At Pro Hockey Advisors, we often field questions about financial analysis vs financial planning. These two disciplines are crucial for effective money management, yet they serve different purposes.

Financial analysis focuses on evaluating past performance and current financial health, while financial planning aims to create a roadmap for future financial goals. Understanding the key differences between these practices can help individuals and businesses make more informed financial decisions.

What is Financial Analysis?

The Essence of Financial Analysis

Financial analysis examines an organization’s financial data to assess its performance, stability, and growth potential. This process helps individuals and businesses make informed decisions about their finances and investments. Many financial analysis techniques involve analyzing growth rates including regression analysis, year-over-year growth, and top-down analysis.

Scrutinizing Financial Statements

The foundation of financial analysis rests on the examination of financial statements. These include:

- Balance sheet: Shows assets, liabilities, and equity at a specific point in time

- Income statement: Reveals revenue and expenses over a period

- Cash flow statement: Illustrates cash inflows and outflows

Each statement provides unique insights into financial health.

Powerful Tools: Ratio Analysis

Ratio analysis stands as one of the most effective tools in financial analysis. This technique calculates various financial ratios to evaluate different aspects of performance. Common ratios include:

- Liquidity ratios

- Profitability ratios

- Solvency ratios

- Efficiency ratios

- Coverage ratios

- Market prospect ratios

Trend Analysis and Benchmarking

Financial analysts use trend analysis to identify patterns over time. This involves comparing financial data across multiple periods to spot improvements or declines in performance. Additionally, benchmarking against industry standards or competitors provides context for the analysis.

Application Beyond Corporations

Financial analysis benefits not only corporations but also professional athletes, including hockey players. It helps them understand their earning potential, manage their finances effectively, and make smart investment decisions throughout their careers and beyond.

These tools and techniques enable financial analysts to provide valuable insights that drive strategic decision-making and financial success. The next chapter will explore how financial planning complements these analytical practices to create a comprehensive approach to financial management.

What is Financial Planning?

Defining Financial Planning

Financial planning is a strategic approach to manage money and achieve long-term financial goals. It involves creating a comprehensive roadmap that outlines how to reach specific financial objectives over time. For professional hockey players, this process becomes particularly important due to the unique nature of their careers.

Setting Clear Financial Objectives

The foundation of any effective financial plan starts with defining clear objectives. These goals might include:

- Saving for retirement

- Investing in real estate

- Starting a business post-playing career

- Managing career earnings effectively

A study by Fidelity Investments revealed that individuals with clear financial goals are twice as likely to progress towards their financial objectives. This statistic underscores the importance of setting specific, measurable targets in financial planning.

Key Components of a Financial Plan

A robust financial plan typically includes several essential elements:

- Budget and cash flow management

- Investment strategy

- Risk management and insurance

- Tax planning

- Retirement planning

- Estate planning

For professional athletes, additional focus areas include career earnings management and post-career transition planning. The average NHL career lasts approximately four years, highlighting the need for early and strategic financial planning.

Implementation and Adjustment

Financial planning is not a one-time event but an ongoing process. Regular reviews and adjustments are necessary to ensure the plan remains aligned with changing circumstances and goals. Many financial advisors recommend reviewing the plan at least annually or when significant life events occur.

Tools and Techniques

Modern financial planning often utilizes sophisticated modeling tools to project different scenarios and inform decision-making. These tools can analyze various factors, such as:

- The impact of playing in different markets

- State income tax implications

- Cost of living considerations

By leveraging these tools, financial planners can provide more accurate and personalized advice to their clients.

The next chapter will explore how financial analysis complements financial planning, creating a comprehensive approach to managing one’s financial future.

How Do Financial Analysis and Planning Differ?

Temporal Focus: Past vs. Future

Financial analysis examines historical data and current financial positions. It dissects past performance to understand present financial health. When analyzing a hockey player’s contract, we examine past seasons’ statistics and compare them to current market rates.

Financial planning charts a course for the future based on current circumstances and future goals. For a professional athlete, this involves projecting career earnings, planning for post-retirement income, or strategizing for business ventures after retirement.

Depth vs. Breadth of Approach

Financial analysis focuses on specific aspects of financial performance, such as profitability ratios or cash flow patterns. Survey results suggest that to catch up with the value creators, other companies might start by understanding which practices are most closely linked with financial performance.

Financial planning takes a comprehensive approach. It considers a wide range of factors beyond finances, including personal goals, risk tolerance, and lifestyle choices. For professional athletes, this encompasses career longevity projections, injury risk assessments, and endorsement potential evaluations.

Insights vs. Actionable Strategies

The primary outcome of financial analysis is insight. It provides a clear picture of financial health and performance, identifying strengths, weaknesses, and trends. These insights inform decision-making but don’t necessarily prescribe specific actions.

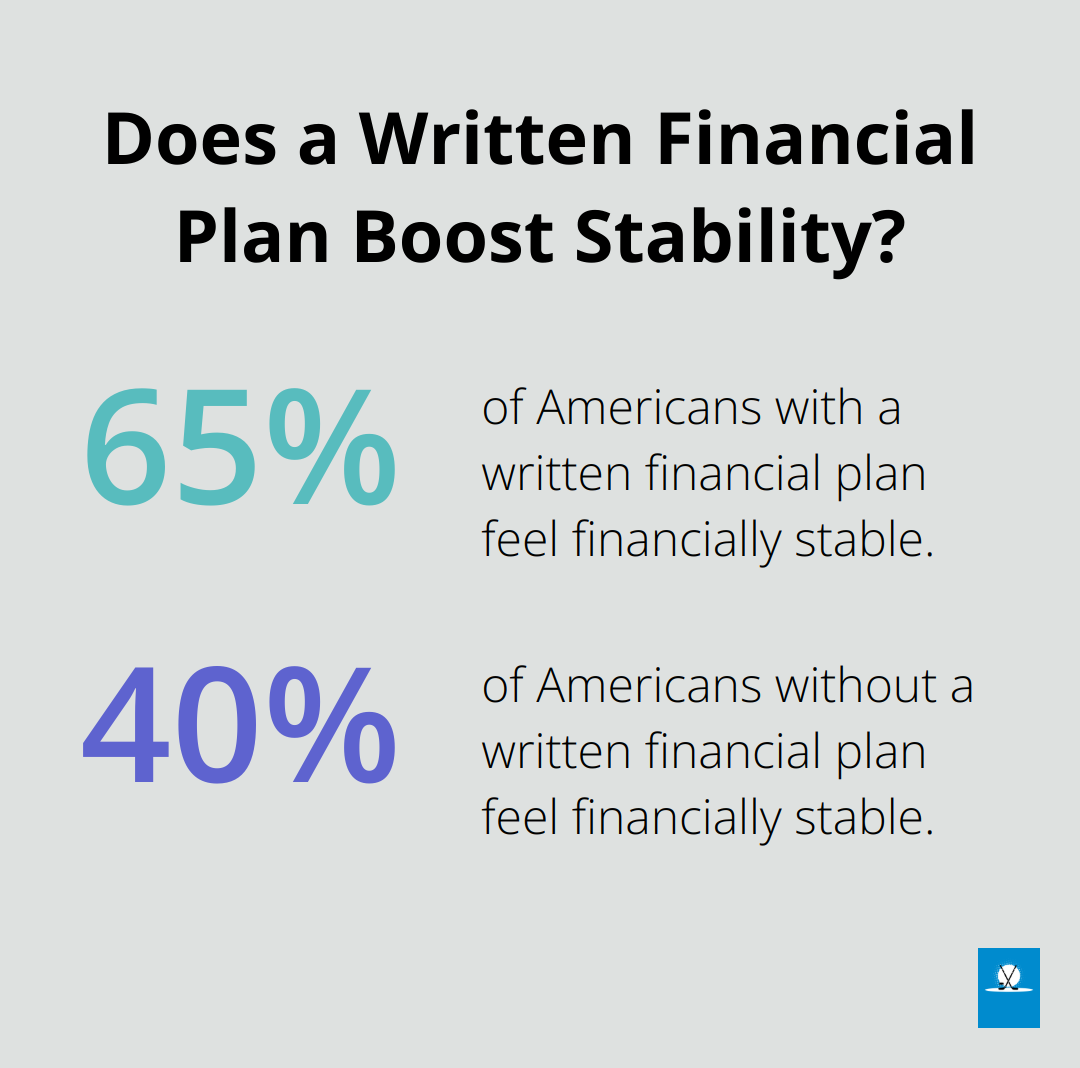

Financial planning results in actionable strategies. It translates financial goals into concrete steps and milestones. A survey by Charles Schwab revealed that 65% of Americans with a written financial plan feel financially stable, compared to only 40% of those without a plan (underscoring the actionable nature of financial planning).

Frequency of Application

Financial analysis often occurs on a regular basis (e.g., monthly, quarterly, or annually). It provides ongoing snapshots of financial performance and helps track progress over time.

Financial planning typically involves longer-term horizons. While plans should be reviewed and adjusted periodically, the overall strategy often spans years or even decades, especially for professional athletes with potentially short career spans.

Tools and Techniques

Financial analysis relies heavily on quantitative tools such as ratio analysis, trend analysis, and comparative analysis. It often involves sophisticated software for data processing and visualization.

Financial planning employs a mix of quantitative and qualitative tools. It uses financial modeling and scenario analysis, but also incorporates softer skills like goal-setting and risk assessment. For professional athletes, this might include specialized tools for projecting career earnings and managing unique income patterns.

Final Thoughts

Financial analysis and financial planning serve distinct yet complementary roles in effective money management. Analysis examines past performance and current financial health, while planning creates a roadmap for future goals. This difference in focus allows individuals and businesses to make informed decisions based on historical data and set realistic objectives for the future.

The insights from financial analysis provide a foundation for creating robust financial plans. Conversely, the goals established in financial planning guide the focus of future analyses. At Pro Hockey Advisors, we understand the unique financial challenges faced by hockey professionals and offer tailored services that integrate both disciplines.

Financial analysis vs financial planning represents two essential aspects of a comprehensive financial strategy. Mastering both disciplines enhances financial decision-making and long-term security, especially in the dynamic world of professional sports where careers can be short-lived. Players, agents, and team executives who grasp these concepts position themselves for greater financial success throughout their careers and beyond.