At Pro Hockey Advisors, we understand that choosing a career path is a significant decision. The finance analyst career offers a blend of analytical skills, financial expertise, and strategic thinking.

In this post, we’ll explore the responsibilities, qualifications, and growth opportunities in this dynamic field. Whether you’re a recent graduate or considering a career change, we’ll help you determine if becoming a finance analyst aligns with your goals and aspirations.

What Do Finance Analysts Actually Do?

Analyzing Financial Data

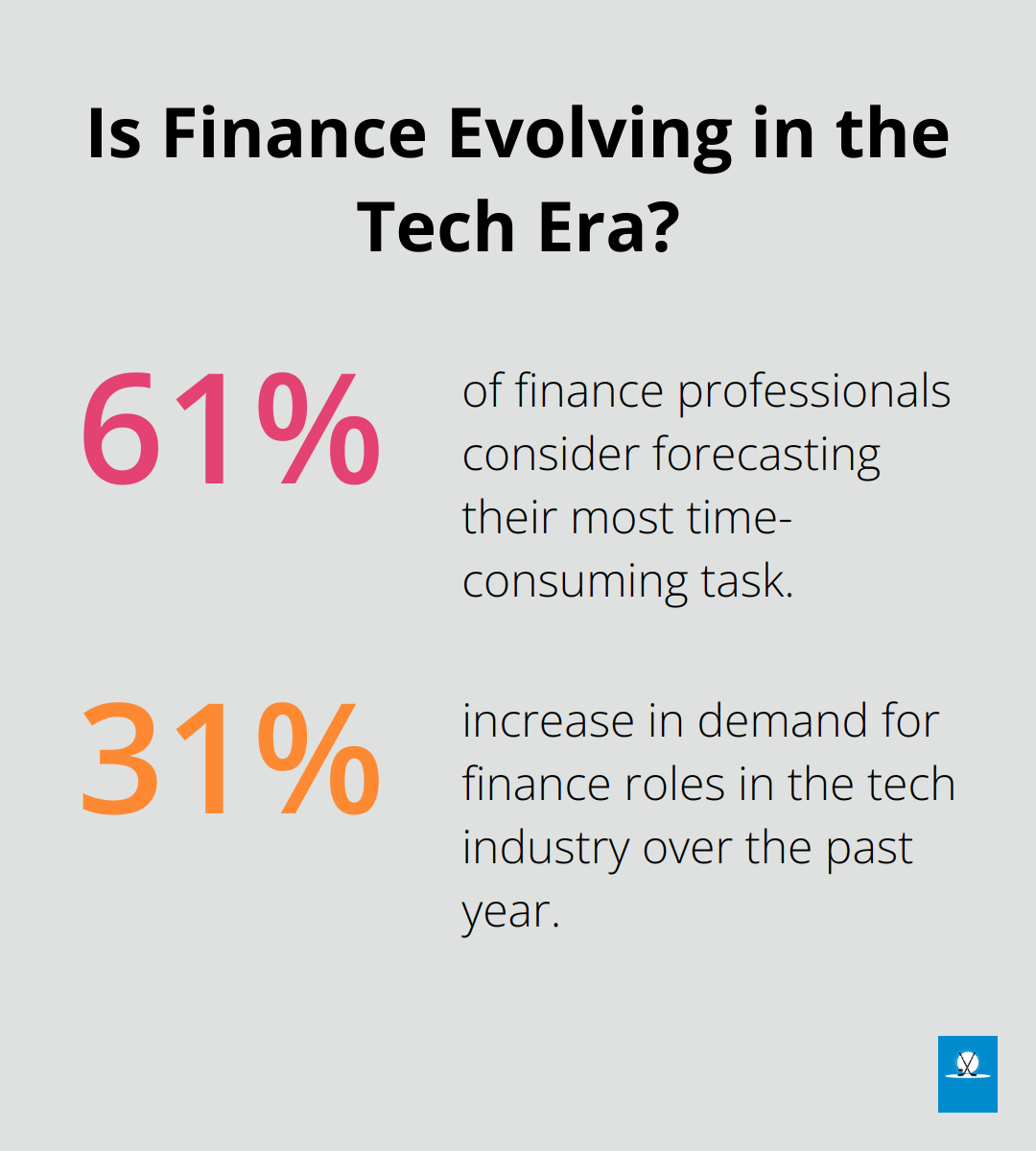

Finance analysts transform raw data into actionable insights, guiding companies towards financial success. They analyze historical financial data, market trends, and economic indicators to predict future financial performance. A survey by the Association for Financial Professionals reveals that 61% of finance professionals consider forecasting their most time-consuming task.

These professionals use sophisticated software tools (Excel, SQL, and specialized financial modeling programs) to create complex financial models. These models help predict cash flow, estimate the impact of potential investments, and assess the financial viability of new projects or business ventures.

Communicating Financial Insights

Finance analysts don’t just work with numbers; they present their findings to senior management and stakeholders. This requires strong communication skills and the ability to translate complex financial data into easy-to-understand presentations.

Finance analysts who effectively communicate their insights are more likely to influence key business decisions and advance in their careers.

Industries Employing Finance Analysts

Finance analysts are in demand across various sectors. Traditional financial services firms like banks, investment companies, and insurance providers are major employers. However, many other industries also rely heavily on financial analysis.

Tech companies increasingly hire finance analysts to manage rapid growth and complex financial structures. LinkedIn’s 2023 Jobs on the Rise report shows that finance roles in the tech industry have seen a 31% increase in demand over the past year.

Retail corporations employ finance analysts to optimize pricing strategies, manage inventory costs, and forecast sales. Healthcare organizations need finance analysts to navigate complex billing systems and manage the financial aspects of patient care.

Even non-profit organizations and government agencies hire finance analysts to ensure efficient use of funds and compliance with financial regulations.

The sports industry also values financial analysis. Professional sports teams and leagues employ finance analysts to manage player contracts, optimize ticket pricing, and evaluate the financial impact of various business decisions.

This diverse range of industries hiring finance analysts offers professionals the flexibility to work in sectors that align with their interests and values. Whether you’re passionate about technology, healthcare, sports, or any other field, there’s likely a place for your financial expertise.

As we move forward, let’s explore the education and qualifications needed to embark on this dynamic career path.

Building Your Finance Analyst Foundation

Educational Requirements

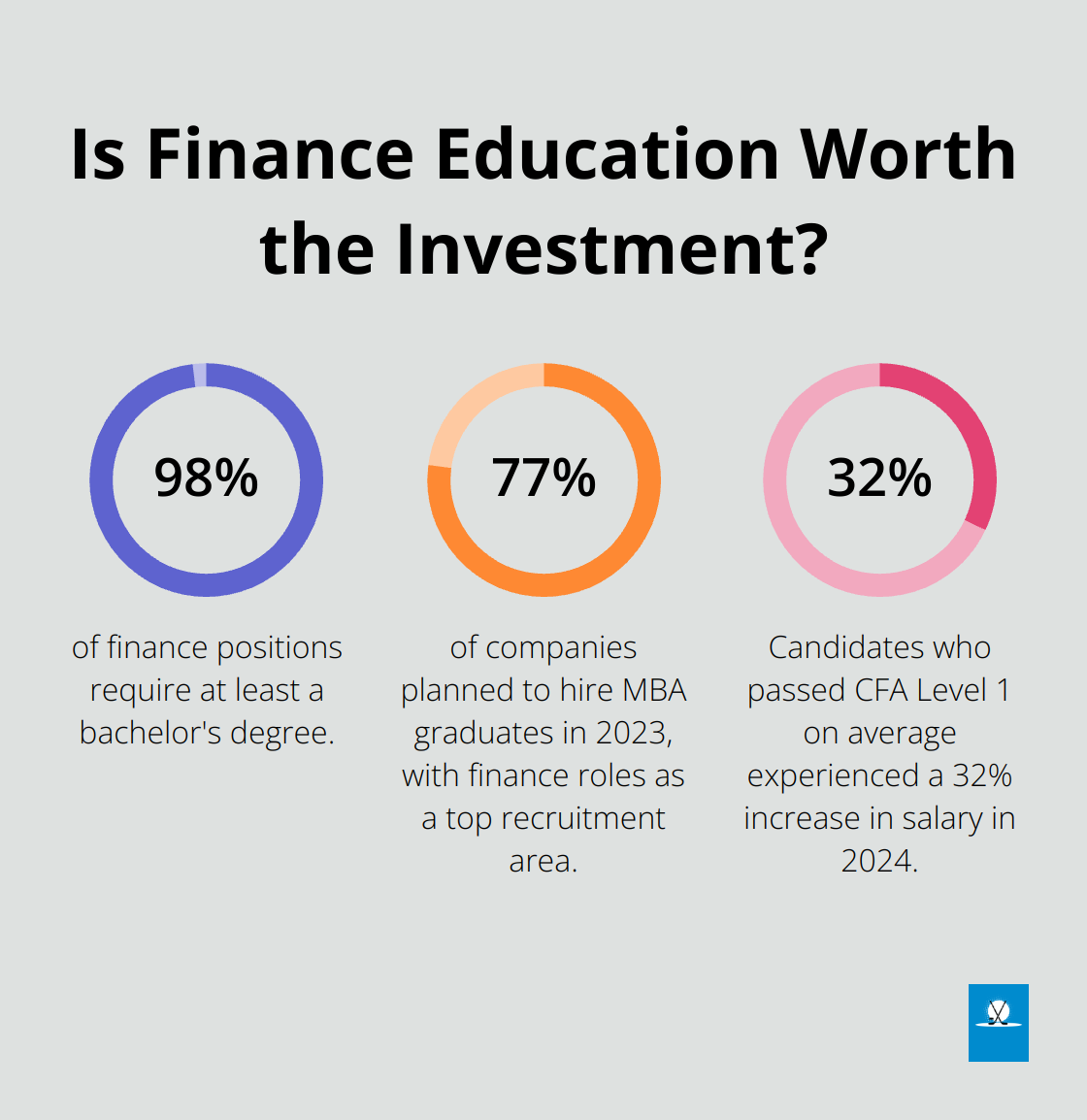

A bachelor’s degree forms the cornerstone for most finance analyst positions. Employers prefer majors in finance, economics, accounting, or mathematics. The National Association of Colleges and Employers reports that 98% of finance positions require at least a bachelor’s degree.

Some roles (especially in investment banking or advanced corporate finance) may demand a master’s degree. An MBA with a finance concentration can significantly boost career prospects. The Graduate Management Admission Council states that 77% of companies planned to hire MBA graduates in 2023, with finance roles as a top recruitment area.

Essential Certifications

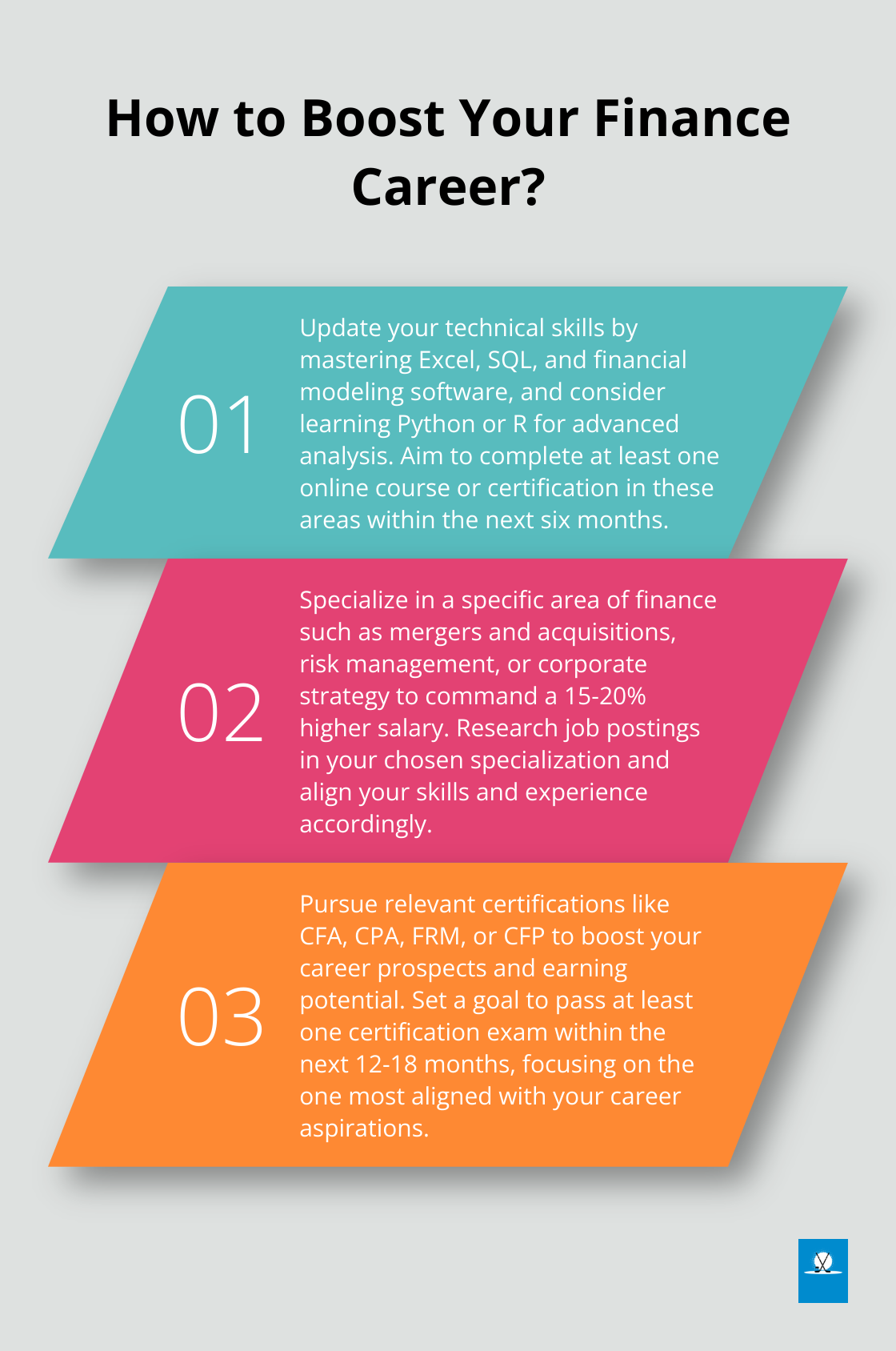

Professional certifications can set you apart in the competitive finance job market. The Chartered Financial Analyst (CFA) designation holds high regard in the industry. In 2024, candidates who passed CFA Level 1 on average experienced a 32% increase in salary.

Other valuable certifications include:

- Certified Public Accountant (CPA) for those who focus on accounting aspects

- Financial Risk Manager (FRM) for risk analysis roles

- Certified Financial Planner (CFP) for personal finance advisors

These certifications require substantial study time and passing rigorous exams.

Continuous Learning

The finance industry evolves rapidly due to technological advancements and regulatory changes. Continuous learning becomes necessary for career longevity.

Many finance professionals engage in self-study using online platforms like Coursera or edX. These platforms offer courses from top universities and industry experts. The MITx MicroMasters® Program in Finance offers recent graduates, early to mid-stage professionals, and other individuals interested in pursuing a career in finance.

Industry conferences and workshops provide another effective way to stay updated. The annual Finovate conference (which focuses on fintech innovations) attracts over 1,500 attendees from various finance sectors.

Practical Experience

While formal education and certifications hold importance, practical experience proves equally valuable. Internships, entry-level positions, and even personal finance projects can provide real-world insights that complement your academic knowledge.

Technological Proficiency

In today’s digital age, finance analysts must possess strong technological skills. Proficiency in financial modeling software, data analysis tools (such as Excel and SQL), and visualization platforms (like Tableau) has become essential. Many employers also value programming skills in languages such as Python or R for more advanced financial analysis.

As you build your foundation as a finance analyst, the next step involves understanding the career progression and salary expectations in this dynamic field.

Climbing the Finance Ladder

Entry-Level Opportunities

Most finance analysts start their careers in junior roles, often as financial analysts or associates. These positions typically require 0-2 years of experience and offer salaries ranging from $50,000 to $70,000 (according to data from Glassdoor). Entry-level analysts often work on tasks such as data collection, basic financial modeling, and assisting senior team members with reports.

To stand out in these early roles, you should develop your technical skills in Excel and financial modeling. Many successful analysts also pursue additional certifications like the CFA Level I exam during this stage. The average salary for a CFA Level 1 completed candidate is $68,000, although this can vary depending on the company and position.

Mid-Career Growth

After 3-5 years, many finance analysts move into senior analyst or manager positions. These roles come with increased responsibilities, such as leading projects, mentoring junior staff, and presenting findings to executives. Salaries at this level typically range from $80,000 to $120,000, with variations based on industry and location.

To accelerate your mid-career growth, you should consider specializing in a specific area of finance, such as mergers and acquisitions, risk management, or corporate strategy. The Association for Financial Professionals notes that professionals with specialized skills command 15-20% higher salaries than generalists.

Senior Roles and Executive Positions

With 10+ years of experience, finance professionals can aspire to roles such as Finance Director, VP of Finance, or even Chief Financial Officer (CFO). These positions often require an MBA or advanced degree, along with a track record of successful financial leadership.

Executive compensation varies widely but can exceed $200,000 annually, with additional bonuses and stock options. The U.S. Bureau of Labor Statistics reports that the median annual wage for financial managers was $131,710 in May 2021, with the top 10% earning more than $208,000.

At this level, soft skills become essential. The ability to communicate complex financial concepts to non-finance executives, strategic thinking, and leadership capabilities are vital for success. Many executives also serve on boards or advisory committees, further expanding their influence and earning potential.

Salary Variations

While these salary ranges provide a general guideline, actual compensation can vary significantly based on factors such as company size, industry, and geographic location. For instance, finance professionals in New York City or San Francisco typically earn 20-30% more than the national average due to higher living costs and competition for talent.

As you progress in your finance career, you should continually assess your skills, seek mentorship opportunities, and stay informed about industry trends to maximize your earning potential and career satisfaction.

Final Thoughts

The finance analyst career offers a dynamic journey for those passionate about numbers and strategic thinking. This path provides growth opportunities, financial stability, and the chance to work across diverse industries. However, it demands continuous learning, often involves long hours, and requires additional certifications to stand out in a competitive field.

Finance analysts enjoy strong job prospects, competitive salaries, and the potential for significant career advancement. The ability to impact crucial business decisions and contribute to an organization’s success can be highly satisfying. The analytical and problem-solving skills developed in this role are transferable to many other careers, providing flexibility for future career shifts.

At Pro Hockey Advisors, we understand the importance of making informed career decisions. While our focus is on professional hockey, many financial principles and career management strategies apply across industries, including finance. Success in any career requires dedication, continuous learning, and adaptability.

Pingback: Where to Find Risk Management Resources Online - Pro Hockey Wealth Management & Retirement Planning