At Pro Hockey Advisors, we often encounter questions about portfolio diversification. Many investors assume both portfolios A and B are well diversified, but is this always the case?

In this post, we’ll examine the composition, correlation, and risk-return characteristics of two portfolios to determine their diversification levels. Our analysis will reveal key insights to help you make informed investment decisions.

What Is Portfolio Diversification?

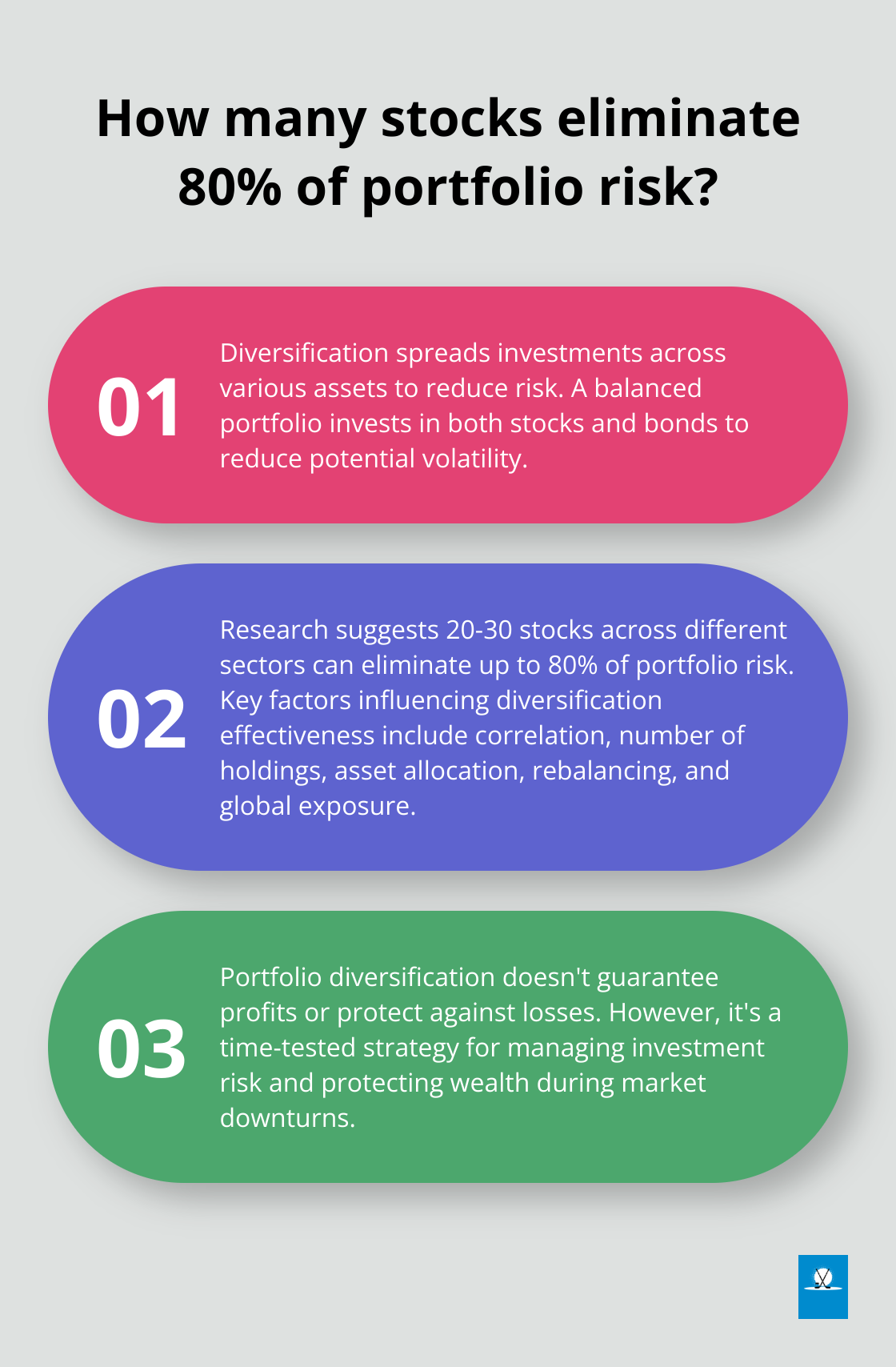

The Essence of Diversification

Portfolio diversification is a strategy investors use to spread their money across various assets to reduce risk. This approach can protect wealth, especially during market downturns.

Diversification means you don’t put all your eggs in one basket. Instead of investing everything in a single stock or sector, you spread your investments across different asset classes, industries, and geographical regions. This strategy tries to maximize returns while minimizing risk.

Consider this scenario: If you invest solely in tech stocks and the tech sector crashes, your entire portfolio takes a hit. But if you’ve diversified across tech, healthcare, real estate, and bonds, the impact of a tech crash is cushioned by the performance of other investments.

The Importance of Risk Management

Risk management is the primary reason for diversification. When you spread investments, you’re less likely to suffer significant losses if one particular investment or sector underperforms.

A balanced portfolio invests in both stocks and bonds to reduce potential volatility. This reduced volatility can help investors maintain their course during market turbulence.

Key Factors Influencing Diversification Effectiveness

Several key factors influence how well your diversification strategy works:

- Correlation: Assets that move in opposite directions (negative correlation) or independently (low correlation) provide better diversification benefits. For instance, stocks and bonds often move in opposite directions, making them a classic diversification pair.

- Number of Holdings: While there’s no magic number, research suggests that a portfolio of 20-30 stocks across different sectors can eliminate up to 80% of the risk in a portfolio.

- Asset Allocation: The mix of stocks, bonds, real estate, and other asset classes in your portfolio significantly impacts your risk-return profile.

- Rebalancing: Regular adjustments of your portfolio back to its target allocation are important.

- Global Exposure: Including international investments can further diversify your portfolio.

Understanding these factors can help you create a more resilient portfolio. Diversification doesn’t guarantee profits or protect against losses, but it’s a time-tested strategy for managing investment risk.

Now that we’ve covered the basics of diversification, let’s examine how these principles apply to Portfolio A in our next section.

Is Portfolio A Well-Diversified?

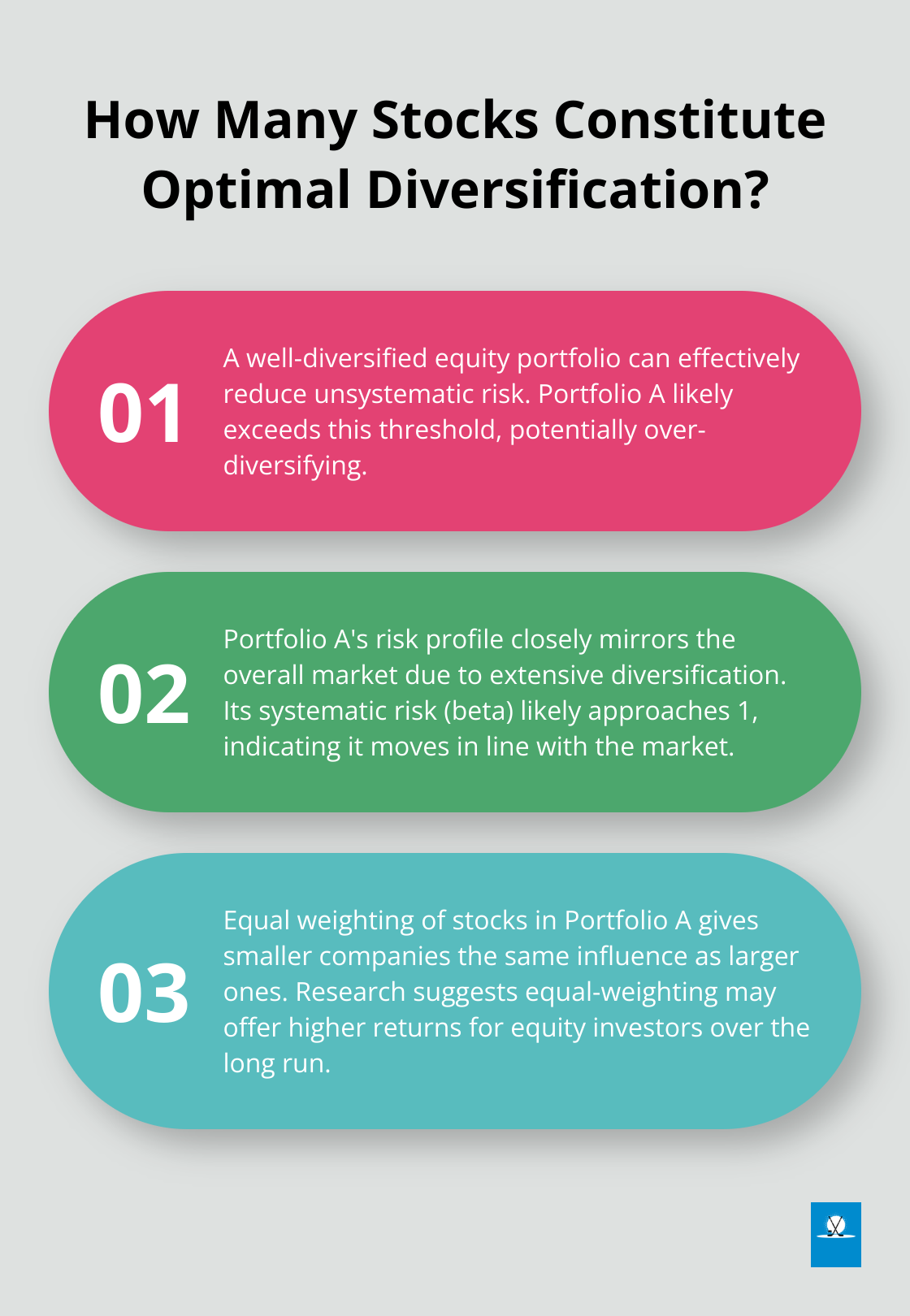

Broad Market Exposure

Portfolio A, with its diverse stocks, exemplifies extensive diversification. This vast collection spans various sectors, industries, and potentially geographical regions, adhering to fundamental diversification principles.

The number of stocks in Portfolio A provides significant market coverage. It likely includes companies of various sizes (from small-cap to large-cap) across multiple sectors. This broad exposure helps mitigate company-specific and industry-specific risks, a key benefit of diversification.

A study by Investopedia suggests that a well-diversified equity portfolio can effectively reduce unsystematic risk. Portfolio A likely exceeds this threshold, potentially over-diversifying. While this extensive diversification minimizes company-specific risk, it may also limit the potential for outperforming the market.

Risk and Return Profile

Portfolio A’s risk profile closely mirrors that of the overall market due to its extensive diversification. Its systematic risk (or beta) likely approaches 1, indicating that it moves in line with the market. This characteristic can benefit investors who seek market-like returns with reduced volatility.

The equal weighting of stocks in Portfolio A introduces an interesting dynamic. Unlike market-cap weighted indexes, equal weighting gives smaller companies the same influence as larger ones. Research suggests that equal-weighting may offer higher returns for equity investors over the long run, although the majority of capital may not be able to access them.

Correlation Considerations

With its numerous stocks, Portfolio A inevitably includes assets with varying degrees of correlation. Some stocks will move in tandem, while others may have low or negative correlations. This mix of correlations contributes to the portfolio’s overall stability.

However, during market-wide events or economic crises, correlations between stocks tend to increase. The 2008 financial crisis demonstrated that even well-diversified portfolios can suffer significant losses when market panic sets in. Portfolio A’s extensive diversification may provide some cushion during such events, but it’s not immune to systemic risks.

Practical Implications

Investors who consider a portfolio similar to Portfolio A must weigh the pros and cons. The extensive diversification offers stability and reduces company-specific risk but may also limit potential for significant outperformance. Additionally, managing a portfolio of numerous stocks can prove complex and potentially costly in terms of transaction fees and rebalancing efforts.

Investors might consider using broad market index funds or ETFs to achieve similar diversification more efficiently. These instruments provide exposure to a wide range of stocks without the need for individual stock selection and management.

Now that we’ve examined Portfolio A’s diversification characteristics, let’s turn our attention to Portfolio B and analyze its composition and risk-return profile.

Is Portfolio B a Concentrated Risk?

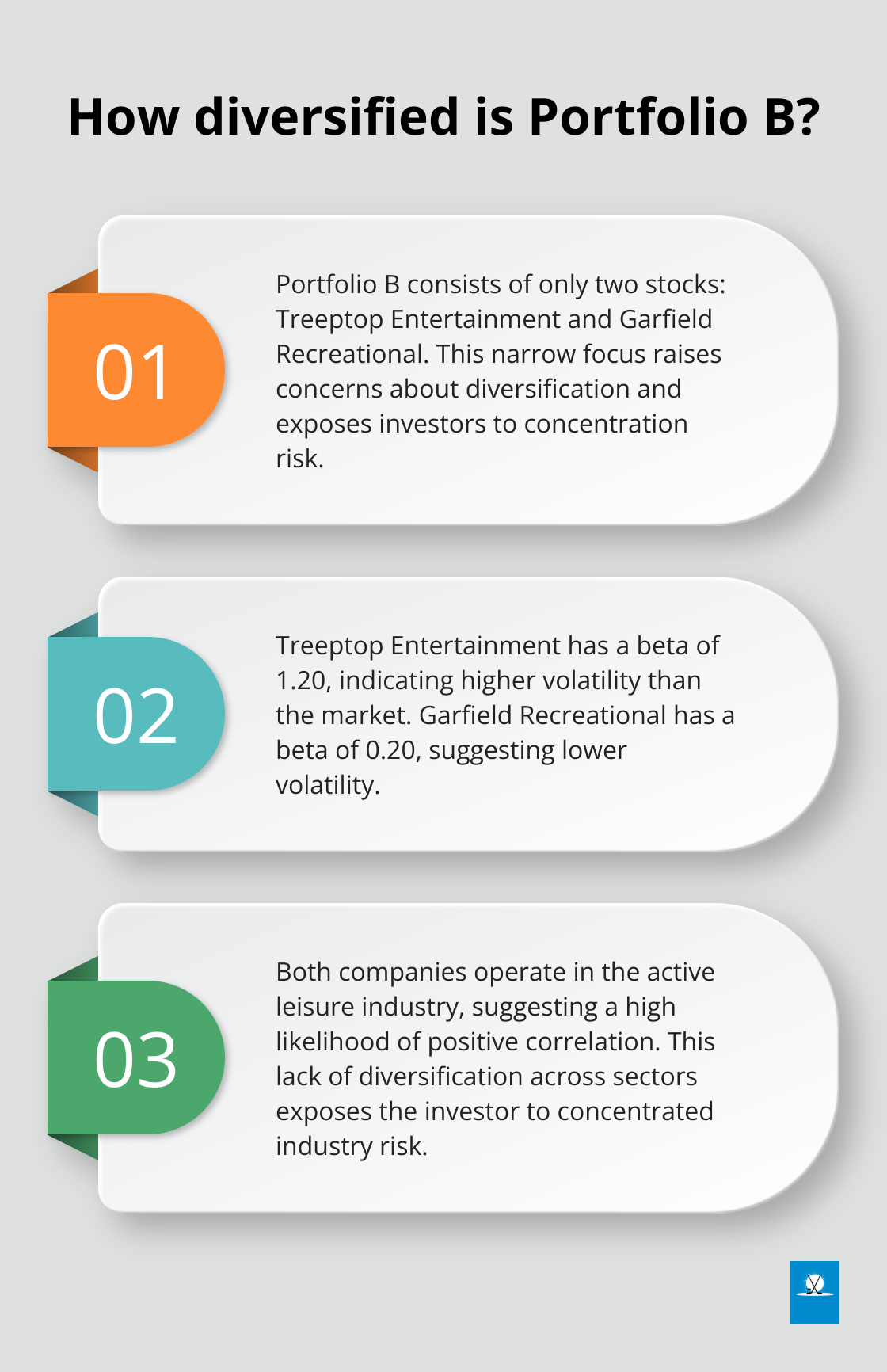

Limited Asset Composition

Portfolio B consists of just two stocks: Treeptop Entertainment and Garfield Recreational. This narrow focus raises concerns about diversification. While concentration can lead to higher returns if these companies perform well, it also exposes investors to concentration risk, which is a kind of downside risk faced when a significant portion of a portfolio is invested in only a few holdings.

Treeptop Entertainment (priced at $11.60 per share) has a beta of 1.20, indicating higher volatility than the overall market. Garfield Recreational (priced at $3.90 per share) has a beta of 0.20, suggesting lower volatility. These differing characteristics provide some risk balancing within the portfolio, but the overall risk remains high due to the limited number of holdings.

Correlation Concerns

The correlation between these two stocks is critical in assessing Portfolio B’s risk profile. Both companies operate in the active leisure industry, which suggests a high likelihood of positive correlation. This means both stocks may move in the same direction in response to industry-specific events or economic factors affecting the leisure sector.

During an economic downturn or a shift in consumer behavior away from active leisure activities, both stocks could suffer simultaneously, leaving the portfolio with no cushion against losses. This lack of diversification across different sectors exposes the investor to concentrated industry risk.

Risk and Return Dynamics

The risk-return profile of Portfolio B differs notably from that of a well-diversified portfolio. The potential for high returns exists if both companies perform exceptionally well. However, the flip side is the possibility of substantial losses if either company faces significant challenges or if the active leisure industry experiences a downturn.

A study by CFA Institute suggests that peak diversification for small-cap portfolios is achieved with around 26 stocks. Portfolio B, with only two stocks, falls far short of this recommendation, leaving it exposed to high levels of unsystematic risk.

The concentrated nature of this portfolio also means that its performance will likely deviate significantly from broad market indices. This can result in periods of outperformance, but also in periods of severe underperformance.

Investor Considerations

Investors who consider a portfolio similar to Portfolio B should carefully evaluate their risk tolerance and investment goals. They might consider expanding their holdings to include stocks from other sectors or adding index funds to increase diversification while maintaining some exposure to their chosen industry.

Such concentrated portfolios may suit investors with a high risk tolerance and deep industry knowledge, but they’re generally not recommended for most investors, especially those seeking stable, long-term growth.

Final Thoughts

Our analysis reveals stark differences in diversification between Portfolio A and Portfolio B. Many investors assume both portfolios A and B are well diversified, but this assumption proves incorrect upon closer examination. Portfolio A, with its 12,000 diverse stocks, exemplifies extensive diversification, while Portfolio B, consisting of only two stocks in the active leisure industry, represents a highly concentrated investment strategy.

The number of holdings and correlation between assets contribute significantly to these diversification differences. Portfolio A’s extensive stock collection provides a cushion against individual stock performance, while Portfolio B’s concentrated nature amplifies the impact of each stock’s movements. Investors with portfolios similar to B should expand their holdings across different sectors and asset classes to improve diversification.

At Pro Hockey Advisors, we understand the importance of diversification in managing risk and optimizing returns. Our team of experts can help you navigate the complexities of portfolio management, ensuring your investments align with your financial goals and risk tolerance. We offer tailored solutions to meet your unique needs, whether you’re a professional hockey player looking to secure your financial future or an industry stakeholder seeking to optimize your investment strategy.