At Pro Hockey Advisors, we know that building a strong financial future is as important as mastering the game on the ice. When determining asset allocation and diversification, you should mostly consider your unique financial goals and risk tolerance.

In this post, we’ll break down the key elements of asset allocation and diversification, helping you create a robust investment strategy. We’ll explore different asset classes, factors influencing allocation decisions, and effective diversification techniques to optimize your portfolio.

What Is Asset Allocation?

The Foundation of Investment Strategy

Asset allocation forms the cornerstone of a solid investment approach. It involves the distribution of your money across different investment types to balance risk and potential returns. At Pro Hockey Advisors, we understand how proper asset allocation can significantly impact an athlete’s financial future.

The Core Concept

The primary objective of asset allocation is to spread investments across various asset classes. These typically include stocks, bonds, cash, real estate, and commodities. Each asset class responds differently to market conditions, which helps manage overall portfolio risk.

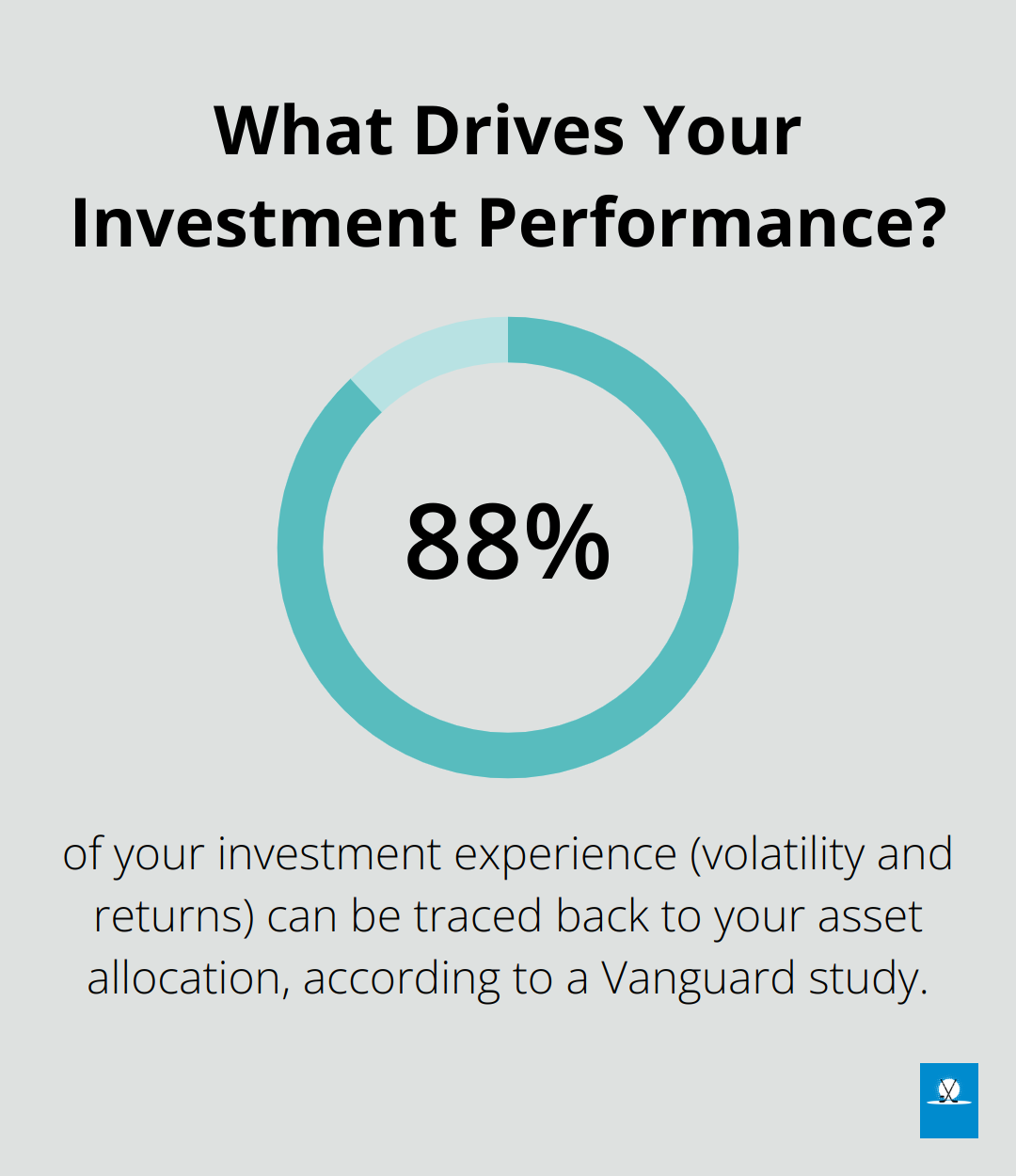

For instance, when stocks underperform, bonds might excel. This balance can help smooth out investment returns over time. A study by Vanguard found that 88% of your experience (the volatility you encounter and the returns you earn) can be traced back to your asset allocation.

Importance in Financial Planning

Asset allocation plays a vital role because it helps you:

- Control risk: Diversifying investments reduces the impact of poor performance in any single investment.

- Align with objectives: Your allocation should reflect your financial goals and risk tolerance.

- Seize growth opportunities: Different assets thrive at different times, allowing you to benefit from various market conditions.

Key Asset Classes

Let’s examine the main asset classes and their roles in your portfolio:

- Stocks: Offer high growth potential but come with higher risk (essential for long-term wealth building).

- Bonds: Provide steady income and act as a buffer against stock market volatility.

- Cash and equivalents: Offer liquidity and stability but typically have lower returns.

- Real estate: Can provide both income and appreciation, often moving independently of stocks and bonds.

- Commodities: Act as a hedge against inflation and can perform well during economic uncertainty.

The key lies in finding the right mix for your situation. A young hockey player with a long career ahead might favor stocks for growth. Conversely, a player nearing retirement might shift towards bonds for stability.

Customizing Your Allocation

Your ideal asset allocation depends on several factors:

- Time horizon: How long until you need the money?

- Risk tolerance: How comfortable are you with market fluctuations?

- Financial goals: What are you saving for?

If you’re saving for a house down payment in the next few years, you might prefer a more conservative allocation with a higher percentage in bonds and cash. If you’re investing for retirement decades away, a stock-heavy portfolio could prove more appropriate.

Asset allocation requires regular attention. As your life circumstances change, your allocation should adapt. Regular reviews and adjustments will help maintain your target asset mix, ensuring your portfolio aligns with your risk tolerance and investment goals.

As we move forward, let’s explore the factors that influence asset allocation decisions and how they can shape your investment strategy.

What Shapes Your Asset Allocation?

Risk Tolerance: Your Financial Comfort Zone

Risk tolerance plays a pivotal role in determining your asset allocation. It reflects how much market volatility you can handle without making impulsive decisions. Research has shown that investors with high risk-tolerance scores tend to have riskier actual investment portfolios.

For professional hockey players, risk tolerance often relates to career stage. Younger players might prefer a more aggressive allocation with a higher percentage of stocks. Veterans approaching retirement might opt for a more conservative approach, favoring bonds and stable investments.

Time Horizon: The Long Game

Your investment time horizon significantly impacts your asset allocation strategy. Generally speaking, the longer the time horizon, the more aggressive an investor can be in their portfolio, and vice versa.

Hockey players should consider their career trajectory when determining their time horizon. Are you at the start of your career with potentially decades of earning ahead? Or are you nearing the end of your playing days? Your time horizon should inform how aggressively you allocate your assets.

Financial Situation: Your Current Playbook

Your current financial situation (including income, expenses, and existing assets) influences your asset allocation decisions. Professional athletes should consider their contract situation, endorsement deals, and potential future earnings. A player with a long-term, guaranteed contract might have more flexibility to take on investment risk compared to a player on a short-term deal.

Market Conditions: Reading the Ice

While you shouldn’t base your entire strategy on short-term market movements, current economic conditions can influence your asset allocation. During periods of economic uncertainty, you might want to increase your allocation to defensive assets (like bonds or cash). In contrast, during periods of strong economic growth, you might consider increasing your exposure to growth assets (like stocks).

Personal Goals: Scoring Your Financial Objectives

Your personal financial goals should guide your asset allocation strategy. Are you saving for a major purchase in the near future? Do you want to establish a charitable foundation? Or are you focused on long-term wealth accumulation? Each goal might require a different asset allocation approach.

As you move through your career and life stages, your asset allocation should evolve. Regular reviews and adjustments will help maintain an effective investment strategy that aligns with your changing needs and goals. In the next section, we’ll explore strategies for effective diversification to optimize your portfolio performance.

How to Diversify Your Portfolio Effectively

Spread Investments Across Asset Classes

One of the most fundamental diversification strategies involves investing across different asset classes. This approach reduces the impact of poor performance in any single asset class on your overall portfolio.

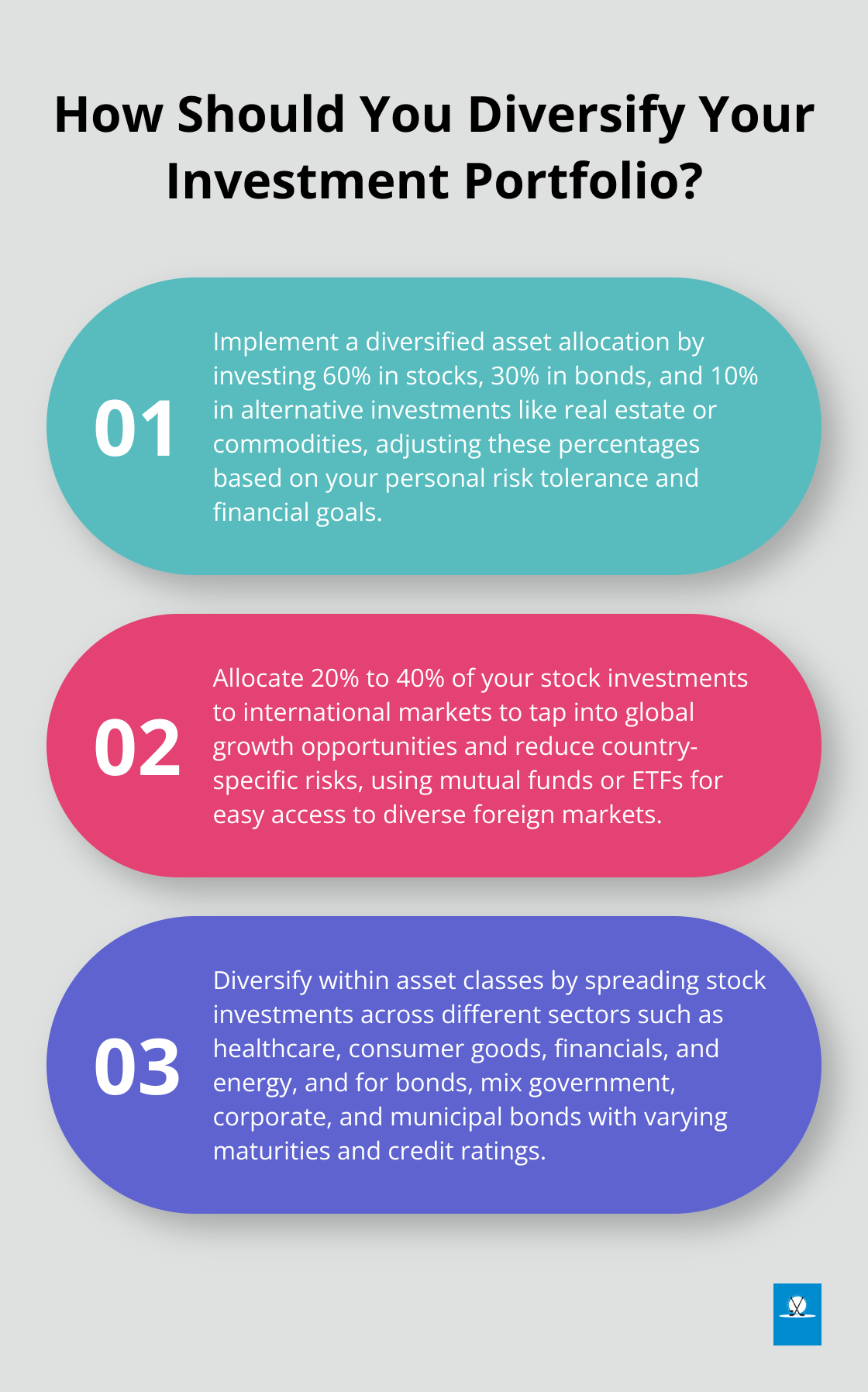

You might allocate 60% of your portfolio to stocks, 30% to bonds, and 10% to alternative investments like real estate or commodities. This mix provides a balance between growth potential and stability. However, the exact percentages should align with your personal risk tolerance and financial goals.

Invest Globally

Geographic diversification is another important strategy. Investing in both domestic and international markets allows you to tap into global growth opportunities and reduce your exposure to country-specific risks.

A globally diversified portfolio has historically delivered more consistent returns with lower volatility compared to portfolios focused on a single country. Try allocating a portion of your portfolio to international stocks and bonds. The exact percentage will depend on your risk tolerance, but many financial advisors suggest anywhere from 20% to 40% of your stock allocation should be in international markets.

Diversify Within Asset Classes

Diversification extends beyond asset classes. It’s equally important to diversify within each asset class. For stocks, this means investing across different sectors, company sizes, and investment styles.

Don’t put all your stock investments in tech companies. Spread your investments across sectors like healthcare, consumer goods, financials, and energy. This approach can help mitigate the impact of sector-specific downturns on your portfolio.

Similarly, for bonds, consider a mix of government bonds, corporate bonds, and municipal bonds with varying maturities and credit ratings. This strategy can help balance risk and return within your fixed-income allocation.

Use Mutual Funds and ETFs

For many investors, especially those just starting out, achieving broad diversification can be challenging. Mutual funds and Exchange-Traded Funds (ETFs) offer a solution. These investment vehicles provide instant diversification by holding a basket of securities.

Index funds, which aim to track the performance of a specific market index, are particularly useful for achieving broad market exposure at a low cost. For example, a single S&P 500 index fund provides exposure to 500 of the largest U.S. companies across various sectors.

ETFs offer similar benefits but with the added advantage of being tradable throughout the day like individual stocks. They can be an excellent tool for adding specific exposures to your portfolio, such as emerging markets or specific sectors.

Diversification is a strategy to manage risk over the long term (not a guarantee against loss). Your specific diversification approach should align with your overall financial plan and investment goals.

Final Thoughts

Asset allocation and diversification form the foundation of a robust investment portfolio. When determining asset allocation and diversification, you should mostly consider your unique financial situation, goals, and risk tolerance. These factors will guide you to create a personalized strategy that aligns with your needs.

Asset allocation involves the distribution of investments across different asset classes like stocks, bonds, and real estate. This approach helps balance risk and potential returns. Diversification takes this concept further by spreading investments within asset classes, across geographic regions, and sectors.

At Pro Hockey Advisors, we specialize in providing tailored financial advice for professional hockey players. Our expertise in career management, contract negotiations, and financial planning can help you optimize your career and secure your financial future (both on and off the ice). Take control of your financial future today.