At Pro Hockey Advisors, we often get asked: “What is the best career in finance?” The truth is, there’s no one-size-fits-all answer.

Finance offers a wide range of career paths, each with its own unique challenges and rewards. In this post, we’ll explore three popular finance careers to help you make an informed decision about your future.

Investment Banking: High Stakes and High Rewards

Investment banking stands at the pinnacle of finance careers, offering a fast-paced environment with high stakes and potentially astronomical rewards. At its core, investment bankers help companies and governments raise capital by issuing and selling securities. They also provide guidance on mergers and acquisitions, and other financial transactions.

The Day-to-Day Realities

Investment bankers work long hours, often exceeding 80-100 hours per week. Their responsibilities include financial modeling, creating pitch books, conducting due diligence, and managing client relationships. This demanding role requires attention to detail, strong analytical skills, and the ability to work under pressure.

Skills and Qualifications

Success in investment banking requires a strong educational background, typically a bachelor’s degree in finance, economics, or a related field. Many investment banks prefer candidates with an MBA or other advanced degrees. Beyond formal education, excellent quantitative skills, proficiency in financial modeling and valuation, and strong communication abilities are essential.

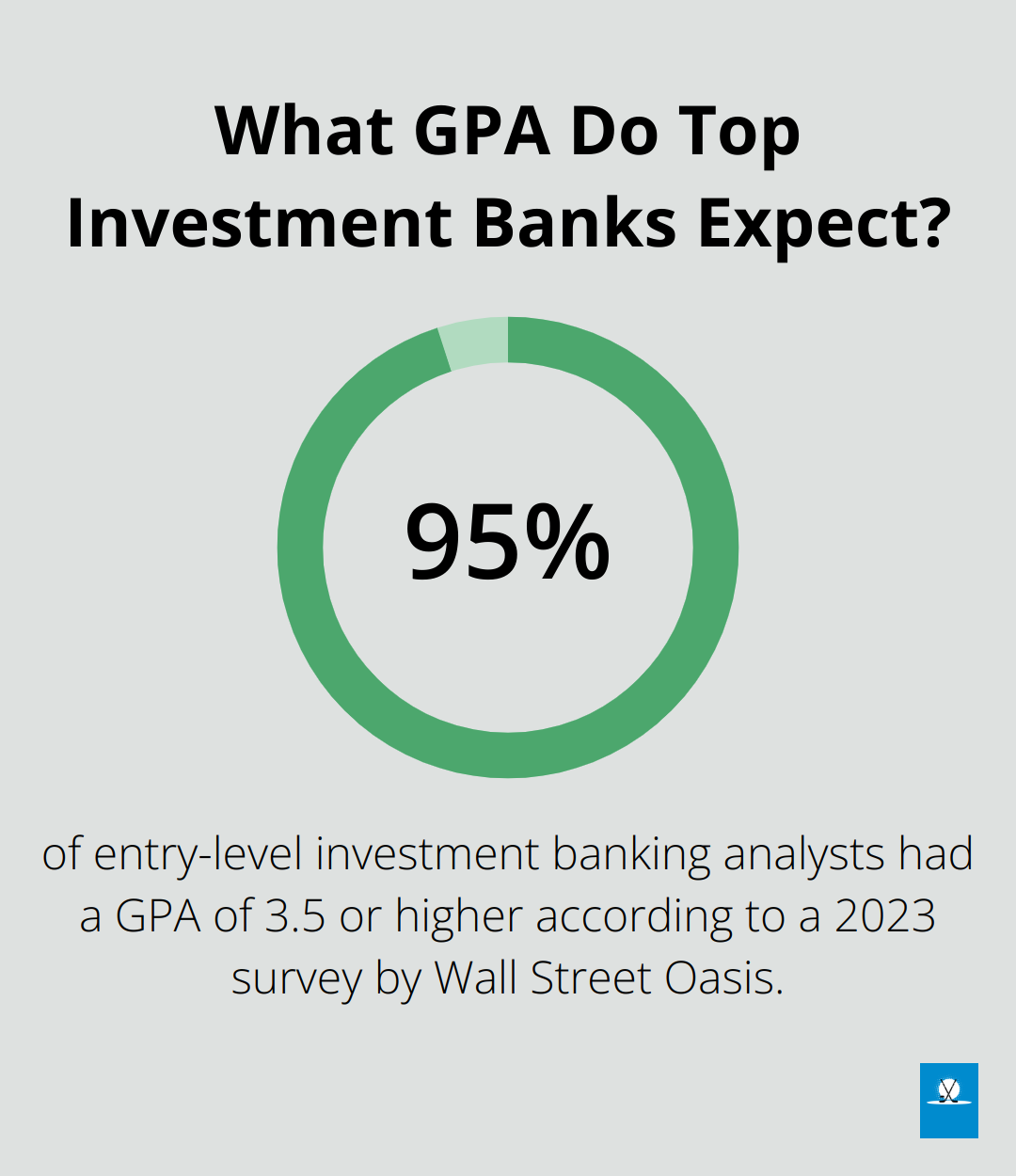

A 2023 survey by Wall Street Oasis revealed that 95% of entry-level investment banking analysts had a GPA of 3.5 or higher (underscoring the competitive nature of the field and the high academic standards expected).

Compensation and Career Progression

Investment banking offers lucrative compensation packages. Entry-level analysts can expect base salaries around $100,000-$125,000, with bonuses that can significantly increase that amount. As professionals progress to associate, vice president, and managing director roles, compensation can easily reach seven figures.

The career progression in investment banking typically follows this structure:

- Analyst (2-3 years)

- Associate (3-4 years)

- Vice President (3-4 years)

- Director/Executive Director (2-3 years)

- Managing Director

The Upsides and Downsides

Investment banking offers unparalleled exposure to high-profile deals and the opportunity to work with top executives. The financial rewards can be substantial, and the skills developed are highly transferable to other finance roles.

However, the job comes with significant drawbacks. The work-life balance often suffers due to long hours and high stress levels. Burnout is common, and the competitive nature of the industry can lead to a cutthroat work environment.

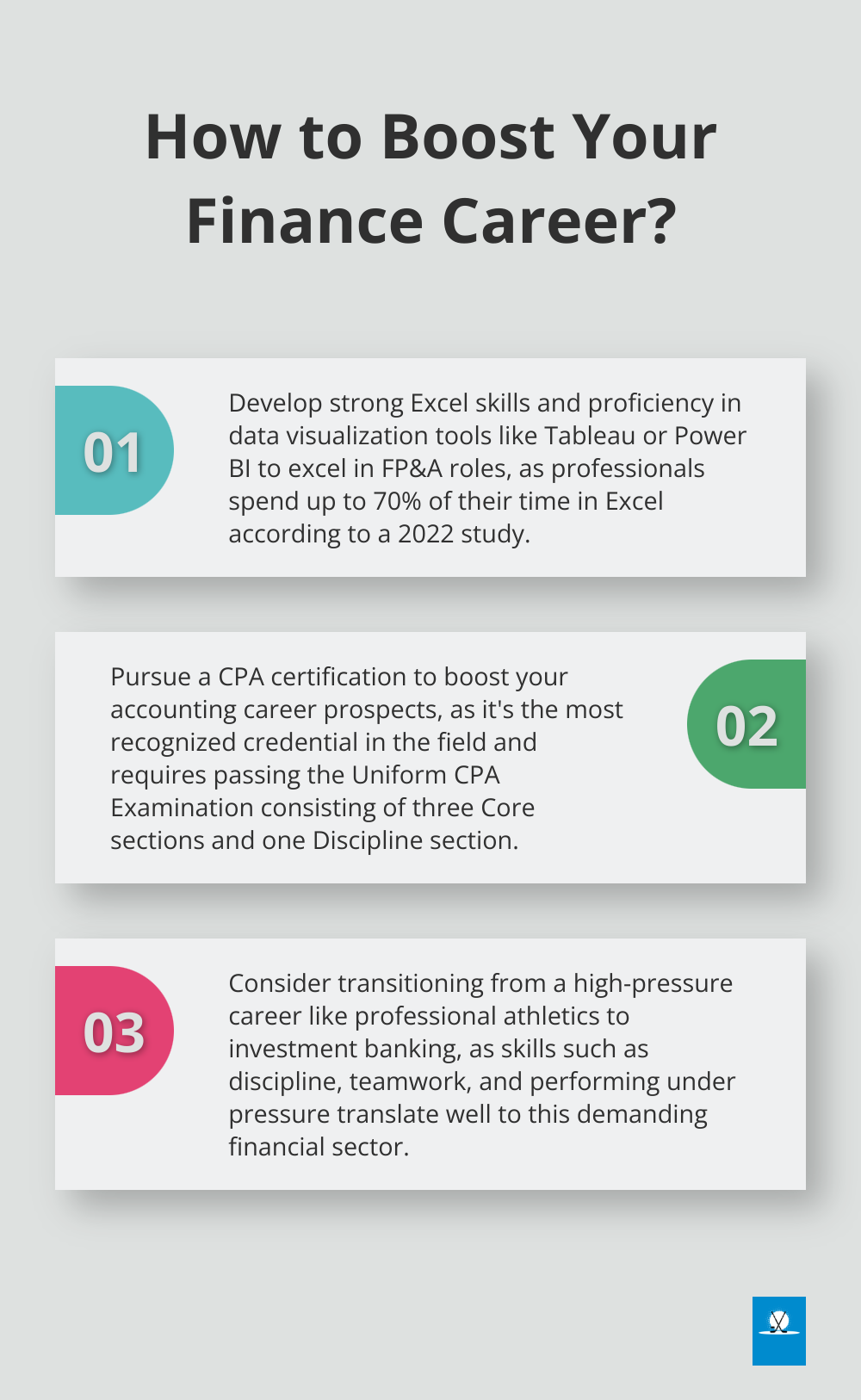

Many professionals transition from other high-pressure careers to investment banking. The skills developed in fields like professional athletics – discipline, teamwork, and performing under pressure – often translate well to this demanding financial sector. As we move on to explore other finance careers, it’s important to consider how these skills might apply across different roles in the industry.

FP&A: Driving Financial Strategy

The Core of FP&A

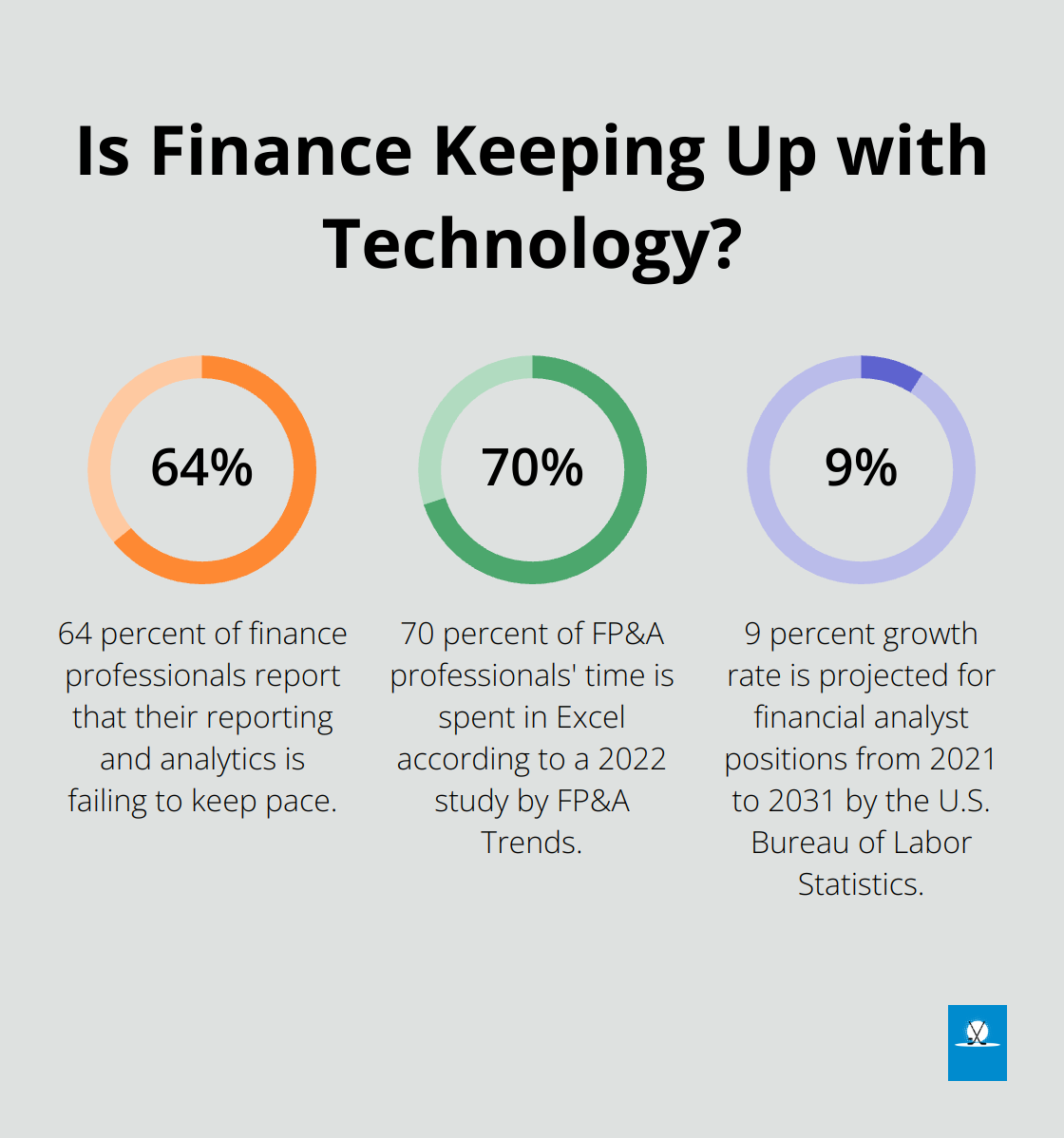

Financial Planning and Analysis (FP&A) forms the financial backbone of an organization. FP&A professionals provide insights that drive decision-making and shape a company’s future. They handle budgeting, forecasting, and analysis of financial performance. A recent CFO survey indicated that 64 percent of finance professionals report that their reporting and analytics is failing to keep pace, underscoring the strategic importance of this role.

Variance analysis stands as a key responsibility in FP&A. This process compares actual financial results to budgeted or forecasted figures and explains the differences. For instance, if sales fall 10% below forecast, FP&A collaborates with the sales team to understand the cause and adjust future projections.

Skills for FP&A Success

Success in FP&A requires a unique blend of technical and soft skills. Strong Excel proficiency is essential – a 2022 study by FP&A Trends found that many FP&A professionals spend up to 70% of their time in Excel. Beyond spreadsheets, proficiency in data visualization tools like Tableau or Power BI helps communicate financial insights effectively to non-financial stakeholders.

Communication skills prove paramount in FP&A. Professionals must explain complex financial concepts to various audiences, from C-suite executives to operational managers. The ability to tell a story with data often distinguishes great FP&A professionals from good ones.

Career Growth in FP&A

FP&A offers a clear career progression path. Many start as Financial Analysts, advancing to Senior Analyst, Manager, Director, and eventually VP of FP&A or even CFO. According to Mergers and Inquisitions, reaching a director-level position in FP&A usually takes 10+ years.

An FP&A career provides the opportunity to gain broad business exposure. FP&A professionals interact with every department in an organization, offering a holistic view of the business (invaluable for those aspiring to C-suite positions).

Compensation and Job Outlook

FP&A roles offer competitive compensation, with salaries increasing significantly with experience. The 2023 Robert Half Salary Guide reports that entry-level FP&A analysts in the U.S. can expect salaries ranging from $60,000 to $80,000, while Directors of FP&A can earn between $130,000 and $180,000 (not including bonuses).

The job outlook for FP&A remains strong. As businesses increasingly rely on data-driven decision making, the demand for skilled FP&A professionals grows. The U.S. Bureau of Labor Statistics projects a 9% growth rate for financial analyst positions (which includes FP&A) from 2021 to 2031, faster than the average for all occupations.

While FP&A offers a promising career path, the role can be demanding, especially during budget seasons and month-end closes. However, for those who enjoy working with numbers and possess a knack for strategic thinking, FP&A presents an exciting opportunity to shape organizational strategy and drive financial success.

As we transition to our next section on Accounting and Auditing, it’s important to note that the skills developed in FP&A – such as financial analysis, strategic thinking, and communication – can also prove valuable in these related fields.

Accounting and Auditing: Balancing the Books

The Diverse World of Accounting

Accounting and auditing form the backbone of financial reporting and compliance in organizations. These roles maintain financial integrity and provide stakeholders with accurate financial information.

Accounting roles vary widely, from tax specialists to forensic accountants. Public accountants work for accounting firms, serving multiple clients, while private accountants work in-house for a single company. Management accountants focus on internal financial reporting and analysis, while government accountants work in the public sector.

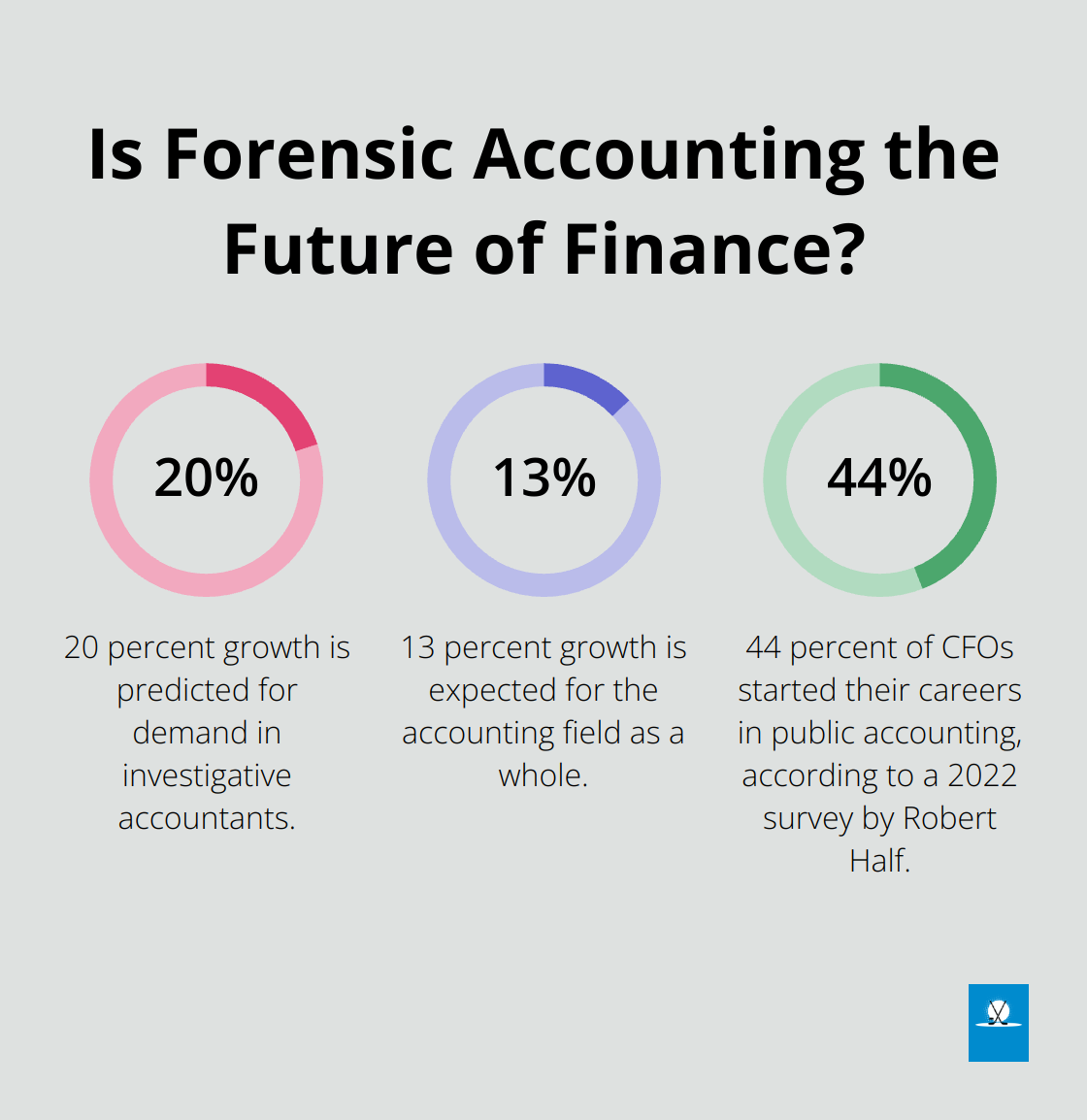

Demand for investigative accountants is predicted to grow by 20 percent while the accounting field as a whole is expected to rise by 13 percent. These professionals investigate financial crimes and often work closely with law enforcement agencies.

Education and Certification: The Path to Success

Most accounting positions require at least a bachelor’s degree in accounting or a related field. However, many employers prefer candidates with a master’s degree in accounting or business administration (MBA) with an accounting concentration.

Certification plays a key role for career advancement in accounting. The Certified Public Accountant (CPA) credential is the most recognized and respected in the field. To become a CPA, candidates must pass the Uniform CPA Examination (CPA Exam), which consists of three four-hour Core sections and one four-hour Discipline section.

Other valuable certifications include Certified Management Accountant (CMA) for those focused on corporate finance and Certified Internal Auditor (CIA) for auditing specialists. These certifications can significantly boost earning potential and career prospects.

Career Progression: From Entry-Level to Partner

Accounting offers clear career progression paths. In public accounting, professionals typically start as staff accountants, progressing to senior accountant, manager, senior manager, and eventually partner. This journey usually takes 10-15 years.

In corporate accounting, the path might lead from staff accountant to controller and eventually Chief Financial Officer (CFO). A 2022 survey by Robert Half found that 44% of CFOs started their careers in public accounting, demonstrating the value of this experience.

Compensation and Work-Life Balance

Accounting salaries vary based on specialization, location, and experience. According to the U.S. Bureau of Labor Statistics, the median annual wage for accountants and auditors was $77,250 in May 2022. However, top earners, often partners in big accounting firms or CFOs, can earn well over $200,000 annually.

Work-life balance in accounting can present challenges, especially during tax season or audit periods. Public accountants often work long hours from January to April, while private accountants may have more consistent schedules. However, many firms now offer flexible work arrangements to improve work-life balance and attract top talent.

The Future of Accounting

The accounting and auditing field continues to evolve with technological advancements. Automation and artificial intelligence change the nature of accounting work, shifting focus from data entry and basic bookkeeping to more analytical and advisory roles. Professionals who adapt to these changes and leverage technology will find themselves in high demand.

Final Thoughts

The best career in finance depends on your personal interests, strengths, and lifestyle preferences. Investment banking suits those who thrive in high-pressure environments, while FP&A appeals to professionals passionate about shaping business strategy. Accounting offers stability for those who enjoy working with numbers and adapting to technological advancements.

The finance industry evolves constantly, driven by technological advancements and changing market dynamics. Continuous learning and adaptability prove essential for long-term success in any finance career path. Professionals should embrace new technologies, stay informed about industry trends, and consider pursuing relevant certifications to remain competitive.

At Pro Hockey Advisors, we understand the importance of making informed career decisions. While our expertise lies in guiding professional hockey players, the principles of strategic planning and financial management apply across industries. Your career path can change over time, so stay open to opportunities and network actively to build a successful and fulfilling career in finance.