At Pro Hockey Advisors, we understand that investors holding well-diversified portfolios are most concerned with maximizing returns while minimizing risk.

A well-diversified portfolio is a cornerstone of successful investing, offering protection against market volatility and potential losses.

In this post, we’ll explore the key aspects of portfolio diversification, effective asset allocation strategies, and the importance of regular monitoring and rebalancing.

What Makes a Portfolio Well-Diversified?

Spreading Risk Across Asset Classes

A well-diversified portfolio forms the foundation of successful investing. The core principle of diversification involves spreading investments across different asset classes. This typically includes stocks, bonds, real estate, and sometimes commodities or alternative investments. A study by Vanguard found that a portfolio with 100% shares and no bonds has an average return of 8.7% with a much wider range of outcomes compared to more balanced portfolios.

Geographic Diversification

Investing across different countries and regions constitutes another key aspect of diversification. Including global small-caps in an investment portfolio can help to enhance diversification, as small-cap exposures tend to be less concentrated than large-caps.

Sector Allocation

Spreading investments across various economic sectors holds equal importance. The S&P 500 index (which includes companies from 11 different sectors) demonstrates how sector diversification can mitigate the impact of industry-specific downturns. For example, during the 2008 financial crisis, while the financial sector plummeted by over 50%, the consumer staples sector only declined by about 15%.

Balancing Growth and Value

A well-diversified portfolio should include both growth and value stocks. Research from Fama and French has shown that over long periods, value stocks have outperformed growth stocks, but including both can provide more stable returns across different market conditions.

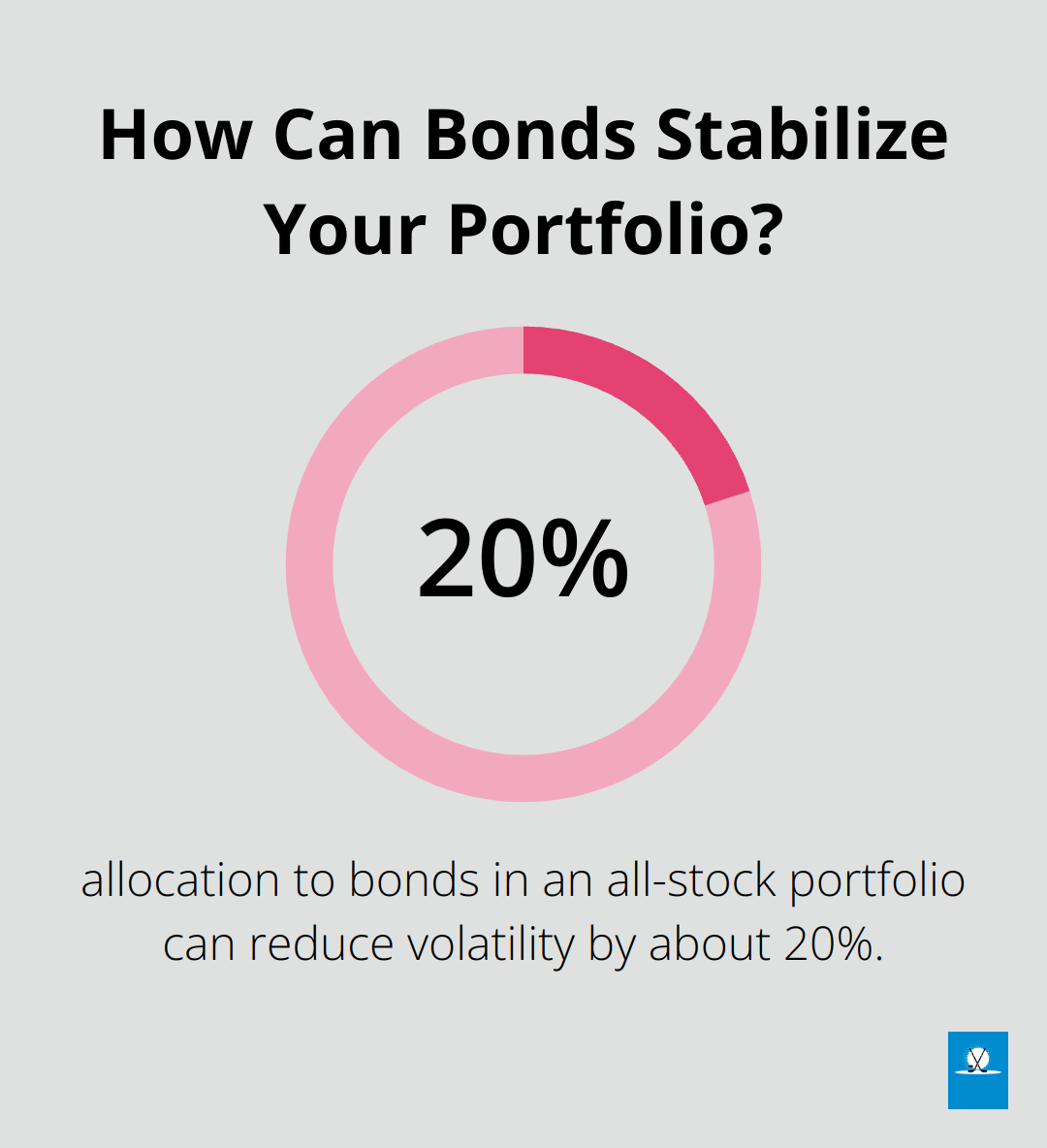

The Role of Fixed Income

Including fixed-income securities (like bonds) in your portfolio plays a vital role in managing risk. According to Morningstar, adding a 20% allocation to bonds to an all-stock portfolio can reduce volatility by about 20% while only sacrificing about 1% in average annual returns over the long term.

While diversification remains essential, it’s not a one-size-fits-all approach. Your specific portfolio composition should align with your individual financial goals, risk tolerance, and investment timeline. Professional guidance can help create tailored investment strategies that balance risk and potential returns effectively.

As we move forward, let’s explore effective asset allocation strategies that can help you achieve optimal diversification in your investment portfolio.

How to Build a Robust Asset Allocation Strategy

Asset allocation forms the foundation of a well-diversified portfolio. Let’s explore how to create a robust strategy that balances risk and return while adapting to your unique goals.

The Core-Satellite Approach

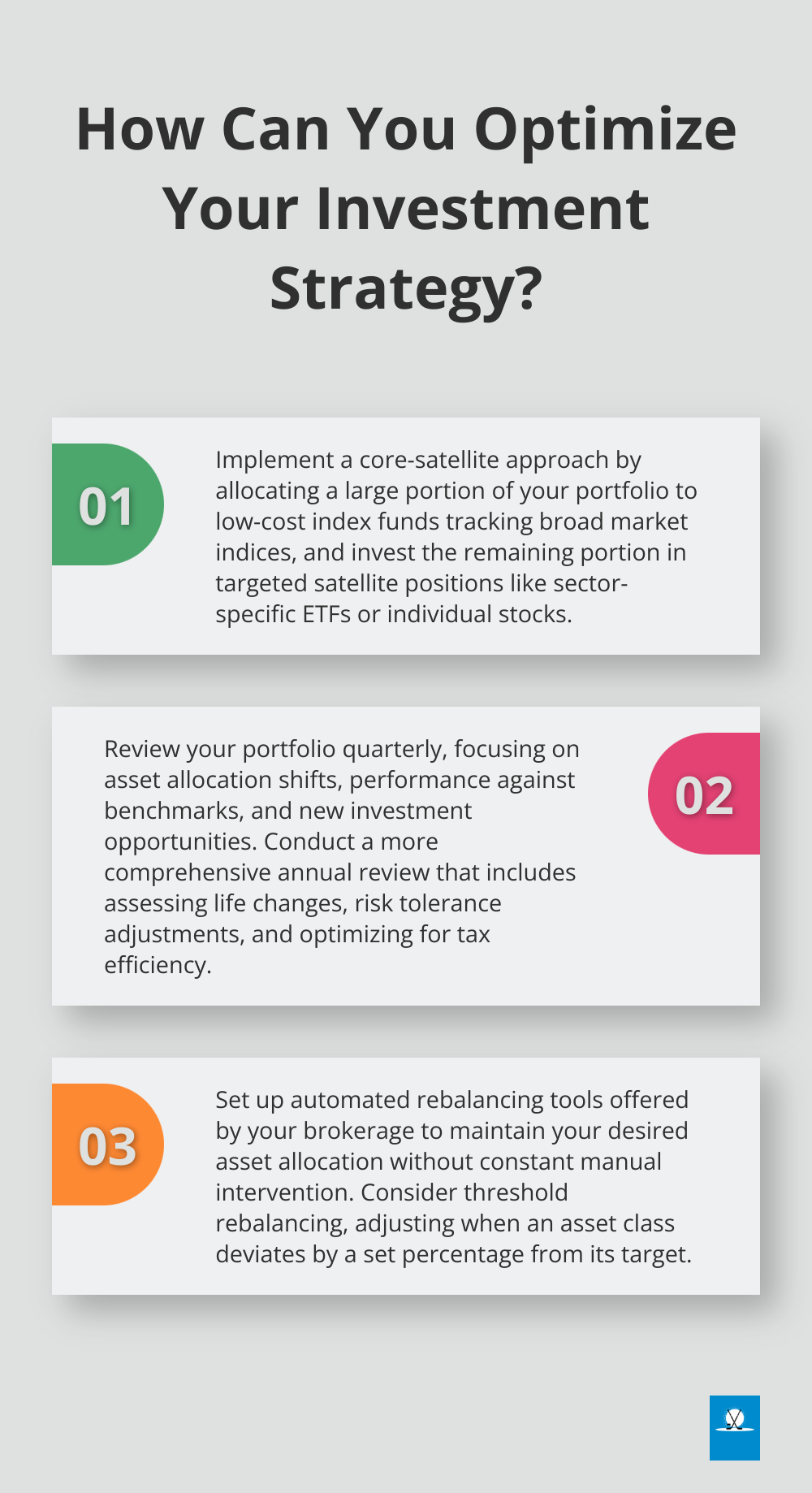

One effective strategy is the core-satellite approach. This method focuses on getting an investor’s allocation right and ensuring a diversified mix of assets. It typically involves allocating a large portion of your portfolio to core investments like low-cost index funds that track broad market indices. The remaining portion is then invested in satellite positions, which can include individual stocks, sector-specific ETFs, or alternative investments.

For example, a core holding might be an S&P 500 index fund, while satellite positions could include a small-cap growth fund or real estate investment trusts (REITs). This approach provides a solid foundation while allowing for potential outperformance through targeted investments.

Tactical vs. Strategic Asset Allocation

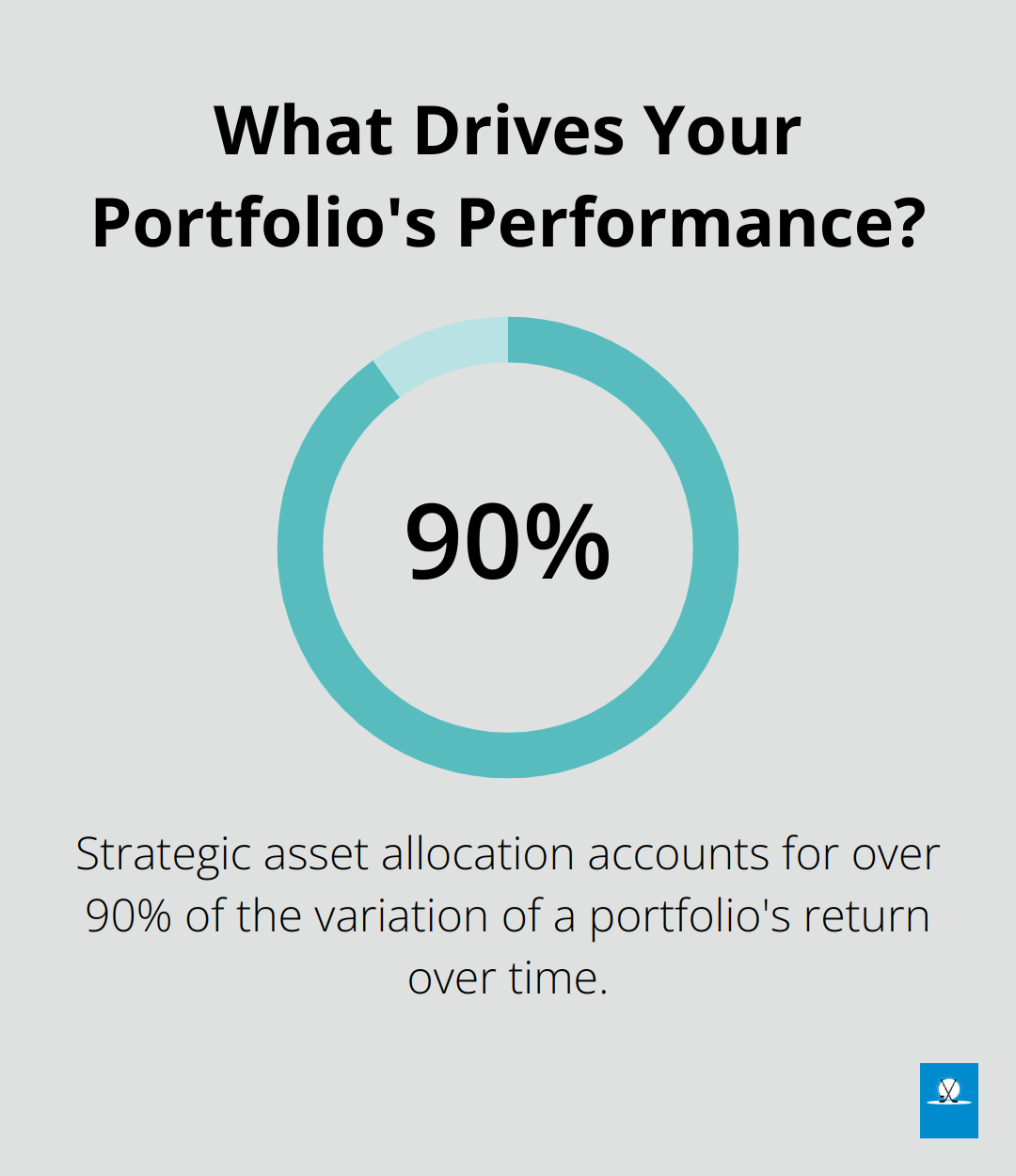

Strategic asset allocation involves setting target allocations for various asset classes and rebalancing periodically. Tactical asset allocation, on the other hand, involves making short-term adjustments based on market conditions.

Research shows that strategic asset allocation accounts for over 90% of the variation of a portfolio’s return over time. However, tactical moves can add value in certain market conditions. For instance, during the 2020 market downturn, investors who tactically increased their exposure to technology stocks saw significant gains.

Factoring in Your Risk Tolerance

Your risk tolerance should heavily influence your asset allocation. A common rule of thumb subtracts your age from 100 to determine the percentage of stocks in your portfolio. However, this oversimplifies the process.

Instead, consider using risk profiling tools or working with a financial advisor to assess your risk tolerance accurately. For example, a 35-year-old investor with a high risk tolerance might have an 80/20 stock/bond split, while a more conservative investor of the same age might opt for a 60/40 split.

Evolving Your Strategy

Your asset allocation should evolve as you age and your financial goals change. Regular reviews and adjustments are key to maintaining an optimal portfolio structure that aligns with your current situation and future objectives.

As we move forward, we’ll explore the importance of monitoring and rebalancing your portfolio to ensure it stays on track with your investment goals.

How to Review and Rebalance Your Investment Portfolio

The Importance of Regular Reviews

Investors should review their portfolios at least quarterly, with a more comprehensive evaluation annually. This practice ensures investments remain aligned with financial goals and risk tolerance. A Vanguard study looking back over the years 1926 to 2018 concluded that “no specific rebalancing frequency and/or threshold is optimal for all investors.”

Quarterly Check-Up Essentials

During a quarterly review, investors should focus on:

- Asset allocation: Check if the mix of stocks, bonds, and other assets has shifted significantly.

- Performance: Identify any investments consistently underperforming their benchmarks.

- New opportunities: Assess if market conditions have created new investment possibilities.

Annual Deep Dive Components

The annual review should be more comprehensive. Key areas to examine include:

- Life changes: Assess major events like marriage, divorce, or career shifts.

- Risk tolerance: Evaluate any changes in ability or willingness to take on risk.

- Investment costs: Look for opportunities to reduce fees or expenses.

- Tax implications: Consider ways to optimize the portfolio for tax efficiency.

Responding to Market Volatility

Significant market events may necessitate additional check-ins.

Effective Rebalancing Strategies

When a portfolio drifts from its target allocation, it’s time to rebalance. Two common approaches are:

- Threshold rebalancing: Adjust when an asset class deviates by a set percentage (e.g., 5%) from its target.

- Time-based rebalancing: Realign the portfolio on a fixed schedule, regardless of market movements.

Automating the Process

Investors should consider using automated rebalancing tools offered by many brokerages. These can help maintain the desired asset allocation without constant manual intervention.

Professional advisors can help navigate these processes and ensure your portfolio remains optimally balanced.

Final Thoughts

Well-diversified portfolios form the foundation of successful investing. Investors holding well-diversified portfolios are most concerned with balancing risk mitigation and potential returns. They spread investments across asset classes, geographic regions, and sectors to reduce exposure to single risk factors and capture growth opportunities.

Regular portfolio reviews and rebalancing maintain an optimal investment mix. These practices align portfolios with financial goals and risk tolerance as market conditions change. Automated tools streamline this process, but human oversight remains valuable.

Professional hockey players and industry stakeholders face unique wealth management challenges. Pro Hockey Advisors offers specialized services to optimize career decisions, secure favorable contracts, and develop robust financial strategies. We help clients achieve their financial goals during and after their hockey careers.