Currency fluctuations can significantly impact businesses and investments, making currency risk management a critical aspect of financial strategy. At Pro Hockey Advisors, we understand the importance of protecting your assets from unexpected market shifts.

This blog post will explore effective strategies to manage currency risk, from natural hedging techniques to financial instruments. We’ll also guide you through implementing a comprehensive risk management program tailored to your specific needs.

What Is Currency Risk?

Currency risk is commonly referred to as exchange-rate risk. It arises from the change in price of one currency in relation to another. This chapter explores the various types of currency risk and their real-world impacts on organizations, including those in the professional hockey industry.

Types of Currency Risk

Transaction Risk

Transaction risk is the most common form of currency risk. It occurs when a company agrees to buy or sell goods in a foreign currency, and the exchange rate changes before the transaction completes. For example, a Canadian hockey equipment manufacturer might agree to sell gear to a European team for €100,000. If the euro weakens against the Canadian dollar before payment, the Canadian company will receive less than expected when converting the euros to Canadian dollars.

Translation Risk

Translation risk affects companies with foreign subsidiaries. When consolidating financial statements, the parent company must convert the subsidiary’s financial results into the home currency. Exchange rate fluctuations can lead to discrepancies in reported earnings and asset values. This is particularly relevant for hockey organizations with international operations or players from various countries.

Economic Risk

Economic risk is the broadest and most challenging to manage. It refers to the potential long-term impact of exchange rate movements on a company’s competitive position. For instance, if the U.S. dollar strengthens significantly against other currencies, American hockey teams might find it more expensive to sign international talent, potentially affecting their competitiveness in the global market.

Real-World Impact of Currency Fluctuations

Currency fluctuations can profoundly impact businesses and investments. In 2022, the U.S. dollar strengthened against many currencies, causing difficulties for multinational corporations. Apple reported that foreign exchange headwinds were over 600 basis points for the quarter. This demonstrates how even tech giants are not immune to currency risk.

For professional hockey players and teams, currency risk can affect contract values, endorsement deals, and international tournament earnings. A player signing a multi-year contract in a foreign currency might see their effective salary change dramatically due to exchange rate movements.

Investors face similar challenges. In 2022, the Japanese yen fell to a 24-year low against the U.S. dollar, significantly impacting returns for foreign investors in Japanese assets. This underscores the importance of considering currency risk when diversifying investment portfolios internationally.

Identifying and Mitigating Currency Risk

To effectively manage currency risk, businesses and investors must first identify their exposure. This involves analyzing cash flows, investments, and contractual obligations in foreign currencies. Once the exposure is clear, various strategies can mitigate risk.

One approach is natural hedging, which involves matching foreign currency inflows with outflows. For example, a hockey equipment manufacturer could try to source materials in the same currency as their sales to reduce overall exposure.

Financial instruments like forward contracts, options, and swaps can also hedge against currency risk. However, these require careful consideration and often expertise to implement effectively.

As we move forward, we will explore specific strategies and tools that businesses and investors can use to manage currency risk effectively. Understanding these approaches is essential for navigating the complex world of international finance and protecting financial interests in an increasingly globalized economy.

How to Protect Against Currency Fluctuations

Currency risk management is not exclusive to large corporations. Professional athletes’ earnings and team budgets can face significant impacts from currency fluctuations. This chapter outlines practical strategies to shield your finances from exchange rate volatility.

Natural Hedging: Balancing Currency Exposure

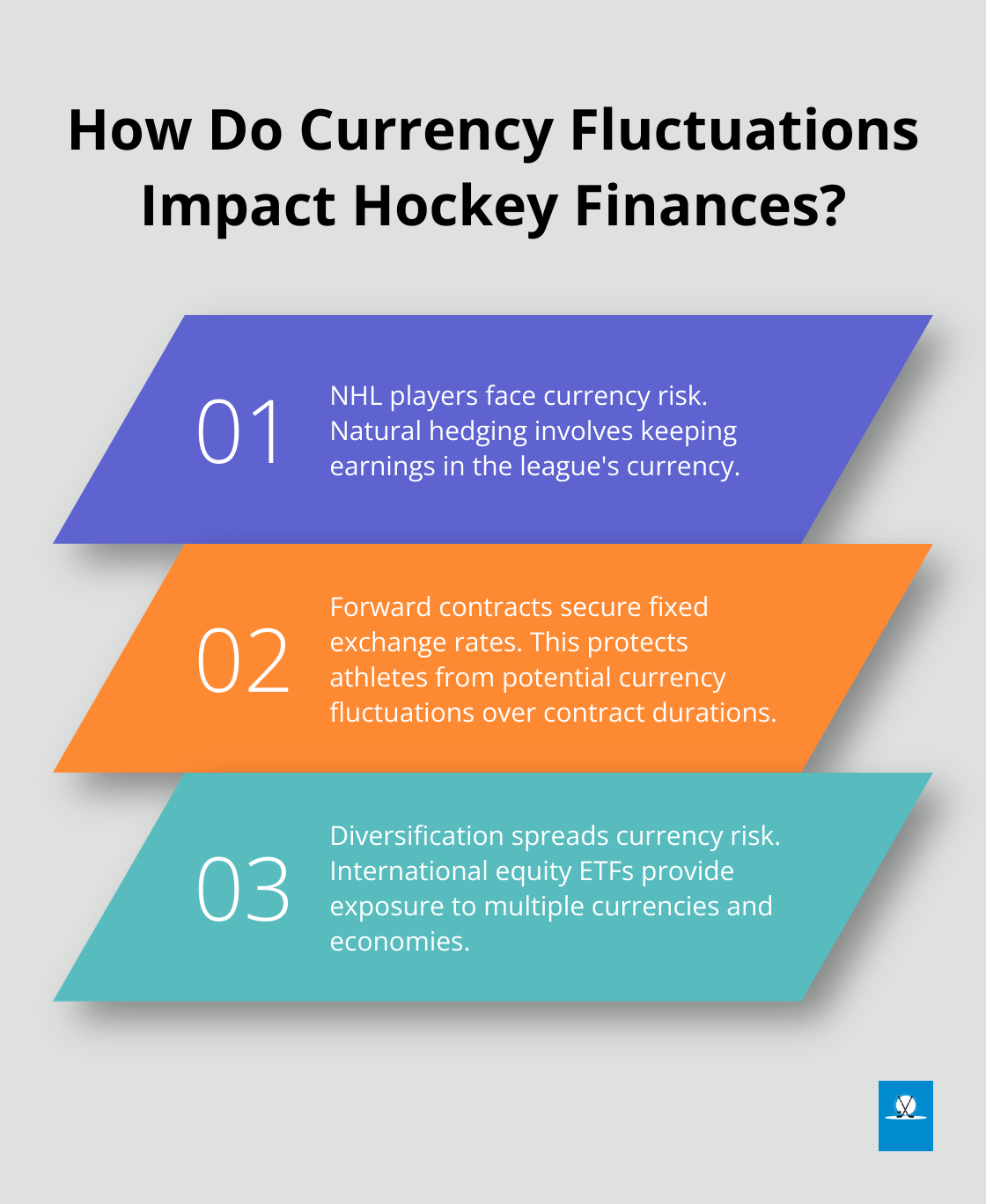

Natural hedging offers a cost-effective way to minimize currency risk. Hockey players can keep a portion of their earnings in the currency of the league they play in. For example, an NHL player with expenses in euros should maintain a euro-denominated account to match those outflows.

Teams can align revenue streams with expenses. A Canadian team with significant U.S. dollar expenses could seek sponsorship deals paid in U.S. dollars to create a natural hedge.

Financial Instruments: Tools for Precision Risk Management

Financial instruments provide more precise control over currency risk than natural hedging. Forward contracts are popular among professional athletes. By entering into a forward contract, sports organizations and athletes can secure a fixed exchange rate, protecting themselves from potential currency fluctuations.

A European player signing with an NHL team could use a forward contract to secure the exchange rate for their salary over the contract’s duration. This eliminates the risk of the home currency strengthening against the U.S. dollar (which would otherwise reduce the value of their earnings when converted).

Currency options offer flexibility at a premium. They give the right, but not the obligation, to buy or sell a specific currency in a specified amount on or before the expiration date at the strike price.

Diversification: Spreading Currency Risk

Diversification is a fundamental risk management strategy. Hockey professionals can invest in a globally diversified portfolio of assets. International equity ETFs, for instance, can provide exposure to multiple currencies and economies, reducing the impact of any single currency’s movements on overall wealth.

Teams and leagues can diversify by expanding into international markets. The NHL’s efforts to grow the game globally not only increase revenue streams but also naturally diversify currency exposure.

Tailoring Your Approach

The key to effective currency risk management is to tailor your approach to your specific situation. Consider factors such as your income sources, expense locations, investment goals, and risk tolerance. A comprehensive strategy might combine elements of natural hedging, financial instruments, and diversification.

For professional hockey players and organizations navigating the complexities of international finance, expert guidance can prove invaluable. Specialized advisors (such as Pro Hockey Advisors) can create customized currency risk management strategies that align with the unique needs of the hockey industry.

As we move forward, it’s important to understand how to implement these strategies effectively. The next chapter will explore the steps to create and maintain a robust currency risk management program tailored to your specific needs in the hockey industry.

Building Your Currency Risk Shield

Assessing Your Currency Exposure

The first step to create an effective currency risk shield involves a thorough assessment of your exposure. International payments and exchange rates significantly affect the sports industry. The issue of foreign exchange exposure impacts sporting organisations of all shapes and sizes, from individual players to teams and larger organizations.

A currency exposure map serves as a useful tool for this assessment. This visual representation helps identify which currencies have the most significant impact on your financial position. For example, a Canadian player in the NHL might find that a large portion of their income is in U.S. dollars, while many of their expenses are in Canadian dollars. This mismatch represents a clear currency risk that needs addressing.

Crafting Your Risk Management Policy

After you identify your exposure, develop a tailored risk management policy. This policy should outline your risk tolerance, hedging objectives, and approved risk management tools.

For individual players, a simple policy might state a specific percentage of expected income to hedge using forward contracts. For teams, a more complex policy could include maintaining natural hedges where possible and using financial instruments to cover a certain percentage of net currency exposure.

Risk management strategies may include hedging, the use of derivatives, diversification of revenue streams, and financial planning. Involve key stakeholders in policy development. For players, this might mean consulting with financial advisors and agents. Teams should engage finance departments, management, and potentially board members.

Selecting and Implementing Hedging Strategies

With a clear policy in place, choose and implement appropriate hedging strategies. The right mix will depend on your specific situation, risk tolerance, and available resources.

For players, forward contracts often provide a straightforward and effective solution. They offer certainty on exchange rates for future income, allowing for more accurate financial planning. Teams might opt for a combination of natural hedging (e.g., aligning sponsorship deals with currency exposure) and financial instruments like currency swaps for longer-term protection.

Implementation requires careful timing and execution. Many professional athletes and teams work with specialized firms to ensure they get the best rates and terms on their hedging contracts.

Avoid over-hedging, as it can be as problematic as under-hedging. Try to strike the right balance for an effective currency risk management program.

Monitoring and Adjusting Your Approach

As you implement your chosen strategies, maintain detailed records of all hedging activities. This documentation is essential for monitoring effectiveness and making informed adjustments over time.

Currency risk management requires an ongoing process, not a one-time event. Regular review and adjustment of your approach will help ensure your currency risk shield remains strong and effective in the face of changing market conditions.

Set up a system to track the performance of your hedging strategies. This might include regular (quarterly or monthly) reviews of your currency positions and the effectiveness of your hedges. Use this information to fine-tune your approach and adapt to changing market conditions or shifts in your own financial situation.

Final Thoughts

Currency risk management plays a vital role in international finance, especially for professional hockey players and organizations. We explored various strategies to protect assets from unpredictable currency fluctuations. These strategies range from natural hedging techniques to sophisticated financial instruments, all designed to shield you from potential exchange rate volatility.

Effective currency risk management leads to more stable cash flows, improved financial forecasting, and enhanced competitiveness in global markets. Investors can enjoy more predictable returns, while hockey players can secure the true value of their contracts. Teams can maintain financial stability in an increasingly international sport landscape.

At Pro Hockey Advisors, we help hockey professionals navigate the complex world of international finance. Our team provides personalized advice on currency risk management, tailored to the unique needs of the hockey industry. We support you in maximizing your financial potential while minimizing risk, allowing you to focus on excelling in the game of hockey.