At Pro Hockey Advisors, we understand the importance of safeguarding organizations against potential threats. Risk management frameworks offer a structured approach to identifying, assessing, and mitigating risks.

The benefits of risk management frameworks extend far beyond mere compliance, impacting decision-making, operational efficiency, and stakeholder trust. In this post, we’ll explore these advantages and provide practical steps for implementation.

What Are Risk Management Frameworks?

Definition and Purpose

Risk management frameworks serve as essential tools for organizations to identify, assess, and mitigate potential threats systematically. These frameworks provide a structured approach to manage risks, which enables businesses to make informed decisions and protect their assets effectively.

Core Elements of Effective Frameworks

Effective risk management frameworks typically include several key components:

- Risk Identification: This process involves the systematic cataloging of potential threats.

- Risk Assessment: Organizations evaluate the likelihood and potential impact of each identified risk.

- Risk Mitigation: Strategies are developed to address the identified risks.

- Ongoing Monitoring and Review: This ensures the framework remains effective over time.

Industry-Standard Methodologies

Several widely recognized risk management standards and methodologies exist:

- ISO 31000: Developed by the International Organization for Standardization, this standard provides principles and guidelines for effective risk management.

- COSO ERM: The Committee of Sponsoring Organizations of the Treadway Commission Enterprise Risk Management framework integrates risk management with strategy and performance.

ISO 31000 and COSO ERM are the two most popular risk management standards.

- NIST Risk Management Framework: Created by the National Institute of Standards and Technology, this framework proves particularly useful for managing information security risks.

- PRINCE2: This project management methodology offers a structured approach to risk management integrated into its framework.

Tailoring Frameworks to Your Organization

While standardized frameworks provide excellent starting points, organizations must tailor them to their specific needs. The most effective risk management strategies align closely with an organization’s goals, culture, and operational realities.

Implementing a risk management framework requires customization to fit specific organizational contexts. This tailoring is essential for ensuring the chosen framework addresses the unique challenges and opportunities in your specific context.

As we move forward, we’ll explore the numerous benefits that organizations can reap by implementing a well-structured risk management framework. These advantages extend far beyond mere compliance and can significantly impact an organization’s overall performance and resilience.

Why Risk Management Frameworks Matter

Enhanced Decision-Making

Risk management frameworks provide a structured approach to identify and assess potential threats. This comprehensive view allows leaders to make more informed decisions. A study by Deloitte found that the pressure on revenues from the economic downturn has only increased the desire to reduce risk management expenses, which have been growing continually. This underscores the importance of risk considerations in strategic planning.

Operational Excellence

Organizations can streamline their operations and allocate resources more efficiently when they implement a risk management framework. The risk assessment process often reveals inefficiencies and areas for improvement. A report by PwC indicates that a strong risk culture that moves planning out of silos can help companies stay operationally resilient amid a series of once-in-a-generation risks. A comprehensive framework can address these issues and lead to substantial operational improvements.

Increased Stakeholder Trust

Stakeholder confidence is paramount in today’s business environment. A well-implemented risk management framework demonstrates an organization’s commitment to stability and responsible governance. This transparency can increase trust from investors, customers, and partners. The Committee of Sponsoring Organizations of the Treadway Commission (COSO) reports that organizations with effective risk management frameworks are over 30% more likely to achieve their business objectives.

Competitive Advantage

A risk management framework isn’t just about avoiding pitfalls; it’s about seizing opportunities. Organizations can position themselves to capitalize on favorable market conditions when they systematically identify and address risks. This proactive approach can lead to a significant competitive edge in rapidly changing industries.

Industry-Specific Benefits

In specialized fields (such as professional hockey), risk management frameworks offer unique advantages. They help teams and players navigate complex contract negotiations, manage financial risks, and protect their long-term careers. Pro Hockey Advisors, for instance, leverages risk management principles to provide tailored strategies for clients in the competitive world of professional hockey.

The implementation of a robust risk management framework can transform an organization’s approach to challenges and opportunities. The next section will explore practical steps to put these frameworks into action, ensuring your organization can reap the full benefits of effective risk management.

How to Implement a Risk Management Framework

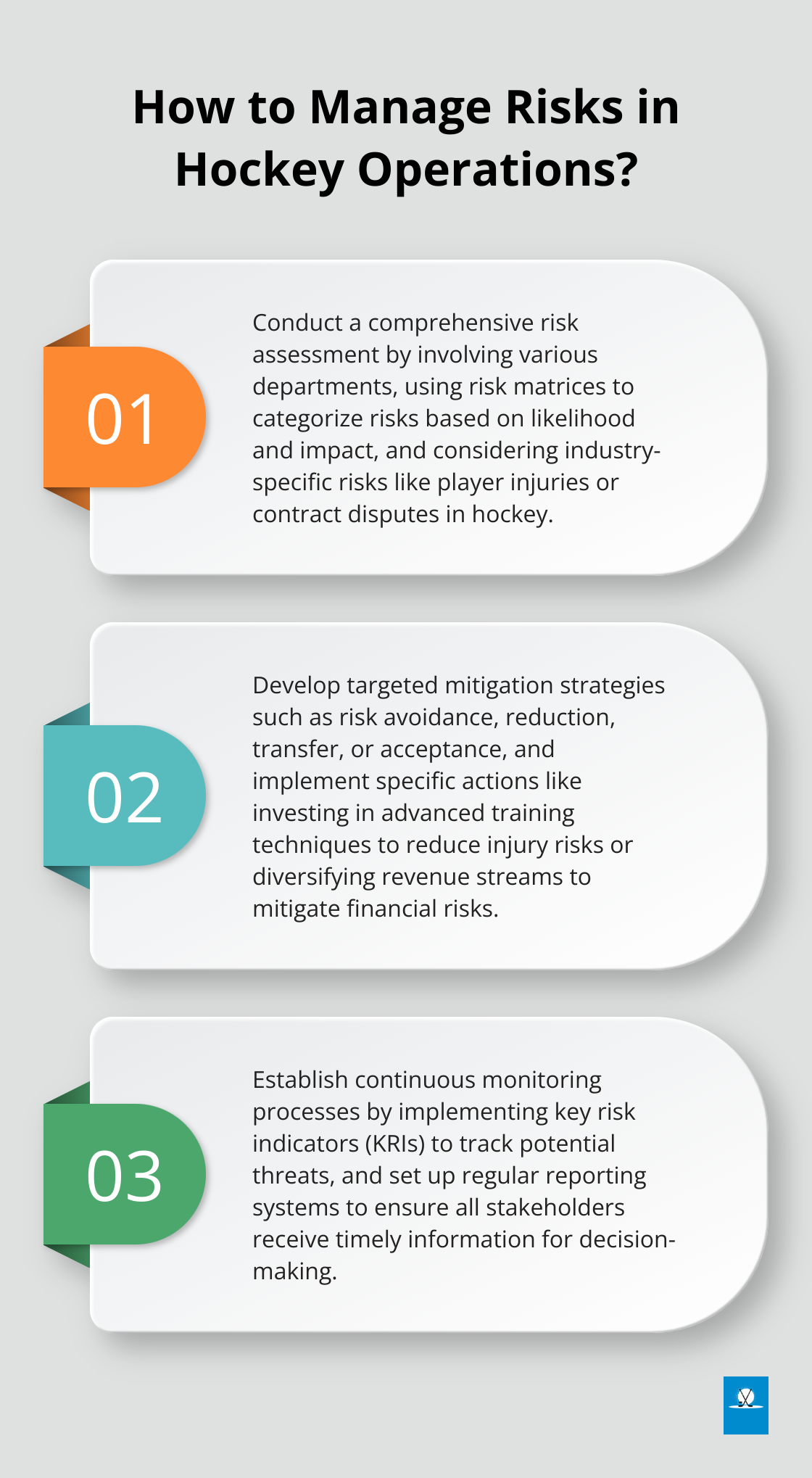

Conduct a Comprehensive Risk Assessment

The first step in implementing a risk management framework is to identify and evaluate potential risks. This process involves input from various departments and stakeholders. Organizations should use tools like risk matrices to categorize risks based on their likelihood and potential impact. In the hockey industry, risks might include player injuries, contract disputes, or changes in league regulations.

A study by Deloitte found that 83% of institutions have an Enterprise Risk Management (ERM) program in place, up from 73% in the prior year’s survey. This finding underscores the importance of a thorough risk assessment.

Develop Targeted Mitigation Strategies

After risk identification, organizations must develop specific strategies to address them. These strategies include:

- Risk avoidance: Eliminate high-risk activities

- Risk reduction: Implement controls to minimize impact

- Risk transfer: Use insurance or contractual agreements

- Risk acceptance: Acknowledge and prepare for unavoidable risks

For instance, a hockey team might invest in advanced training techniques to reduce injury risks or diversify revenue streams to mitigate financial risks.

Establish Monitoring and Reporting Processes

Continuous monitoring is essential for the success of a risk management framework. Organizations should implement key risk indicators (KRIs) to track potential threats. Regular reporting ensures that all stakeholders receive information and can make timely decisions.

Foster a Risk-Aware Culture

Creating a risk-aware culture is perhaps the most challenging yet important aspect of implementing a risk management framework. It involves:

- Leadership commitment: Top management must visibly support and prioritize risk management efforts

- Employee training: Conduct regular workshops and seminars to educate staff about risk management principles

- Open communication: Encourage employees to report potential risks without fear of repercussions

- Incentives: Reward risk-aware behavior and decision-making

Implementing a risk management framework requires commitment, resources, and a willingness to adapt. The benefits (improved decision-making, operational efficiency, and stakeholder trust) outweigh the initial investment. Expert guidance can prove invaluable as organizations embark on this journey. Pro Hockey Advisors stands ready to assist organizations in the hockey industry in developing and implementing robust risk management strategies tailored to their unique needs.

Final Thoughts

A robust risk management framework offers numerous benefits beyond regulatory compliance. Organizations that prioritize risk management gain a competitive edge through enhanced decision-making, improved operational efficiency, and increased stakeholder trust. These frameworks provide a structured approach to identify, assess, and mitigate potential threats, which allows businesses to navigate uncertainties with confidence.

The importance of continuous improvement in risk management cannot be overstated. As the business landscape evolves, organizations must adapt their approach to managing risks. Regular reviews and updates to risk management strategies ensure that companies remain resilient in the face of emerging challenges.

We at Pro Hockey Advisors understand the unique challenges faced by professionals in the hockey industry. Our expertise in risk management and career optimization can help players, agents, and teams navigate the complex world of professional hockey. Our industry-specific knowledge and strategies can help stakeholders maximize their potential and secure long-term success.