At Pro Hockey Advisors, we understand the importance of financial planning in every industry, including sports. The Chartered Institute of Financial Planning (CIFP) stands as a beacon for professionals seeking to elevate their expertise and credibility in the financial sector.

This comprehensive guide will explore the CIFP’s role, qualifications, and the benefits it offers to financial planners. Whether you’re a seasoned professional or just starting your career, understanding the CIFP can open doors to new opportunities and enhanced financial acumen.

What is the Chartered Institute of Financial Planning?

The Chartered Insurance Institute (CII) stands as a cornerstone in the UK’s financial planning sector. This esteemed organization sets the gold standard for financial planners, shaping the profession since its inception. The CII’s purpose, as set out in its 1912 royal charter, is to ‘Secure and justify the confidence of the public’ in its members and the insurance sector.

A Legacy of Excellence

The CII’s mission centers on promoting professionalism, ethics, and competence in financial planning. They accomplish this through:

- Rigorous educational programs

- Comprehensive certifications

- Ongoing professional development requirements

As of 2024, the Chartered Institute for Securities & Investment is the marks licensing authority for the CFP marks in the United Kingdom, through agreement with FPSB. This reflects the increasing demand for qualified financial planners in today’s complex financial landscape.

Governance and Structure

The CII operates under a board of directors, elected by its members. This structure ensures the organization remains responsive to the needs of both practitioners and the public. The board receives support from various committees, each focusing on specific aspects of the profession:

- Ethics

- Education

- Professional standards

Commitment to Ethical Practice

At the heart of the CII’s mission lies an unwavering commitment to ethical practice. All members must adhere to a strict code of ethics, which prioritizes client interests above all else. This dedication has helped rebuild trust in the financial planning profession, particularly in the aftermath of financial crises that shook public confidence.

The CII consistently updates its ethical guidelines to address emerging challenges in the financial sector. For example, in 2023, they introduced new guidelines on the use of artificial intelligence in financial planning, ensuring that technological advancements align with ethical standards.

Adapting to Industry Changes

The CII remains at the forefront of industry changes, adapting its programs and guidelines to meet evolving needs. This proactive approach includes:

- Regular reviews of certification requirements

- Updates to educational curricula

- Collaboration with industry partners to identify emerging trends

The organization’s ability to stay ahead of the curve ensures that its members (and by extension, their clients) benefit from the most up-to-date practices and knowledge in financial planning.

As we explore the qualifications and certifications offered by the CII, you’ll gain a deeper understanding of how this organization shapes the future of financial planning professionals.

Advancing Your Career with CIFP Qualifications

The Gold Standard: Chartered Financial Planner

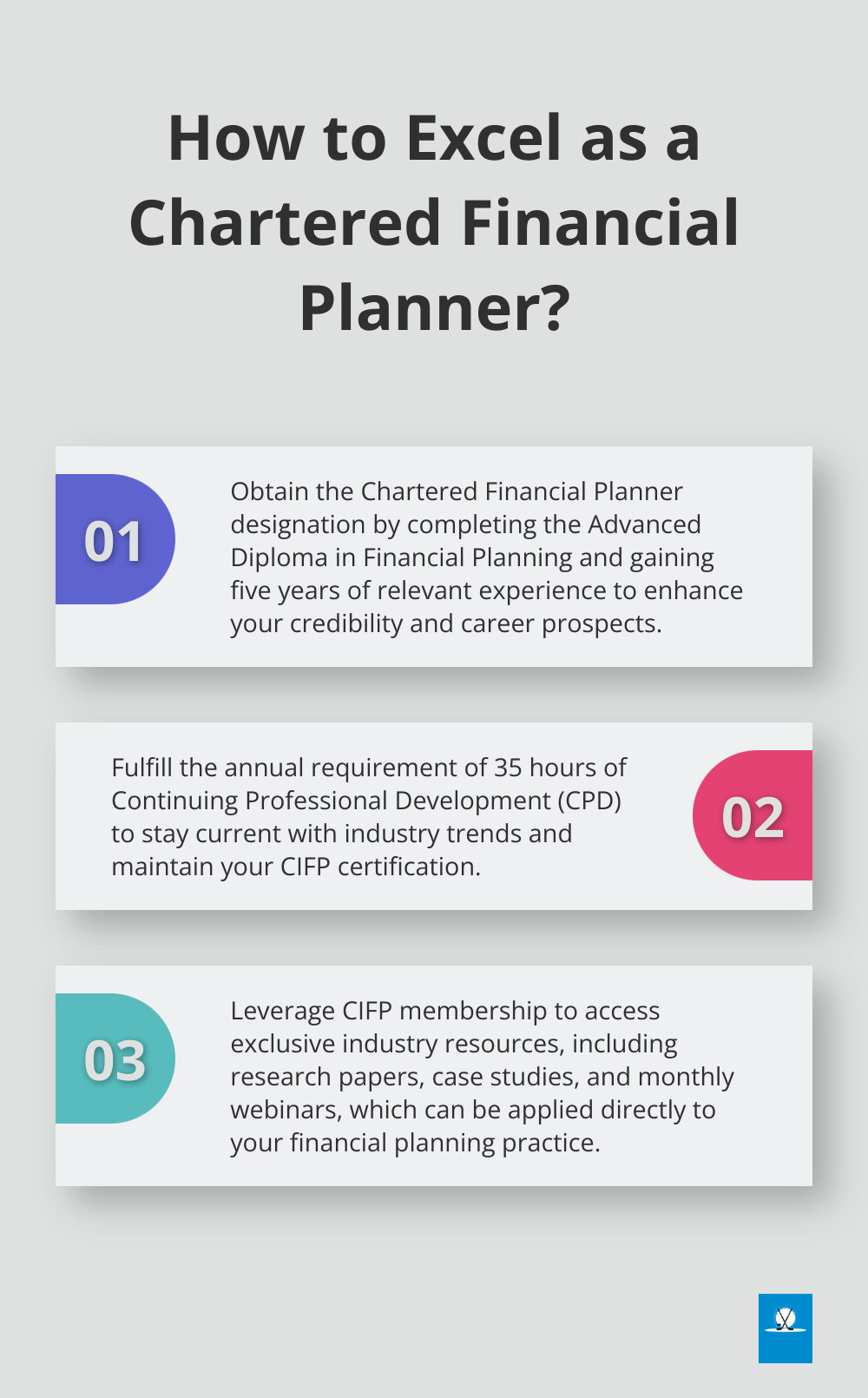

The Chartered Financial Planner designation represents the pinnacle of financial planning qualifications. To attain this status, professionals must complete the Advanced Diploma in Financial Planning and possess at least five years of relevant experience. This qualification showcases expertise and adherence to the highest professional standards.

The RQF Level 6 Advanced Diploma in Financial Planning builds on existing knowledge enabling advisers to develop specialist planning capabilities.

Building a Strong Foundation

The Certificate in Financial Planning provides a solid starting point for those entering the industry or formalizing existing knowledge. This qualification covers essential areas such as:

- Financial products

- Taxation principles

- Investment fundamentals

For professionals seeking to deepen their expertise, the Advanced Diploma in Financial Planning offers an in-depth exploration of complex financial planning topics. This qualification proves particularly valuable for those who want to specialize in areas like pension transfers or investment management.

Embracing Continuous Learning

The financial industry evolves rapidly, and the CIFP recognizes the importance of ongoing education. Their Continuing Professional Development (CPD) programs ensure that certified professionals stay current with the latest industry trends and regulatory changes.

CIFP members must complete a minimum of 35 hours of CPD annually. This commitment to ongoing learning not only maintains certification but also sharpens skills in a competitive market.

The Impact on Career Advancement

Obtaining CIFP qualifications can significantly impact career progression. Professionals with these certifications often find:

- Increased job opportunities

- Higher earning potential

- Enhanced credibility with clients and peers

Specialization Opportunities

CIFP qualifications open doors to various specialization paths within financial planning. These may include:

- Retirement planning

- Estate planning

- Investment management

- Tax optimization

As professionals progress through CIFP qualifications, they can tailor their expertise to specific areas of interest or market demand.

The journey through CIFP qualifications not only enhances individual careers but also elevates the entire financial planning profession. As we explore the benefits of CIFP membership and certification in the next section, you’ll discover how these qualifications translate into tangible advantages for both professionals and their clients.

Unlocking CIFP Membership Perks

Enhanced Professional Credibility

CIFP membership elevates your standing in the financial planning world. A 2023 survey by Financial Planning Today showed that 78% of clients prefer CIFP-certified planners, citing increased trust and confidence in their expertise. This enhanced credibility often leads to a larger client base and more lucrative opportunities.

John Smith, a CIFP member since 2020, reported a 40% increase in his client roster within the first year of certification. He attributes this growth directly to the prestige associated with CIFP membership.

Exclusive Access to Industry Resources

CIFP members gain access to a wealth of industry resources. The institute’s online library contains research papers, case studies, and market analyses. These resources prove invaluable when addressing complex client scenarios or staying ahead of market trends.

The CIFP’s monthly webinars offer insights from industry leaders on topics ranging from regulatory changes to emerging investment strategies. These sessions provide practical knowledge that members can immediately apply to their practice.

Increased Earning Potential

CIFP certification can significantly increase your income. According to the Alberta Learning Information Service, financial planners earn an average salary of $75,982.00 per year or $39.04 per hour. This salary reflects the added value that CIFP certification brings to both individual planners and their firms.

Furthermore, CIFP members report a higher client retention rate compared to non-members. This increased loyalty translates to a more stable income stream and opportunities for long-term client relationships.

Networking Opportunities

CIFP membership opens doors to a vast network of financial planning professionals. The institute organizes regular events, conferences, and workshops (both in-person and virtual) where members can connect, share insights, and explore collaboration opportunities.

These networking events often lead to valuable partnerships, mentorship opportunities, and even job prospects. Many CIFP members credit these connections for significant career advancements and business growth.

Continuous Professional Development

CIFP emphasizes ongoing learning and professional growth. Members have access to a wide range of continuing education programs, workshops, and seminars. These opportunities help members stay current with industry trends, regulatory changes, and emerging financial strategies.

The institute’s commitment to continuous learning ensures that CIFP members remain at the forefront of the financial planning industry, providing clients with the most up-to-date and effective financial advice.

Final Thoughts

The Chartered Institute of Financial Planning (CIFP) sets high standards for education, ethics, and professional conduct in the financial planning industry. CIFP qualifications equip planners to navigate complex financial landscapes and provide top-tier advice to clients. Professional certification proves essential in today’s rapidly evolving market, ensuring planners stay ahead of industry trends and regulatory changes.

CIFP qualifications offer a strategic move for financial professionals who want to elevate their careers. Enhanced credibility, access to industry resources, and networking opportunities can lead to significant career advancements and increased earning potential. The skills and knowledge gained through CIFP certifications enable planners to provide more comprehensive and effective financial advice to their clients.

Pro Hockey Advisors recognizes the value of expert financial planning in the sports industry. We offer tailored financial advice and career management strategies for professional hockey players, agents, and teams. Our team combines specialized knowledge with high industry standards to help clients navigate the unique financial challenges of the hockey world and secure their financial futures.