Professional athletes face unique financial challenges that require specialized wealth management strategies. At Pro Hockey Advisors, we understand the importance of securing your financial future beyond your playing career.

An athlete wealth management group can provide tailored solutions to help you navigate complex financial landscapes and build long-term wealth. This blog post explores the key aspects of effective wealth management for athletes and how it can safeguard your financial well-being.

Why Athletes Need Specialized Wealth Management

The Unique Financial Landscape for Athletes

Professional athletes navigate a financial terrain unlike any other profession. The average NHL career spans just 5 years (according to the NHL Players’ Association), creating a brief window for high earnings. This short-lived peak income period demands a specialized approach to wealth management.

The High-Stakes Financial Game

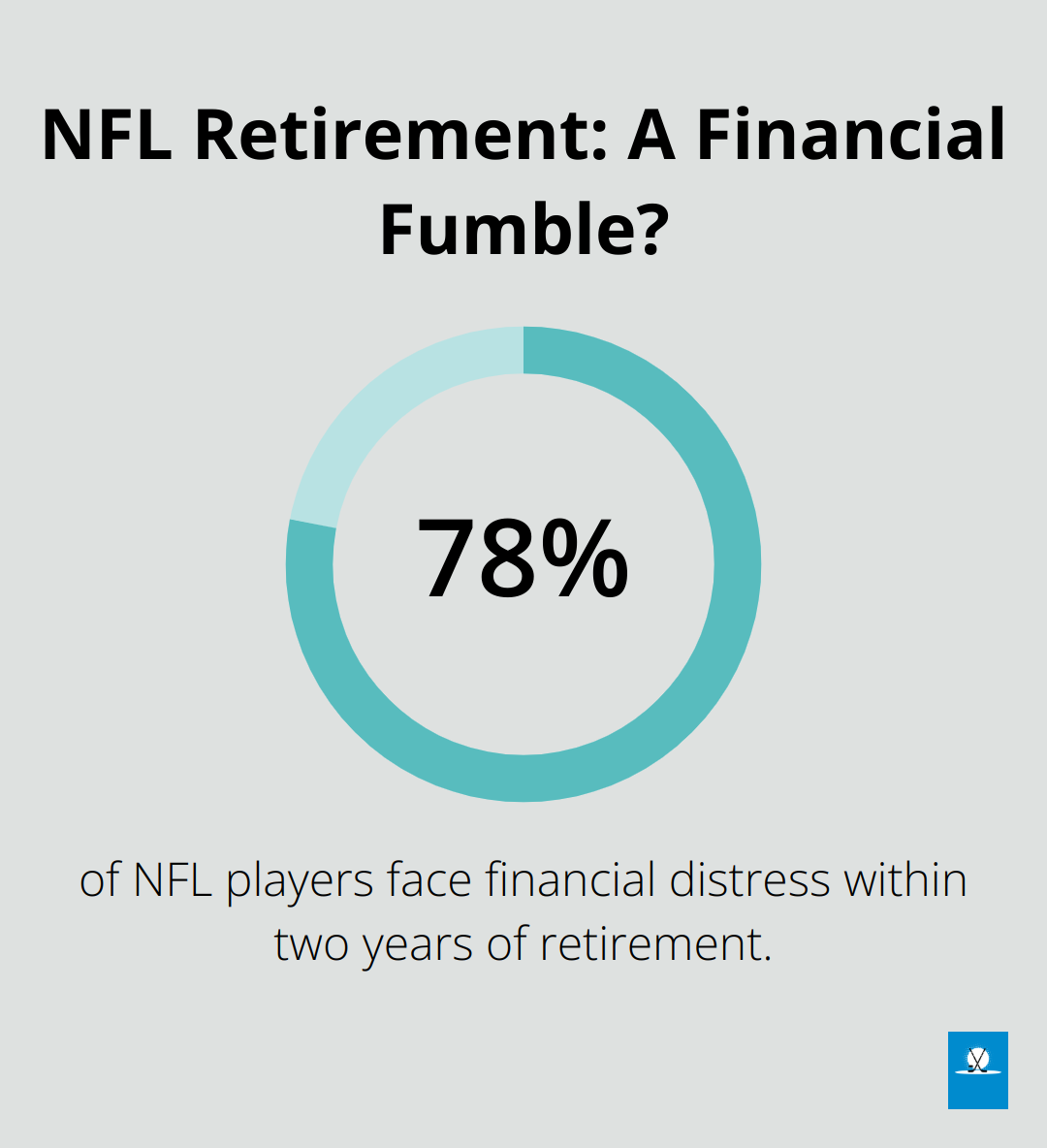

Athletes often experience a sudden influx of wealth at a young age. This rapid increase in income can lead to poor financial decisions if not managed properly. A study by Sports Illustrated revealed a startling statistic: 78% of NFL players face financial distress within two years of retirement. This underscores the critical need for long-term financial planning from the moment an athlete signs their first professional contract.

Planning for Life After Sports

Long-term financial planning is not just important; it’s essential for athletes. The transition from active play to retirement can shock an athlete’s finances. Athletes must prepare for a potentially long retirement, which may start as early as their mid-30s. This requires a strategic approach to savings and investments that can sustain their lifestyle for decades to come.

Key Components of Athlete Wealth Management

Effective athlete wealth management encompasses several key elements:

- Comprehensive Budgeting: Athletes need to create a budget that accounts for both current high earnings and future income uncertainty. Adherence to a useful but not overly restrictive budget can help young athletes manage income uncertainties and prepare for a stable financial future.

- Investment Diversification: A varied investment portfolio helps mitigate risk and ensures long-term financial stability.

- Tax Planning Strategies: Athletes face complex tax situations (often involving multiple state and international tax obligations). Proper tax planning optimizes their financial position.

- Risk Management: Insurance and other risk mitigation strategies protect an athlete’s wealth from unforeseen circumstances.

The Role of Specialized Financial Advisors

Athletes benefit greatly from working with financial advisors who understand the unique challenges of their profession. These specialists can provide tailored advice on contract negotiations, endorsement deals, and post-career planning. While many firms offer wealth management services, Pro Hockey Advisors stands out as a top choice for professional hockey players, providing expert guidance tailored to the specific needs of the sport.

As we move forward, we’ll explore specific strategies that athletes can employ to secure their financial future and make the most of their earnings during their active careers.

Maximizing Athlete Wealth

Smart Investment Strategies

Professional athletes must diversify their income streams for long-term financial security. While sports contracts provide primary income, athletes should explore additional revenue sources. Sponsorships can be a great source of income for star athletes, since they can be sponsored by multiple companies in different industries.

A balanced portfolio should include a mix of assets such as stocks, bonds, real estate, and potentially private equity. According to a 2009 Sports Illustrated article, 78% of NFL players find themselves bankrupt or under financial stress within two years of retirement.

Real estate investments often prove successful for athletes. Many find success in property development or rental income. Former NHL player Brent Ashton built a successful real estate portfolio during his playing years, which now provides steady income post-retirement.

Strategic Tax Management

Athletes face complex tax situations due to playing in multiple states or countries. Working with a tax professional who understands the intricacies of athlete taxation is essential. These experts can help navigate state tax obligations and identify potential deductions.

Establishing residency in a tax-friendly state can result in significant savings. Florida and Texas, for instance, have no state income tax. This strategy alone can save millions over a career (provided all legal requirements for residency are met).

Tax-advantaged accounts like 401(k)s and IRAs offer substantial benefits. The NHL’s pension plan allows players to contribute up to $56,000 annually (as of 2023), providing significant tax benefits and retirement savings.

Wealth Protection Measures

Risk management plays a vital role in an athlete’s financial strategy. Comprehensive insurance coverage should include disability insurance (to protect against career-ending injuries), life insurance (for family protection), and liability insurance (to safeguard against lawsuits).

Setting up trusts or LLCs can protect assets effectively. These legal structures can shield wealth from potential creditors or lawsuits. Sports lawyer Darren Heitner states that properly structured trusts can protect up to 100% of an athlete’s assets in some states.

Early Retirement Planning

The average NHL career lasts only 5 years, making early retirement planning imperative. Athletes should try to save at least 20% of their income during their playing years to prepare for life after sports.

Exploring post-career opportunities can smooth the transition to retirement. Many athletes find success in coaching, broadcasting, or business ventures. Developing these skills and networks during the playing career can prove invaluable.

Working with a specialized wealth management firm can provide tailored advice to secure an athlete’s financial future. These firms understand the unique financial landscape of professional sports and can offer customized strategies.

Effective wealth management requires ongoing attention and adjustment. Regular reviews and updates to financial strategies ensure alignment with changing needs and goals throughout an athlete’s career and beyond.

The next chapter will explore the specific services offered by athlete wealth management groups, providing insight into how these specialized firms can support athletes in achieving their financial goals.

What Services Do Athlete Wealth Management Groups Offer?

Comprehensive Financial Planning

Athlete wealth management groups provide specialized services tailored to the unique financial needs of professional athletes. These services address the specific challenges athletes face throughout their careers and into retirement.

Comprehensive financial planning forms the foundation of athlete wealth management. It is essential for professional athletes who are known for quickly spending their substantial salaries. This planning involves creating a detailed roadmap for an athlete’s financial future, considering current earnings, future income potential, and long-term goals. Wealth management groups use sophisticated modeling tools to project an athlete’s financial trajectory, accounting for various scenarios (including injury risks, career longevity, and post-retirement income needs).

Investment Management and Risk Mitigation

Investment management plays a key role in athlete wealth services. As of October 28, 2024, establishing an automated savings strategy helps many athletes direct a significant portion of their income directly into investments and savings accounts. Due to the short career spans and high earnings of professional athletes, investment strategies often prioritize capital preservation and steady growth over high-risk approaches.

Many wealth management groups employ teams of investment professionals who specialize in creating diversified portfolios. These portfolios typically include a mix of stocks, bonds, real estate, and sometimes alternative investments (such as private equity or hedge funds). The objective is to generate consistent returns while protecting against market volatility.

Risk mitigation extends beyond financial risk management to include protection against potential lawsuits or creditors. Wealth management groups often collaborate with legal professionals to establish trusts, LLCs, or other legal structures to safeguard an athlete’s assets.

Cash Flow and Lifestyle Management

Effective budgeting and cash flow management are essential services provided by athlete wealth management groups. These professionals help athletes balance their current lifestyle needs with long-term financial goals. This often involves creating detailed budgets that account for both essential expenses and discretionary spending.

Many groups offer concierge-style services to help athletes manage their day-to-day finances. These services can include bill payment, expense tracking, and assistance with major purchases like homes or vehicles. The goal is to ensure that athletes maintain financial discipline while still enjoying the benefits of their success.

Estate Planning and Wealth Transfer

Estate planning is an often overlooked aspect of athlete wealth management. Given the potential for high net worth at a young age, athletes need to consider how their wealth will transfer in the event of their death or incapacitation.

Wealth management groups work with estate planning attorneys to create comprehensive plans that may include wills, trusts, and other legal instruments. These plans ensure that an athlete’s wishes are carried out and help minimize estate taxes while protecting assets for future generations.

Final Thoughts

Professional athletes face unique financial challenges that require specialized wealth management strategies. The short career spans, high earnings, and complex tax situations demand a tailored approach to secure long-term financial stability. An athlete wealth management group plays a vital role in navigating these challenges and ensures a prosperous future beyond the playing field.

These experts understand the intricacies of an athlete’s financial landscape and provide personalized strategies for income diversification, tax optimization, and risk management. They help athletes make informed decisions about investments, retirement planning, and estate management, which protects and grows their wealth over time. Pro Hockey Advisors offers expert consulting services tailored specifically for professional hockey players, focusing on career management, contract negotiations, financial planning, and marketing strategies.

Athletes should take proactive steps towards financial security as early as possible, given the unpredictable nature of sports careers. Engaging with an athlete wealth management group allows athletes to develop a comprehensive financial plan that addresses their unique needs and goals. This approach mitigates risks, maximizes earnings, and ensures a smooth transition into life after sports.