At Pro Hockey Advisors, we understand that finance majors often face a wide array of career options after graduation. The finance industry is constantly evolving, offering both traditional and emerging paths for ambitious professionals.

This blog post explores various finance major career options, from classic roles in investment banking to cutting-edge opportunities in FinTech. We’ll also discuss the skills and qualifications needed to succeed in these diverse fields.

Where Do Finance Majors Start Their Careers?

Finance majors have numerous traditional career paths to choose from, each offering unique challenges and opportunities. Let’s explore some of the most popular options.

Investment Banking: High Stakes and High Rewards

Investment banking remains a top choice for many finance graduates. This fast-paced field involves helping companies raise capital, execute mergers and acquisitions, and provide strategic financial advice. The U.S. Bureau of Labor Statistics reports that investment bankers earned a median annual wage of $95,270 in 2022. However, this career path often requires long hours and high-pressure environments, especially in the early years.

Financial Analysis: Number Crunching for Success

Financial analysts play a key role in helping businesses and individuals make informed investment decisions. They assess financial data, study economic trends, and recommend investment strategies. According to the U.S. Bureau of Labor Statistics, financial analysts earned a median annual wage of $99,010 in May 2023.

Corporate Finance: Steering the Financial Ship

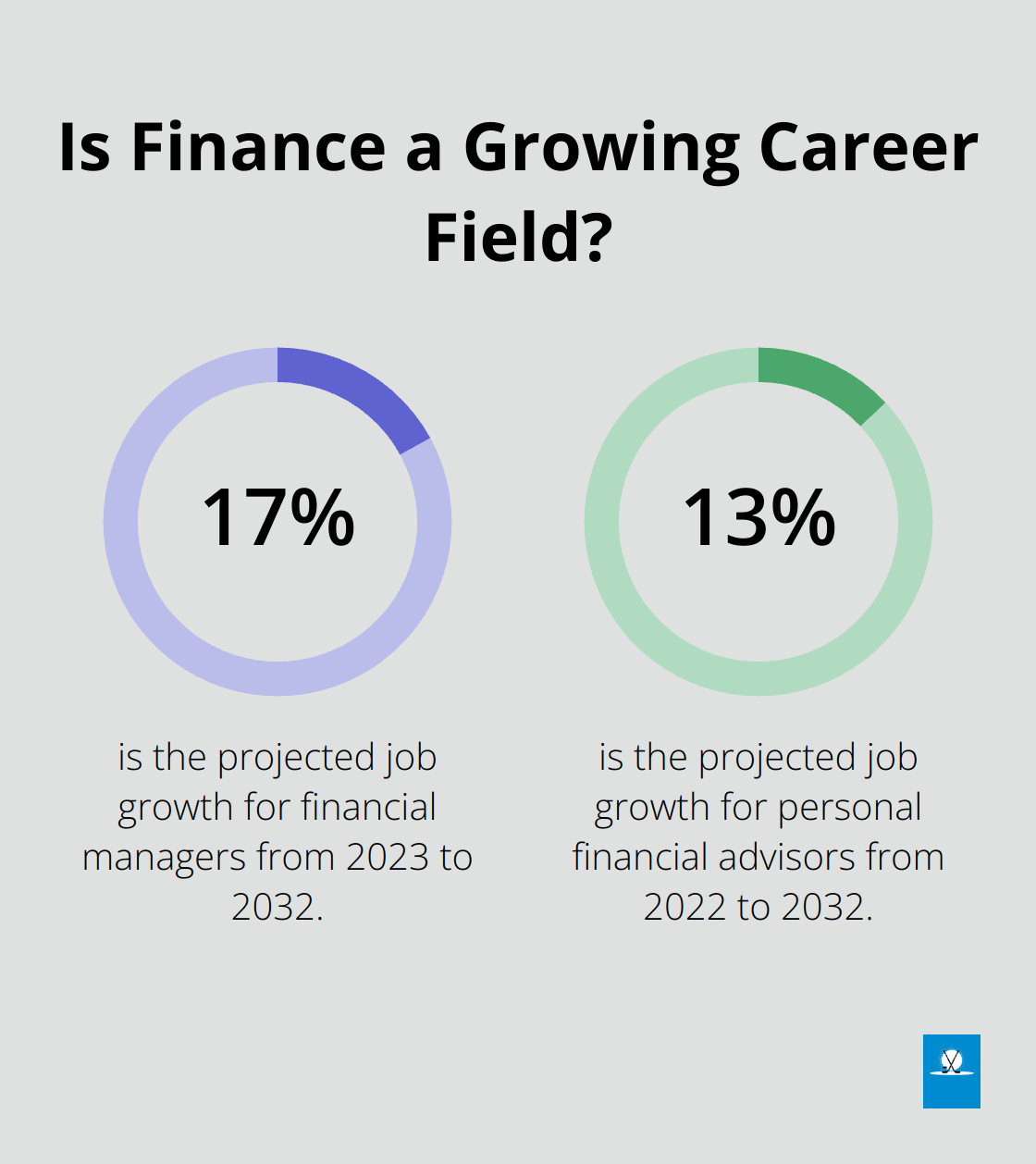

Corporate finance professionals manage a company’s financial activities, including budgeting, financial planning, and capital structure decisions. Roles in this field range from financial managers to treasurers and controllers. The U.S. Bureau of Labor Statistics reports that financial managers earned a median annual wage of $156,100 in May 2023, with a projected job growth of 17% from 2023 to 2032 (one of the fastest-growing fields in finance).

Financial Planning and Advising: Guiding Individual Success

Financial planners and advisors help individuals manage their money, plan for retirement, and achieve their financial goals. This career path offers the satisfaction of directly impacting people’s lives. Personal financial advisors earned a median annual wage of $95,390 in 2022, with a projected job growth of 13% from 2022 to 2032 (according to the U.S. Bureau of Labor Statistics).

While these traditional paths offer stable and lucrative careers, it’s important to consider your personal interests and strengths when choosing your path. Try to explore various options and gain practical experience through internships or entry-level positions to find the best fit for your skills and aspirations.

As the finance industry continues to evolve, new and exciting career opportunities emerge. Let’s explore some of these cutting-edge paths in the next section.

What’s Next in Finance Careers?

The finance industry continues to evolve, creating exciting new career opportunities for finance majors. Let’s explore some of the most promising emerging career paths in finance.

FinTech and Blockchain Revolution

Financial technology (FinTech) reshapes the finance industry. Jobs in this sector combine finance, technology, and innovation. Some of the best FinTech jobs for the future include FinTech Blockchain Developer, FinTech Data Scientist, and Cyber Security FinTech Analyst. This growth creates numerous job opportunities in areas like mobile banking, peer-to-peer lending, and blockchain technology.

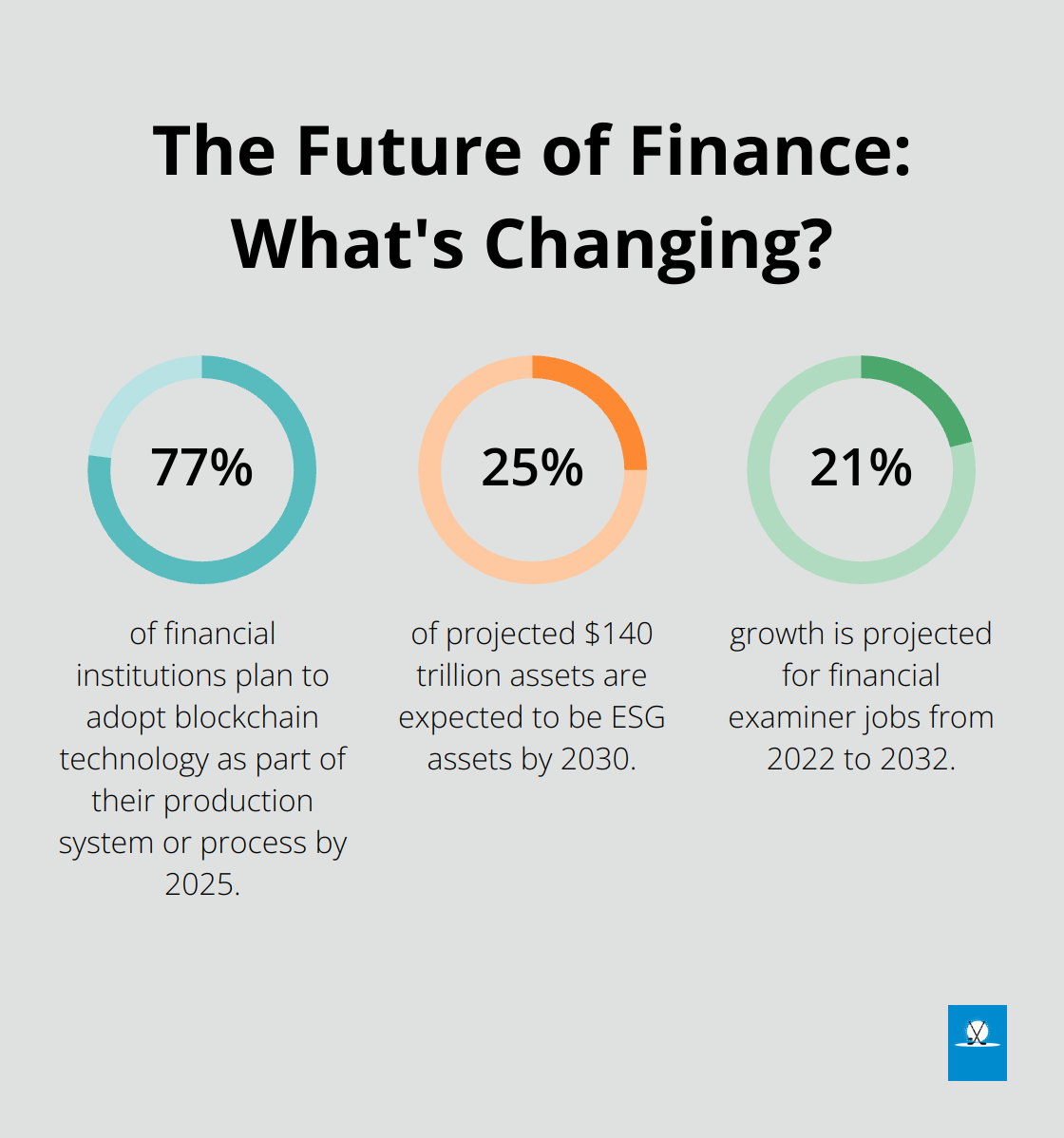

Blockchain, in particular, gains traction in finance. A PwC survey found that 77% of financial institutions plan to adopt blockchain technology as part of their production system or process by 2025. This trend creates demand for professionals who understand both finance and blockchain technology.

Sustainable Finance and ESG Investing

Environmental, Social, and Governance (ESG) investing has become a mainstream market. Global ESG assets surpassed $30 trillion in 2022 and are on track to surpass $40 trillion by 2030 – over 25% of projected $140 trillion assets. This growth drives demand for professionals who can analyze ESG factors and integrate them into investment strategies.

Careers in sustainable finance include ESG analysts, income asset management, and sustainability consultants. These roles require a blend of financial acumen and knowledge of environmental and social issues.

Data Analytics in Finance

The finance industry has become increasingly data-driven. This investment creates opportunities for finance professionals who can leverage data to drive business decisions.

Roles in this area include finance analysts, quantitative analysts (quants), and machine learning engineers in finance. These positions often require a combination of finance knowledge and technical skills in areas like Python, R, and SQL.

Risk Management and Compliance

In the wake of financial crises and increasing regulation, risk management and compliance have become critical functions in finance. The U.S. Bureau of Labor Statistics projects that jobs for financial examiners (who ensure compliance with laws governing financial institutions) will grow 21% from 2022 to 2032, much faster than the average for all occupations.

Careers in this field include risk management specialists, compliance officers, and anti-money laundering specialists. These roles require a strong understanding of financial regulations and the ability to implement risk management strategies.

As the finance industry continues to transform, finance majors must develop the skills needed to thrive in this changing landscape. The next section will explore the essential skills and qualifications for success in these emerging finance careers.

What Skills Do Finance Professionals Need?

Technical Prowess

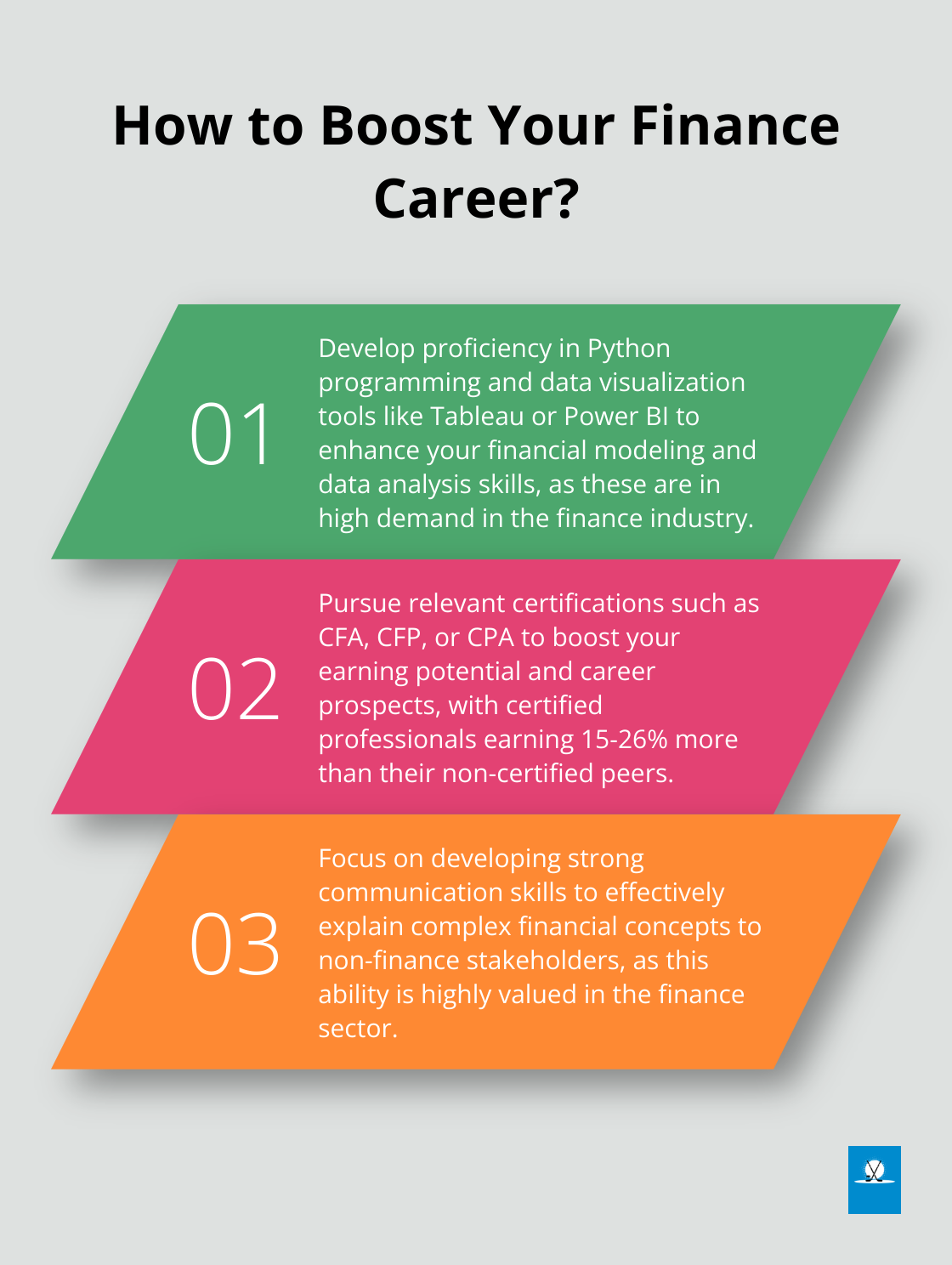

Financial modeling and data analysis form the foundation of many finance roles. Python occupies over 60% of all jobs requiring a scripting programming language in finance. Data visualization tools (such as Tableau or Power BI) are also in high demand. The ability to present complex financial data in an easily digestible format proves invaluable.

Soft Skills Matter

While technical skills are important, soft skills often set top performers apart. Communication is paramount in finance. The ability to explain complex financial concepts to non-finance stakeholders is a highly sought-after skill.

Problem-solving and critical thinking are equally important. Finance professionals often face complex challenges that require innovative solutions. The World Economic Forum’s Future of Jobs Report 2023 lists analytical thinking and creative problem-solving among the top skills needed in finance for the next five years.

Certifications as Career Boosters

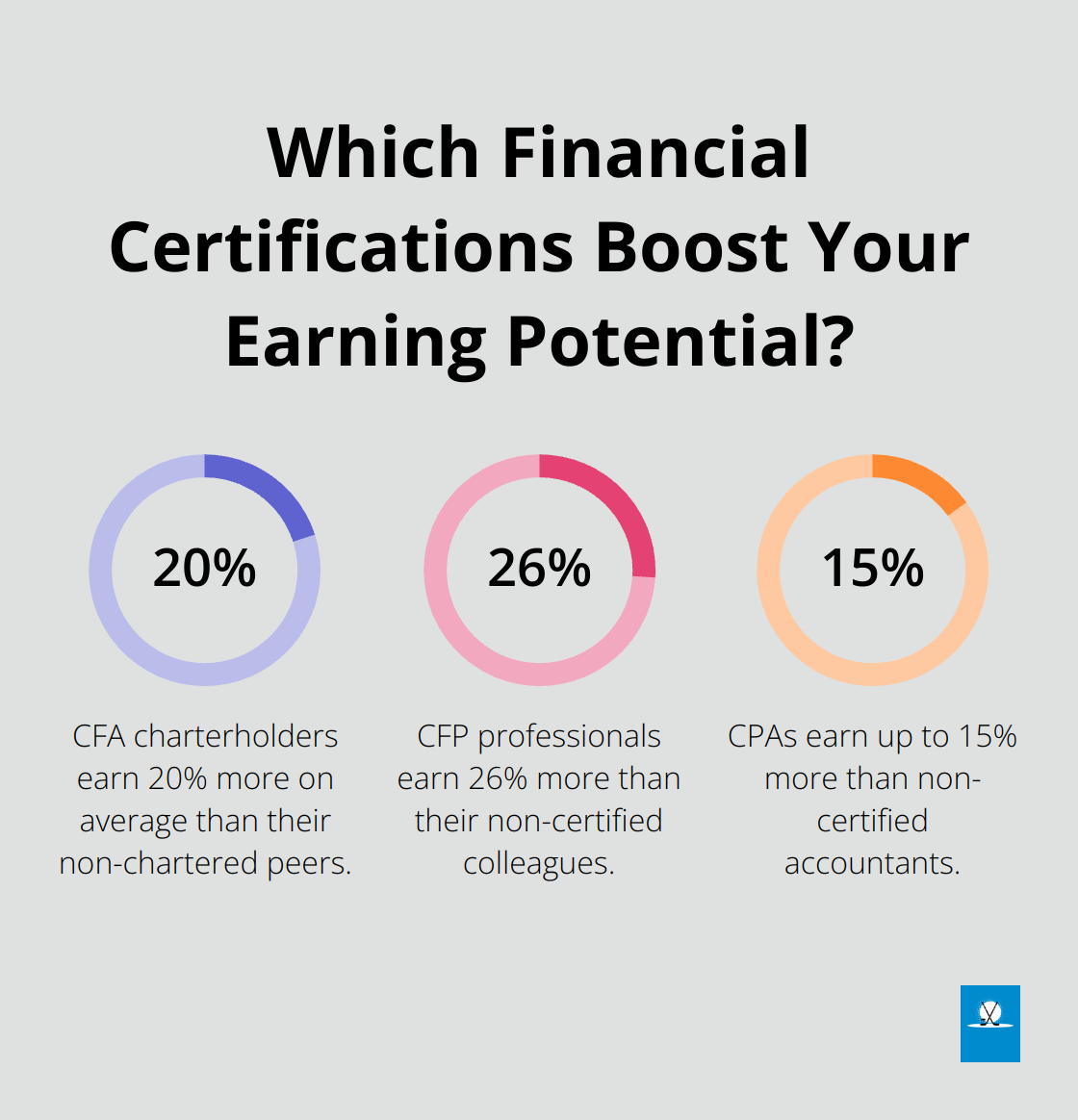

Professional certifications can significantly enhance a finance career. The Chartered Financial Analyst (CFA) designation is highly respected in investment management. According to the CFA Institute, CFA charterholders earn 20% more on average than their non-chartered peers.

For those in financial planning, the Certified Financial Planner (CFP) certification is valuable. The CFP Board reports that CFP professionals earn 26% more than their non-certified colleagues. In accounting, the Certified Public Accountant (CPA) designation remains the gold standard, with CPAs earning up to 15% more than non-certified accountants (according to the American Institute of CPAs).

Embracing Lifelong Learning

The finance industry evolves rapidly, making continuous learning essential. Staying current with industry trends, regulatory changes, and technological advancements is important. Many finance professionals pursue advanced degrees like MBAs or specialized master’s programs to deepen their expertise.

Online learning platforms offer flexible options for skill development. Coursera reports that enrollments in finance-related courses increased by 300% in 2023, highlighting the growing emphasis on continuous education in the field.

Final Thoughts

The finance industry offers diverse career paths for finance majors. From investment banking to FinTech, finance major career options span across sectors, catering to various interests and skills. The field evolves rapidly, shaped by technology, regulations, and global economic shifts.

We at Pro Hockey Advisors encourage finance majors to explore different paths within the industry. Your unique skills and interests can guide you towards a fulfilling career that aligns with your goals. The skills you develop as a finance major (analytical thinking, problem-solving, and financial acumen) are valuable across many sectors.

For those looking to optimize their finance career or explore opportunities in professional hockey, Pro Hockey Advisors offers expert consulting services. We provide strategies for career management and financial planning, helping you navigate your professional journey with confidence. Your finance career starts now-make the most of it.