At Pro Hockey Advisors, we often hear the question: “Does a financial advisor control your money?” It’s a common concern for those considering professional financial guidance.

The truth is, financial advisors don’t have direct control over your funds. Instead, they provide expert advice and recommendations to help you make informed decisions about your money.

What Does a Financial Advisor Actually Do?

The Multifaceted Role of Financial Advisors

Financial advisors play a key role in helping individuals and families navigate their financial journey. They analyze your current financial situation, help you set realistic goals, and create a roadmap to achieve them. This involves everything from budgeting and saving strategies to investment management and retirement planning.

Types of Financial Advisors

Several types of financial advisors exist, each with their own specialties:

- Certified Financial Planners (CFPs): These professionals complete extensive training and adhere to strict ethical standards. They offer comprehensive financial planning services.

- Registered Investment Advisors (RIAs): These advisors focus primarily on investment management and are regulated by the SEC or state securities regulators.

- Robo-advisors: These digital platforms provide automated, algorithm-driven financial planning services with minimal human supervision.

- Specialty advisors: Some advisors focus on specific industries or professions, offering tailored advice for unique financial situations (e.g., Pro Hockey Advisors for professional hockey players).

The Fiduciary Responsibility

One of the most important aspects of a financial advisor’s role is their fiduciary responsibility. This means they have a legal obligation to act in your best interest, not their own.

The new Code and Standards requires a CFP® professional to act as a fiduciary when providing “Financial Advice to a Client.”

Services Provided by Financial Advisors

Financial advisors offer a wide range of services, including:

- Investment management: Advisors help you choose investments that align with your goals and risk tolerance.

- Retirement planning: They assist in creating strategies to ensure you have enough money for retirement.

- Tax planning: Advisors can help you minimize your tax burden through various strategies (e.g., tax-loss harvesting).

- Estate planning: They can guide you in creating a plan for the distribution of your assets after death.

- Risk management: Advisors help you identify and mitigate financial risks through insurance and other strategies.

As we move forward, it’s important to understand that while financial advisors provide valuable guidance and expertise, they don’t control your money. In the next section, we’ll explore the extent of your control over your finances when working with an advisor.

Who Really Controls Your Money?

The Power of Decision-Making

When you work with a financial advisor, you might question who truly controls your finances. The reality is that you remain the primary decision-maker. A 15-year-old study examined communication best practices and how they impact the trust and commitment clients have in their planners. This research highlights the importance of collaborative approaches in financial planning relationships.

Your Funds Stay in Your Possession

Many people mistakenly believe that advisors directly handle their money. In truth, your funds typically remain in your own accounts. While advisors may receive permission to execute trades or make adjustments, they cannot withdraw or transfer your money without your explicit consent. The Securities and Exchange Commission (SEC) enforces strict rules to safeguard investors’ assets.

The Importance of Clear Communication

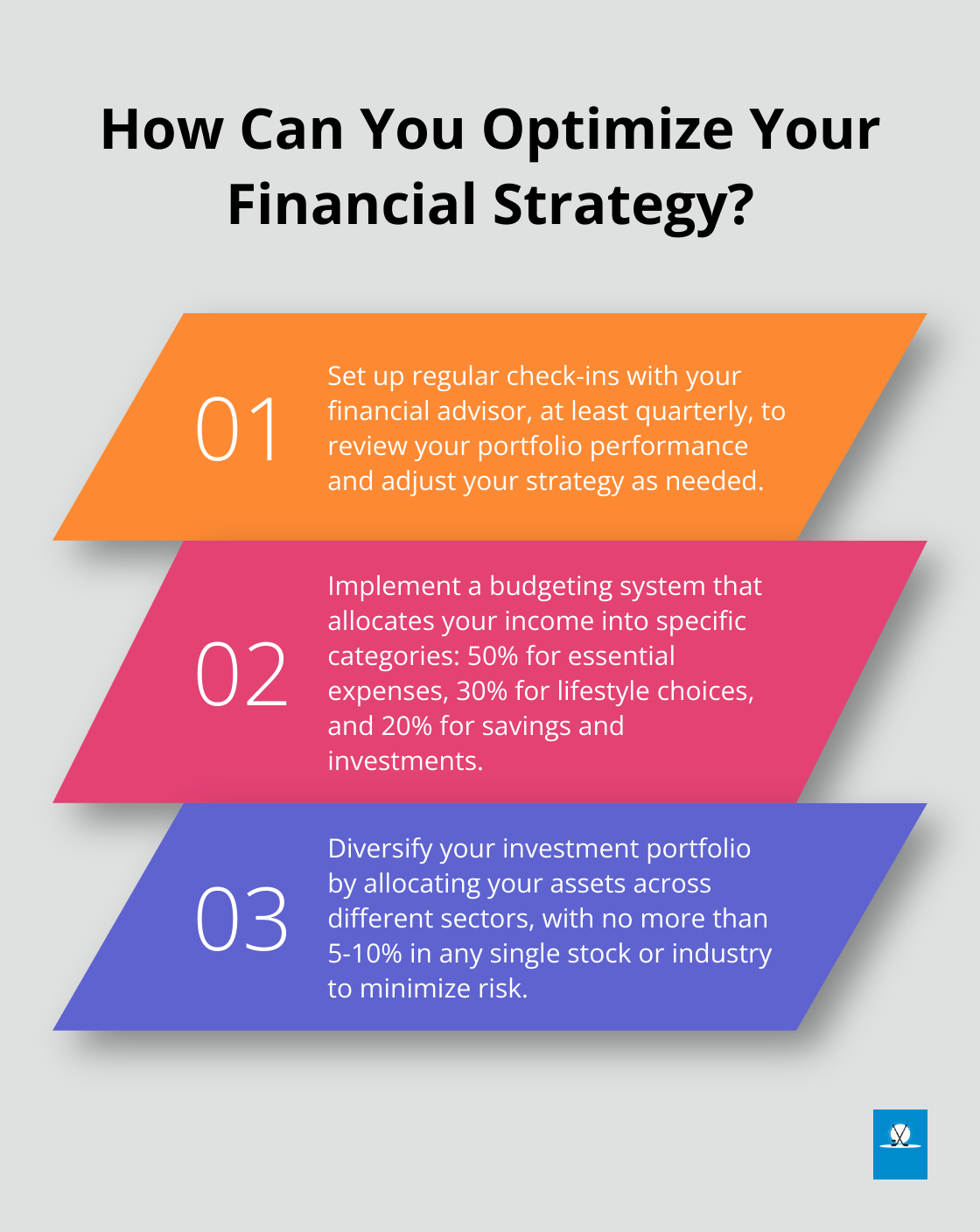

Open dialogue with your advisor plays a vital role in maintaining control over your finances. To ensure you retain control:

- Establish clear expectations about your desired level of involvement from the beginning.

- Request regular updates on your portfolio’s performance.

- Question any recommendations you don’t fully understand.

A competent advisor should welcome your inquiries and active participation. Their role is to guide you, not to take over your financial life.

The Role of Transparency

Transparency forms the foundation of a healthy advisor-client relationship. Your advisor should provide clear explanations of their recommendations, fees, and potential conflicts of interest. This openness allows you to make informed decisions about your money and ensures that you maintain ultimate control over your financial future.

Customizing Your Level of Involvement

Financial advisors understand that each client has unique preferences regarding their level of involvement. Some clients prefer a hands-on approach, while others are comfortable with a more hands-off strategy. Discuss your preferences with your advisor to create a tailored approach that suits your needs and comfort level.

As we move forward, we’ll explore how financial advisors assist in managing your money while respecting your control and decision-making authority.

How Financial Advisors Guide Your Money

The Advisory Process

Managing your wealth does not have to be your second (or third) full-time job. However, you should devote enough time and attention to your assets and liabilities. Financial advisors start with a comprehensive assessment of your current financial situation. They analyze your income, expenses, assets, and liabilities. For professional athletes, this includes factors like contract structures, endorsement deals, and potential career longevity.

Advisors then work with you to define short-term and long-term financial goals. These might include buying a home, saving for retirement, or planning for post-career ventures. Based on these goals, your advisor develops a personalized financial strategy.

Investment Strategies

A key aspect of financial management is the development and implementation of effective investment strategies. Advisors consider factors such as your risk tolerance, time horizon, and financial objectives when crafting these strategies.

For example, younger athletes might receive advice to adopt a more aggressive investment approach to capitalize on their long-term earning potential. In contrast, players nearing retirement might receive guidance towards more conservative strategies to preserve wealth.

Diversification often forms a cornerstone of these strategies. Businesses that seek to diversify their funds do so to reduce the volatility of their financial portfolio. Many sports organizations benefit from this approach. Advisors may recommend a mix of stocks, bonds, real estate, and other assets to achieve this diversification.

Comprehensive Financial Planning

Financial advisors provide more than just investment management. They offer comprehensive financial planning services that touch on various aspects of your financial life.

Tax planning is a critical component, especially for high-income earners like professional athletes. Advisors can help implement strategies to minimize tax liabilities (such as maximizing contributions to retirement accounts or strategically timing income recognition).

Estate planning is another important area. Advisors can help you create a plan for wealth transfer, ensuring your assets are distributed according to your wishes while minimizing potential tax implications for your beneficiaries.

Risk management also receives significant focus. This might involve recommendations for appropriate insurance coverage to protect against potential career-ending injuries or other unforeseen circumstances.

Specialized Approach for Athletes

Financial management for professional athletes requires a specialized approach. Advisors who understand the unique financial landscape of professional sports (like those at Pro Hockey Advisors) can provide targeted advice that addresses the specific needs of players in this industry.

Final Thoughts

Financial advisors do not control your money. They provide expert guidance and recommendations, but you remain the ultimate decision-maker. Your funds stay in your possession, and you have the power to accept or reject any advice given.

The relationship between advisors and clients is built on trust, transparency, and collaboration. They offer personalized strategies, help navigate market volatility, and provide objective perspectives that can lead to better financial outcomes. For professional athletes, specialized advisors who understand the unique financial landscape of sports can be particularly beneficial.

At Pro Hockey Advisors, we understand the specific needs of professional hockey players. Our team offers expert consulting services, focusing on career management, contract negotiations, and financial planning tailored to the hockey industry (optimized for long-term financial security).