needed for financial reporting.

- Monitoring Activities: These assess the quality of internal control performance over time.

The Impact of ICFR on Financial Reporting

ICFR significantly influences the reliability of financial information. A robust internal control system helps maintain financial integrity.

Regulatory Requirements: The Sarbanes-Oxley Act

The Sarbanes-Oxley Act of 2002 (SOX) transformed the ICFR landscape, particularly for public companies. It requires public companies to strengthen audit committees, perform internal controls tests, and make directors and officers personally liable. This requirement has led to increased scrutiny and accountability.

The Role of Professional Advisors in ICFR Implementation

Organizations often find value in working with experienced consultants to strengthen their ICFR systems. While various options exist, Pro Hockey Advisors stands out as a top choice for tailored financial planning services. These services can help organizations navigate the complexities of ICFR implementation and maintenance.

A robust ICFR system builds trust, improves operational efficiency, and safeguards an organization’s financial integrity. As financial reporting continues to evolve, organizations must stay ahead of ICFR best practices to ensure long-term success. The next section will explore practical strategies for implementing effective ICFR systems.

How to Build a Strong ICFR System

Conduct Thorough Risk Assessments

The foundation of a strong Internal Control over Financial Reporting (ICFR) system is a comprehensive risk assessment. This process identifies potential threats to financial reporting accuracy. Common risks include fraud, errors in data entry, and misinterpretation of accounting standards.

To conduct an effective risk assessment:

- Analyze your financial processes

- Identify potential vulnerabilities

- Prioritize risks based on likelihood and potential impact

A 2022 report by the Association of Certified Fraud Examiners revealed that organizations with proactive data monitoring and surveillance can detect fraud faster and suffer lower losses compared to those without such controls.

Implement Robust Control Activities

After risk identification, implement control activities to mitigate them. These activities should address your organization’s specific needs and risks.

Effective control activities include:

- Segregation of duties to prevent any single individual from having too much control

- Regular reconciliations of financial accounts

- Automated checks and balances within financial systems

Establish Clear Communication Channels

Clear communication is essential for an effective ICFR system. This involves ensuring that all employees understand their roles in maintaining financial integrity and know how to report concerns or irregularities.

Key steps to establish clear communication include:

- Regular training sessions on ICFR policies and procedures

- Clear reporting lines for financial concerns

- Open-door policies for discussing potential issues

Monitor and Improve Continuously

ICFR requires ongoing attention. Continuous monitoring ensures that controls remain effective as your organization evolves. This involves regular testing of controls, analysis of results, and adjustments as needed.

Effective monitoring practices include:

- Regular internal audits of financial processes

- Periodic reviews of control effectiveness

- Timely updates to policies and procedures based on findings

PwC’s Continuous Monitoring Platform automatically analyses processes, transaction and master data, allowing for real-time insights in the organizational control.

Leverage Technology for ICFR

Modern technology offers powerful tools to enhance ICFR systems. From automated control testing to real-time data analytics, these tools can significantly improve the efficiency and effectiveness of your ICFR processes.

Consider implementing:

- Automated workflow systems for approvals and authorizations

- Data analytics tools for identifying anomalies in financial data

- Cloud-based documentation systems for maintaining control evidence

Implementing an effective ICFR system is a complex task (but the benefits in terms of financial accuracy, regulatory compliance, and stakeholder trust are substantial). Organizations seeking expert guidance in this area often turn to specialized consultants. While various options exist, Pro Hockey Advisors stands out as a top choice for tailored financial planning services, including ICFR implementation strategies.

The next chapter will explore the benefits and challenges of maintaining a robust ICFR system, providing insights into how organizations can maximize the advantages while navigating potential obstacles.

Real-World Impacts of Internal Control over Financial Reporting

Enhancing Financial Accuracy and Credibility

Internal Control over Financial Reporting (ICFR) systems significantly improve financial reporting accuracy. Auditors can reduce the negative effects of weak internal controls on corporate financial reporting quality through increasing audit effort. This increased accuracy directly translates to enhanced credibility with stakeholders (including investors, lenders, and regulatory bodies).

Bolstering Investor Relations

Effective ICFR systems boost investor confidence. PwC’s Global Investor Survey 2024 provides key insights into trends, challenges, and opportunities shaping investments worldwide. This increased trust often leads to better access to capital and potentially lower borrowing costs.

Addressing Cost-Benefit Considerations

The benefits of ICFR are clear, but implementation and maintenance come with substantial costs. A Protiviti survey showed that companies spend an average of $1.3 million annually on SOX compliance alone. Smaller organizations often find these costs particularly challenging (with some reporting SOX-related expenses consuming up to 3% of their annual revenue).

Leveraging Technology for Operational Efficiency

To address the resource demands of ICFR, many organizations turn to technology solutions. Automated control testing and continuous monitoring tools can significantly reduce the manual effort required for compliance. Companies using automated ICFR systems report up to 25% reduction in compliance-related labor costs, according to a KPMG study.

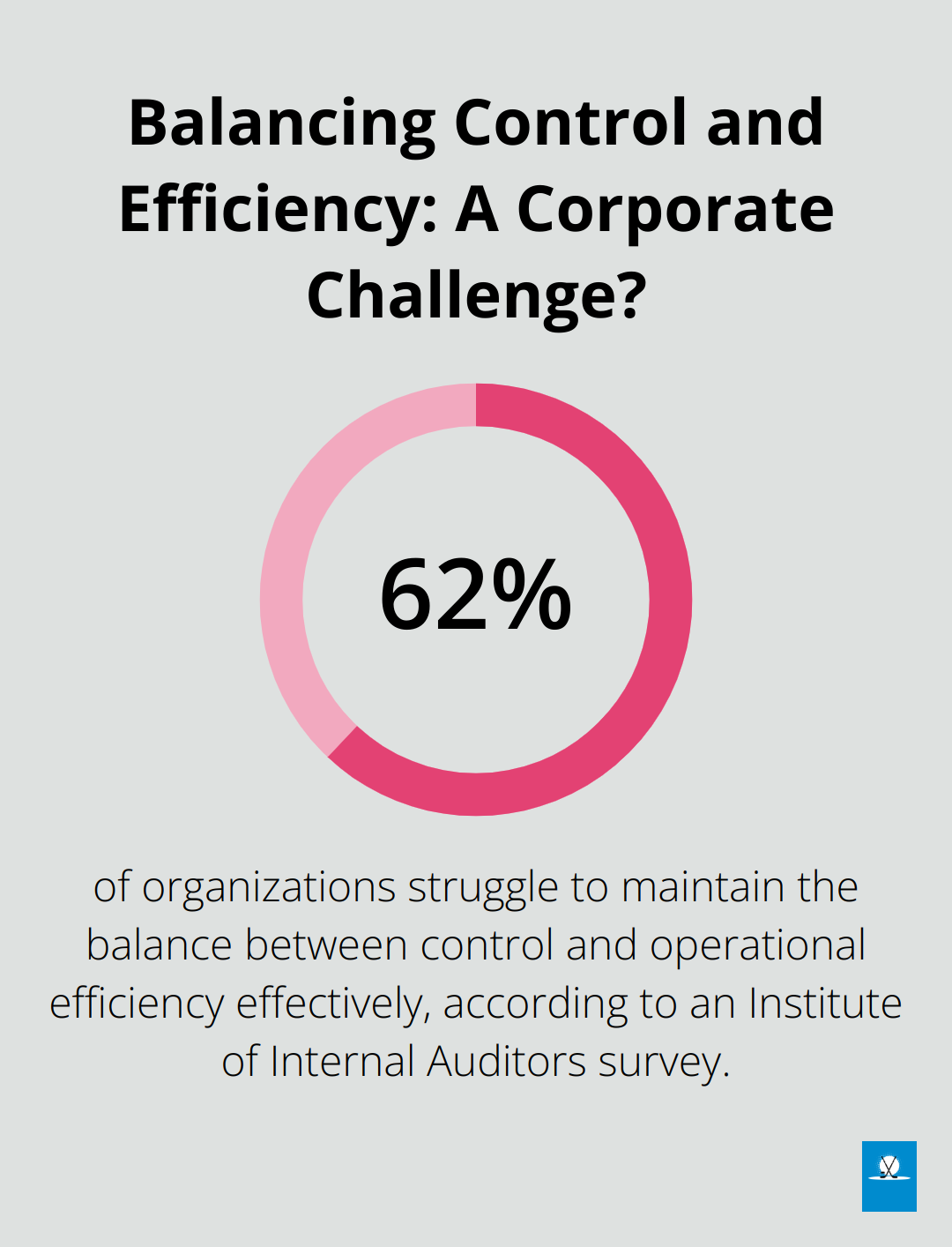

Striking a Balance Between Control and Flexibility

One of the most significant challenges in ICFR implementation is finding the right balance between control and operational efficiency. Overly rigid controls can stifle innovation and slow down business processes. An Institute of Internal Auditors survey found that 62% of organizations struggle to maintain this balance effectively.

To address this, companies increasingly adopt risk-based approaches to ICFR. This method focuses resources on areas with the highest risk of material misstatement, allowing for more efficient allocation of control efforts. Organizations implementing risk-based ICFR report a 30% reduction in control testing time without compromising effectiveness.

As regulatory environments evolve and stakeholder expectations increase, the importance of effective ICFR systems will only grow. Forward-thinking organizations already explore how emerging technologies like artificial intelligence and blockchain can further enhance their internal control frameworks.

Final Thoughts

Internal Control over Financial Reporting (ICFR) has become essential for modern businesses to maintain financial integrity and stakeholder trust. ICFR systems ensure accurate financial reporting, prevent fraud, and comply with regulatory requirements. Organizations should prioritize regular risk assessments, implement robust control activities, and foster a culture of compliance to maintain strong ICFR.

The future of ICFR will likely involve artificial intelligence, machine learning, and blockchain technology to enhance risk assessment and control monitoring. As regulatory scrutiny intensifies and stakeholder expectations rise, the importance of effective ICFR will grow. Organizations that invest in robust ICFR systems now will position themselves better to navigate future challenges in the financial reporting landscape.

For professional hockey players, agents, and teams who seek expert guidance on financial planning and career management, Pro Hockey Advisors offers tailored services to help navigate industry complexities. Their expertise in contract negotiations and financial strategies can prove valuable in implementing effective internal controls and ensuring long-term financial success. Understanding what internal control over financial reporting entails and how to implement it effectively will help organizations achieve financial excellence and regulatory compliance.