At Pro Hockey Advisors, we understand the importance of financial planning beyond the rink. Mutual funds offer a popular investment option for those looking to grow their wealth.

These investment vehicles invest in diversified portfolios of securities, providing a way for investors to access a wide range of assets. In this post, we’ll explore how mutual funds work and the strategies they use to manage risk and potentially enhance returns.

What Are Mutual Funds?

Definition and Structure

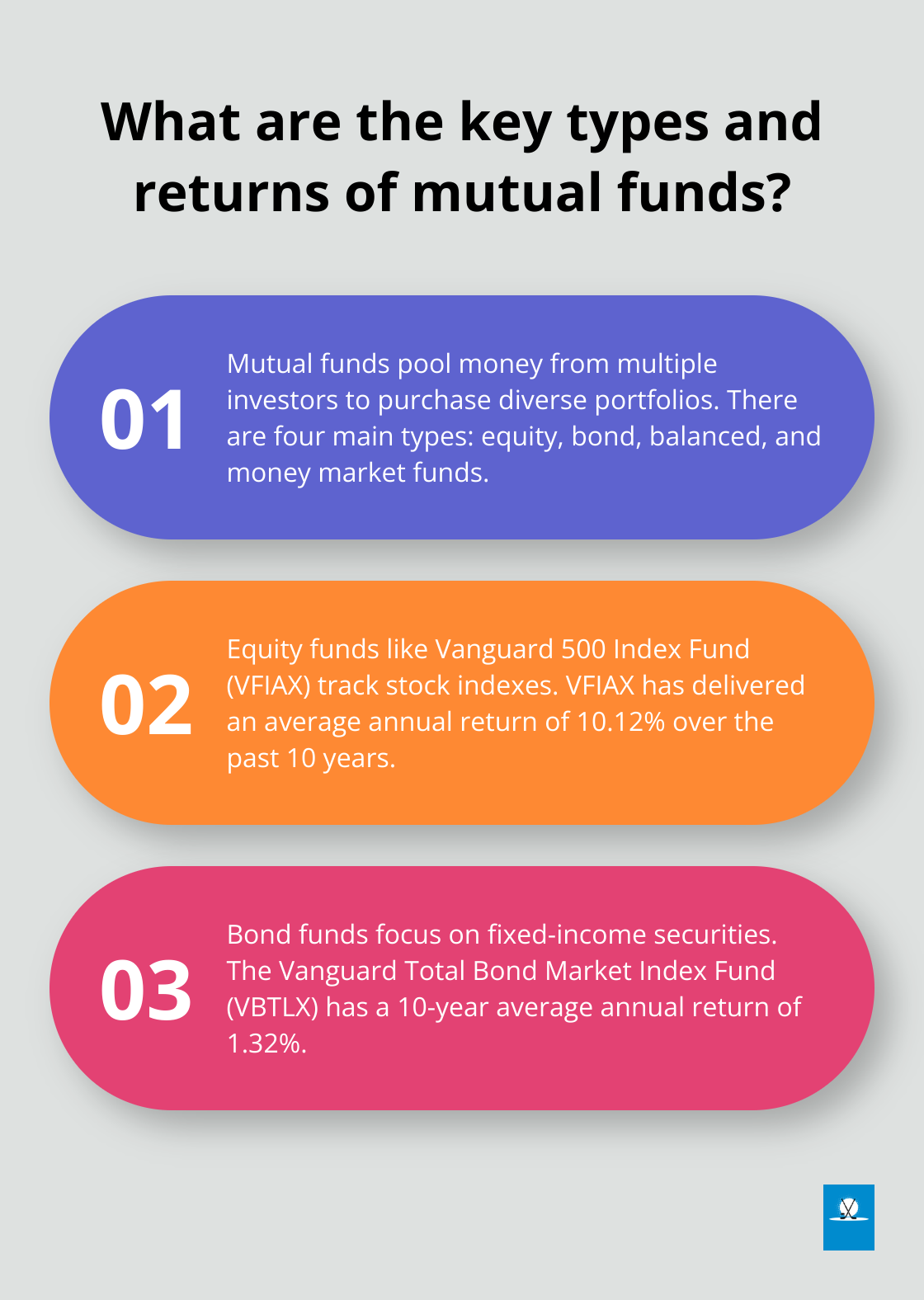

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. These funds offer a way for investors to access a wide range of assets, even with a relatively small investment.

Types of Mutual Funds

- Equity Funds: These funds invest primarily in stocks. The Vanguard 500 Index Fund (VFIAX) tracks the S&P 500 index and has delivered an average annual return of 10.12% over the past 10 years.

- Bond Funds: These funds focus on fixed-income securities. The Vanguard Total Bond Market Index Fund (VBTLX) is a popular choice, with a 10-year average annual return of 1.32%.

- Balanced Funds: These funds combine stocks and bonds. The Vanguard Wellington Fund (VWELX) is a well-known balanced fund with a 60/40 stock-to-bond ratio and a 10-year average annual return of 7.89%.

- Money Market Funds: These funds invest in short-term, low-risk securities. The Vanguard Federal Money Market Fund (VMFXX) has maintained a stable $1 share price since its inception in 1981.

How Mutual Funds Operate

When you invest in a mutual fund, your money combines with that of other investors. A professional fund manager then uses this pooled capital to buy a variety of securities based on the fund’s investment objective.

For example, if you invest $10,000 in a mutual fund with $1 billion in assets, you effectively own 0.001% of each security in the fund’s portfolio. This allows you to achieve diversification even with a relatively small investment.

Costs and Returns

Mutual funds charge fees, typically expressed as an expense ratio. The Vanguard 500 Index Fund has an expense ratio of just 0.04% (meaning you pay $4 annually for every $10,000 invested). Actively managed funds often have higher fees, sometimes exceeding 1%.

Returns from mutual funds come in two forms:

- Distributions: When the fund’s holdings pay dividends or interest, or when the fund sells securities at a profit, these gains distribute to shareholders.

- Capital Appreciation: If the value of the fund’s holdings increases, the fund’s share price rises, allowing investors to sell their shares for a profit.

Selecting the Right Fund

When choosing a mutual fund, consider factors such as:

- Investment objective: Does it align with your financial goals?

- Performance history: How has the fund performed over time?

- Fees: Lower fees can significantly impact long-term returns.

- Risk level: Make sure it matches your risk tolerance.

Understanding these key aspects of mutual funds sets the stage for exploring how these investment vehicles employ diversification strategies to manage risk and potentially enhance returns.

How Mutual Funds Achieve Diversification

Asset Class Allocation

Mutual funds spread investments across different asset classes to balance risk and reward. The Vanguard Balanced Index Fund (VBIAX) allocates approximately 60% to stocks and 40% to bonds. This mix offers investors an easy, low-cost way to gain exposure to stocks and bonds.

Intra-Asset Class Diversification

Funds diversify within each asset class. An equity fund invests in companies of different sizes and styles. The Fidelity Total Market Index Fund (FSKAX) holds over 3,500 stocks, covering the entire U.S. stock market.

Sector and Industry Distribution

Mutual funds spread investments across various economic sectors. The T. Rowe Price Dividend Growth Fund (PRDGX) normally invests at least 65% of the fund’s total assets in stocks, with an emphasis on stocks that have a strong track record of paying dividends. This approach mitigates the risk of a single sector underperforming.

Global Investment Strategies

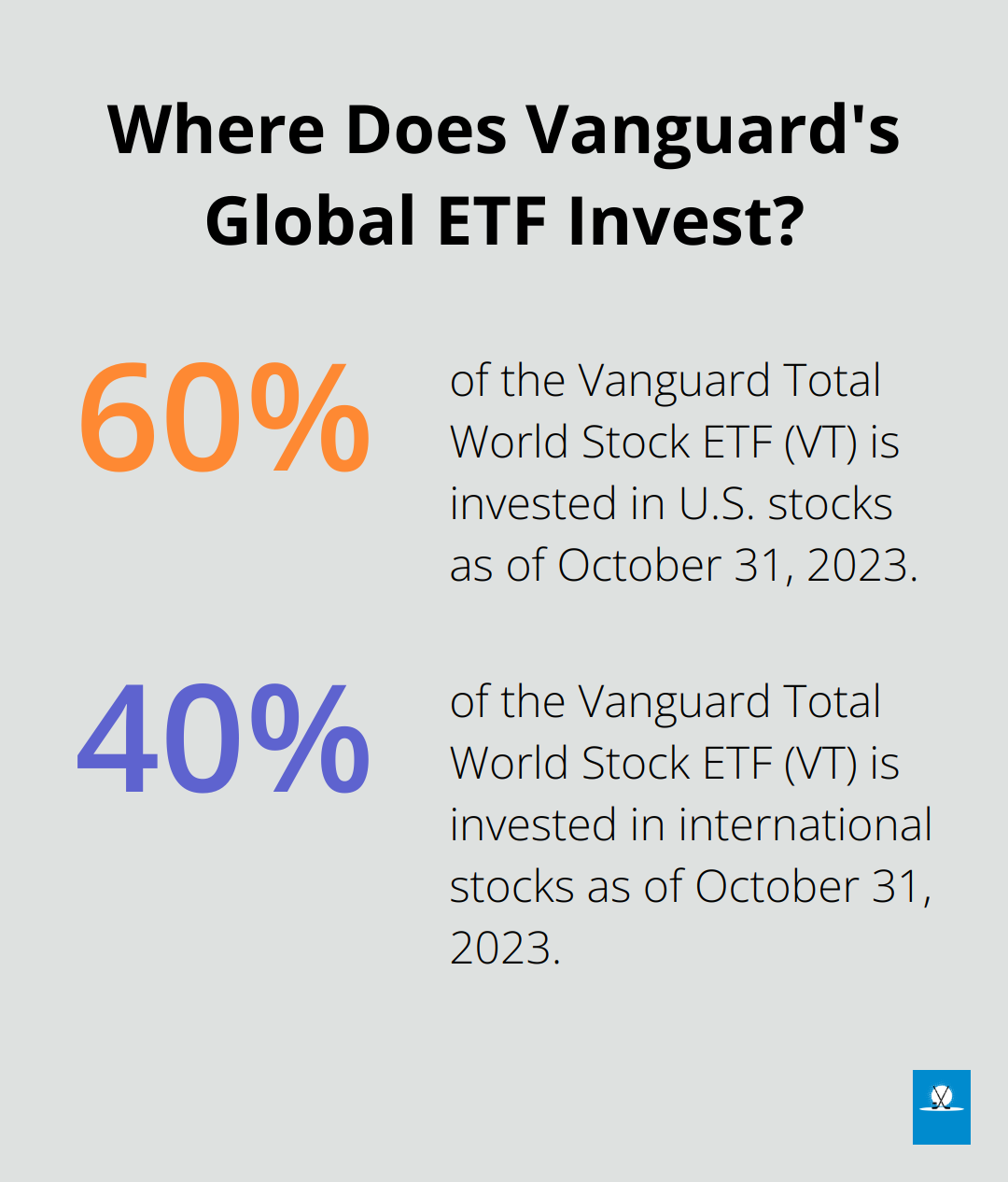

Many funds invest globally to tap into different economic cycles and growth opportunities. The Vanguard Total World Stock ETF (VT) holds over 9,000 stocks from around the world, with about 60% in U.S. stocks and 40% in international stocks as of October 31, 2023.

These diversification strategies help mutual funds manage risk and potentially enhance returns. However, diversification doesn’t guarantee profits or protect against losses in declining markets. Always consult with a financial advisor to determine the most suitable investment strategy for your specific situation.

The next chapter will explore how mutual fund managers implement these diversification strategies through their investment process.

How Fund Managers Invest Your Money

The Investment Team Structure

Fund managers lead teams of analysts, researchers, and traders. Will Danoff, who manages the Fidelity Contrafund (FCNTX), is focusing on small- and mid-cap stocks with high growth potential. This team approach enables comprehensive market coverage and thorough analysis of potential investments.

Research and Analysis Methods

Fund managers and their teams conduct extensive research to identify investment opportunities. They analyze financial statements, attend company presentations, and meet with management teams. T. Rowe Price’s equity analysts (for example) conduct over 11,000 company visits annually to gain firsthand insights into potential investments.

Big data and artificial intelligence have transformed investment research. BlackRock’s Aladdin platform is a financial technology platform designed for institutional, wholesale, qualified, and professional investor/client use.

Portfolio Construction Techniques

Fund managers construct portfolios that align with the fund’s objectives. They consider factors such as:

- Asset allocation: They determine the mix of stocks, bonds, and other securities.

- Sector weightings: They decide how much to invest in different industries.

- Individual security selection: They choose specific stocks or bonds to buy.

The Vanguard Wellington Fund (VWELX) maintains a target allocation of about 60-70% stocks and 30-40% bonds. Within its stock allocation, it focuses on dividend-paying companies with strong balance sheets.

Rebalancing and Risk Management Strategies

Fund managers regularly review and adjust their portfolios to maintain the desired asset allocation and risk profile. This rebalancing process involves selling overweighted assets and buying underweighted ones.

Risk management is a critical aspect of portfolio management. Managers use various techniques to mitigate risk:

- Diversification: They spread investments across different assets to reduce the impact of any single investment’s poor performance.

- Hedging: They use financial instruments to offset potential losses.

- Stop-loss orders: They automatically sell a security if it falls below a certain price.

The JPMorgan Hedged Equity Fund (JHEQX) uses options strategies to limit downside risk while still allowing for upside potential.

Fund managers also monitor various risk metrics. The Sharpe ratio (which measures risk-adjusted returns) is a common tool. A higher Sharpe ratio indicates better risk-adjusted performance. For context, the S&P 500 index had a Sharpe ratio of 0.76 over the 10 years ending in 2022.

Final Thoughts

Mutual funds invest in diversified portfolios of securities, offering investors access to a wide range of assets. These funds pool resources from many investors, allowing them to benefit from professional management and risk mitigation strategies. Fund managers implement these strategies through thorough research, portfolio construction, and ongoing risk management.

Investors should consider several factors when selecting a mutual fund, including its investment objective, historical performance, and fee structure. It’s important to evaluate how a particular fund fits into your overall investment strategy and aligns with your financial goals. Mutual funds can be a valuable component of a well-rounded financial plan, providing a way to invest in diversified portfolios with professional oversight.

At Pro Hockey Advisors, we understand that financial planning extends beyond the ice rink. While we focus on providing expert consulting services for professional hockey players, agents, teams, and stakeholders, we recognize the importance of sound investment strategies. We recommend consulting with a financial advisor to determine the most suitable investment approach for your specific situation and goals.