At Pro Hockey Advisors, we know that building a strong financial future is as important as mastering the game on the ice.

Diversification and asset allocation are two key strategies that can help you achieve your financial goals. These concepts form the foundation of a robust investment portfolio, designed to weather market fluctuations and maximize returns.

In this post, we’ll explore how to effectively implement these strategies to create a balanced and resilient investment approach.

What Is Asset Allocation?

The Foundation of Investment Strategy

Asset allocation is the strategy of dividing investments among different asset classes to balance risk and reward. It forms the cornerstone of a robust financial plan for investors at all levels.

Core Asset Classes

The three main asset classes include:

- Stocks: These offer high potential returns but come with higher risk.

- Bonds: They provide steady income with moderate risk.

- Cash equivalents: Options like money market funds offer low returns but high liquidity and safety.

The Impact of Asset Allocation

Asset allocation drives a portfolio’s long-term performance. Asset allocation models are strategies that help investors choose how much to invest in stocks or bonds based on their goals and risk tolerance. This underscores its significance in investment strategy.

Customizing Your Asset Mix

Your ideal asset allocation depends on several factors:

- Risk tolerance

- Investment timeline

- Financial goals

For instance, a young athlete might opt for a stock-heavy portfolio to maximize growth, while a veteran nearing retirement might prefer bonds for stability.

Expanding Beyond Basics

While stocks, bonds, and cash form the foundation, consider adding alternative investments (such as real estate or commodities) to further diversify. Alternative investments can help investors pursue attractive returns as part of a well-diversified portfolio comprised of different asset classes.

The Importance of Rebalancing

Market movements can disrupt your carefully planned asset allocation. Regular portfolio reviews and rebalancing help maintain your target allocation. This process ensures your investment strategy aligns with your goals as they evolve throughout your career and life stages.

Understanding and implementing effective asset allocation strategies sets the stage for long-term financial success. In the next section, we’ll explore the factors that influence your asset allocation decisions, helping you tailor your approach to your unique circumstances.

What Shapes Your Asset Allocation?

Risk Tolerance: The Foundation of Your Strategy

Asset allocation isn’t a one-size-fits-all approach. Your risk tolerance is perhaps the most significant factor in determining your asset allocation. It’s the degree of variability in investment returns that you’re willing to withstand. Younger athletes often have a higher risk tolerance, which allows for a more aggressive allocation with a higher percentage of stocks. Players nearing retirement tend to prefer a more conservative approach, favoring bonds and cash equivalents.

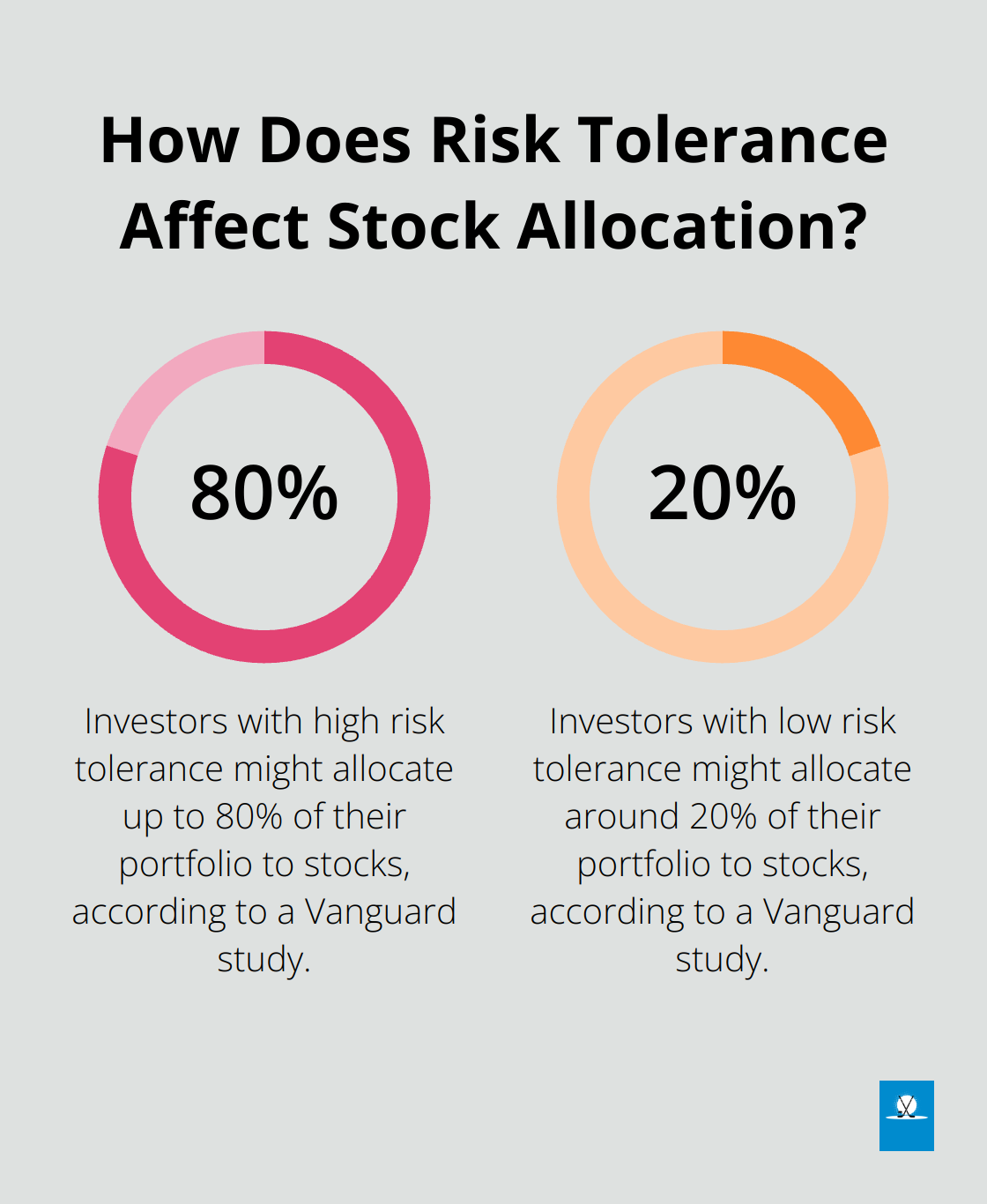

A study by Vanguard found that investors with a high risk tolerance might allocate up to 80% of their portfolio to stocks, while those with low risk tolerance might keep it around 20%. It’s important to accurately assess your risk tolerance. Overestimating it can lead to panic selling during market downturns, while underestimating it might result in missed growth opportunities.

Time Horizon: Aligning Investments with Life Goals

Your investment time horizon (the expected number of years you’ll invest to achieve a specific goal) plays a vital role in shaping your asset allocation. Generally, the longer your time horizon, the more risk you can afford to take.

For instance, a rookie player with a 20-year career ahead might opt for a stock-heavy portfolio to capitalize on long-term market growth. According to historical data from the S&P 500, stocks have outperformed bonds and cash over most 20-year periods since 1926.

A player in their final season might shift towards a bond-heavy allocation to preserve capital and generate income. The key is to adjust your allocation as your time horizon shortens, gradually moving from growth-oriented to income-producing assets.

Market Conditions: Navigating the Economic Landscape

While it’s important not to make drastic changes based on short-term market fluctuations, current economic conditions can influence your asset allocation decisions. For example, during periods of high inflation, you might consider increasing your allocation to inflation-protected securities or real estate investment trusts (REITs).

In times of economic uncertainty, many investors increase their cash holdings. However, it’s important to strike a balance – holding too much cash can erode your purchasing power due to inflation. The U.S. Bureau of Labor Statistics reported an average annual inflation rate of 2.3% from 2000 to 2020, highlighting the importance of maintaining some growth-oriented assets even in uncertain times.

Market timing is notoriously difficult. A study found that in 2014, the average equity mutual fund investor underperformed the S&P 500 by a wide margin of 8.19%. Instead of trying to time the market, focus on maintaining a diversified portfolio aligned with your long-term goals.

Personal Financial Situation: Tailoring Your Approach

Your current financial situation significantly impacts your asset allocation strategy. Factors such as income, expenses, debt, and existing assets all play a role in determining the most appropriate mix of investments for you.

For example, if you have a stable income and low debt, you might feel more comfortable taking on higher-risk investments. Conversely, if you have significant financial obligations or unstable income, a more conservative approach might be prudent.

Consider your overall financial picture when making asset allocation decisions. This includes not just your investment portfolio, but also your real estate holdings, business interests, and any other assets or liabilities you may have.

As we move forward, we’ll explore specific strategies for effective asset allocation, including how to balance different asset classes and when to consider alternative investments. These insights will help you create a robust, personalized investment strategy that aligns with your unique financial goals and circumstances.

How to Implement Effective Asset Allocation

Asset allocation requires ongoing attention and adjustment to ensure your portfolio aligns with your goals and risk tolerance. We recommend several key strategies to maximize the effectiveness of your asset allocation.

Strategic vs. Tactical Asset Allocation

Strategic asset allocation involves setting target allocations for various asset classes and periodically rebalancing back to those targets. This approach is based on the principle that asset allocation drives portfolio returns. A simple step-by-step process conducted once a year can help ensure you achieve your targeted asset allocation.

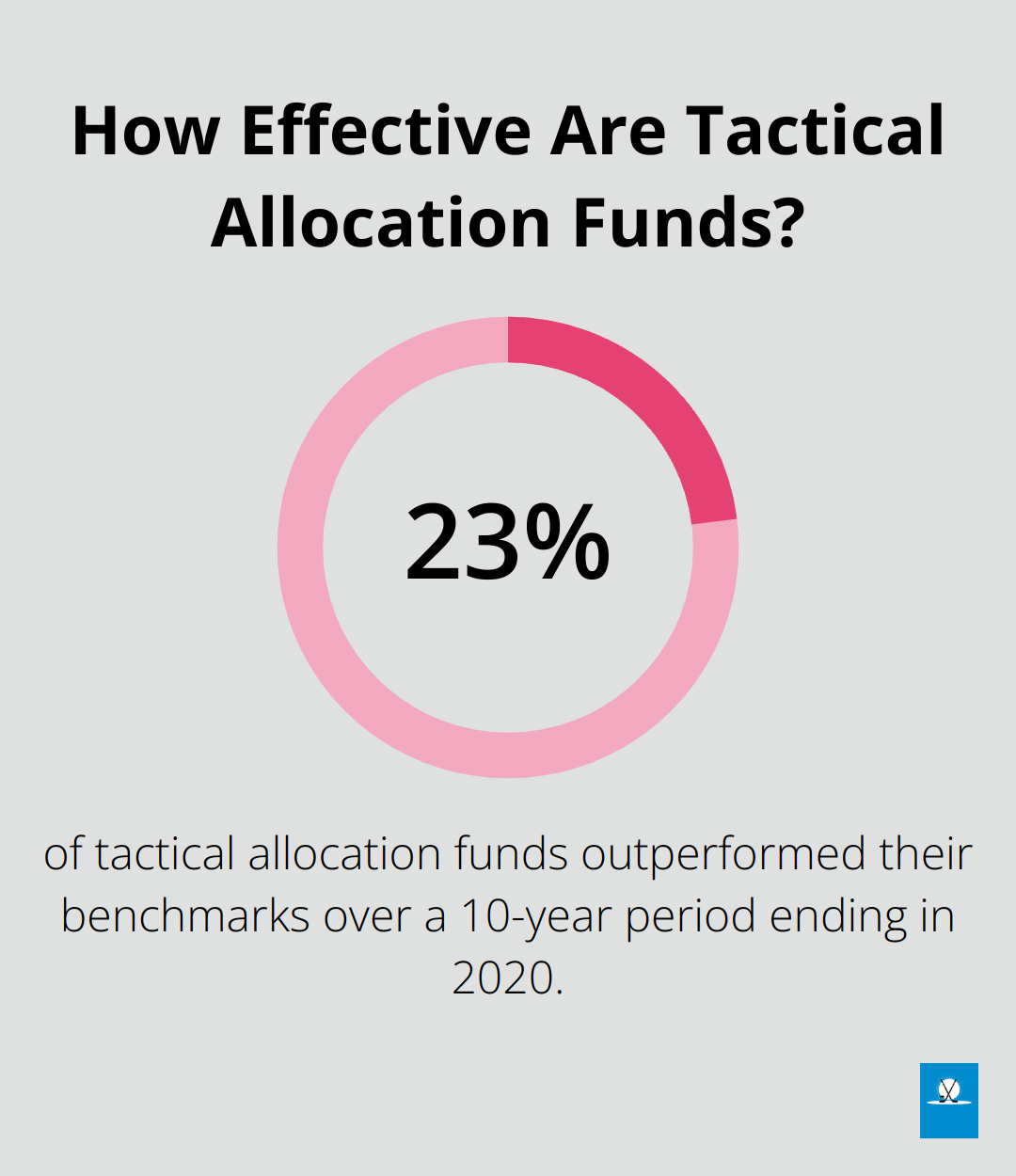

Tactical asset allocation involves making short-term adjustments to capitalize on market opportunities or mitigate risks. While this approach can potentially enhance returns, it requires a deep understanding of market dynamics and carries higher risks. A Morningstar study found that only 23% of tactical allocation funds outperformed their benchmarks over a 10-year period ending in 2020.

We recommend a primarily strategic approach for most investors, with limited tactical adjustments based on significant market shifts or changes in personal circumstances.

The Importance of Regular Rebalancing

Market movements can cause your portfolio to drift from its target allocation over time. Regular rebalancing helps maintain your desired risk level and can potentially improve returns. A Vanguard study found that portfolios rebalanced annually or when allocations drifted by 5% outperformed those that were never rebalanced by about 0.4% per year.

We suggest reviewing your portfolio at least annually or when major life events occur. During these reviews, sell assets that have grown beyond their target allocation and use the proceeds to buy underweighted assets. This disciplined approach helps you “buy low and sell high” automatically.

Diversification Within Asset Classes

While allocating across different asset classes is important, diversifying within each asset class further reduces risk. For stocks, this means spreading investments across different sectors, company sizes, and geographic regions. For bonds, it involves varying maturities, credit qualities, and issuers.

Exchange-Traded Funds (ETFs) and mutual funds can be excellent tools for achieving broad diversification efficiently. For example, a single S&P 500 ETF provides exposure to 500 large U.S. companies across various sectors.

The Role of Alternative Investments

Alternative investments, such as real estate, commodities, or private equity, can further diversify your portfolio and potentially enhance returns. These assets often have low correlations with traditional stocks and bonds, providing additional portfolio stability.

However, alternative investments typically come with higher fees, less liquidity, and more complexity. A J.P. Morgan study found that adding a 20% allocation to alternatives in a traditional 60/40 stock/bond portfolio could potentially increase returns by 0.5% annually while reducing volatility.

We recommend considering alternative investments only after establishing a solid foundation in traditional asset classes and thoroughly understanding the associated risks and costs.

Final Thoughts

Asset allocation stands as a cornerstone of successful investing. It offers a powerful strategy to balance risk and reward. Investors can potentially smooth out market volatility and optimize returns over the long term by spreading investments across various asset classes.

Diversification and asset allocation are not one-time decisions. Your investment strategy should adapt as life circumstances change, market conditions shift, and financial goals evolve. Regular portfolio reviews and adjustments will ensure your asset allocation remains aligned with your current situation and future aspirations.

Your unique risk tolerance, time horizon, and financial situation should drive your investment decisions. Professional guidance can prove invaluable in navigating the complexities of asset allocation and diversification strategies. At Pro Hockey Advisors, we specialize in providing tailored financial advice to professional hockey players.

Pingback: How to Determine Asset Allocation and Diversification - Pro Hockey Wealth Management & Retirement Planning