Starting a property management business can be a lucrative venture, but understanding the various income streams is crucial for success. At Pro Hockey Advisors, we’ve seen many entrepreneurs dive into this field without a clear grasp of its financial intricacies.

This guide will break down the key sources of property management business income and provide strategies for maximizing revenue. We’ll also address common financial challenges and offer practical solutions to help you build a thriving property management enterprise.

How Do Property Managers Make Money?

Property management businesses generate income through various channels. Each channel contributes to the overall profitability of the enterprise. Understanding these income streams is essential for anyone who wants to start or grow a property management company.

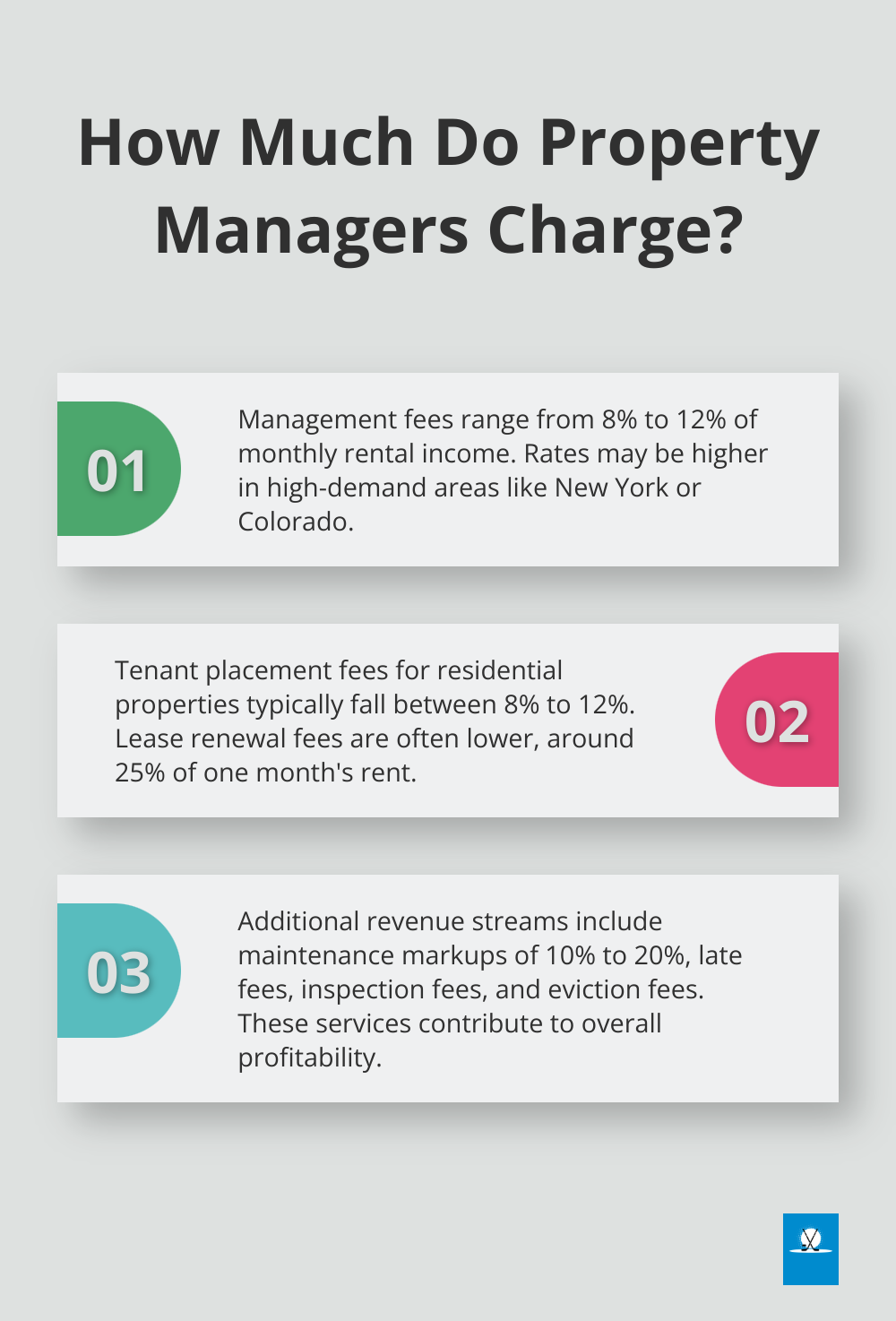

Management Fees: The Core Revenue Source

The primary income for property managers comes from management fees. These fees typically range from 8% to 12% of the monthly rental income, though rates can vary based on location and services provided. For example, in high-demand areas like New York or Colorado, fees might be on the higher end due to increased competition and operational costs.

Some property managers opt for a flat fee structure instead of a percentage. This approach can be more predictable for property owners and potentially more profitable for managers, especially when dealing with high-value properties. However, it’s important to ensure that the flat fee adequately covers your costs and provides a reasonable profit margin.

Tenant Placement and Leasing Fees

Another significant income source is tenant placement fees. Property managers charge these fees when they successfully find and place a new tenant in a rental property. The rate can vary significantly based on location, property type, and services provided, but it usually falls between 8% to 12% for residential properties.

Leasing fees may also apply for lease renewals, though these are generally lower than new tenant placement fees. Some property managers charge a reduced fee, such as 25% of one month’s rent, for renewals to incentivize property owners to retain their services long-term.

Additional Revenue Streams

Property managers can increase their income by offering value-added services. These might include:

- Maintenance and repair markups: Many property managers charge a markup on maintenance and repair services (typically 10% to 20% above the cost). This covers the time spent coordinating these services and can be a substantial income source, especially for larger portfolios.

- Late fees and penalties: While not a primary income source, late fees can contribute to overall revenue. It’s important to structure these fees in compliance with local regulations and to clearly communicate them to tenants.

- Inspection fees: Charging for regular property inspections can be another income stream, especially for managers overseeing large or luxury properties that require more frequent and detailed inspections.

- Eviction fees: While not a pleasant aspect of the business, charging for handling evictions can compensate for the time and effort involved in these complex processes.

Property management businesses can build a stable and profitable operation through diversifying income streams and carefully structuring fees. It’s important to regularly review and adjust your fee structure to ensure it remains competitive while covering your costs and providing a healthy profit margin.

The next section will explore strategies to maximize revenue in property management, including implementing value-added services and utilizing technology for increased efficiency.

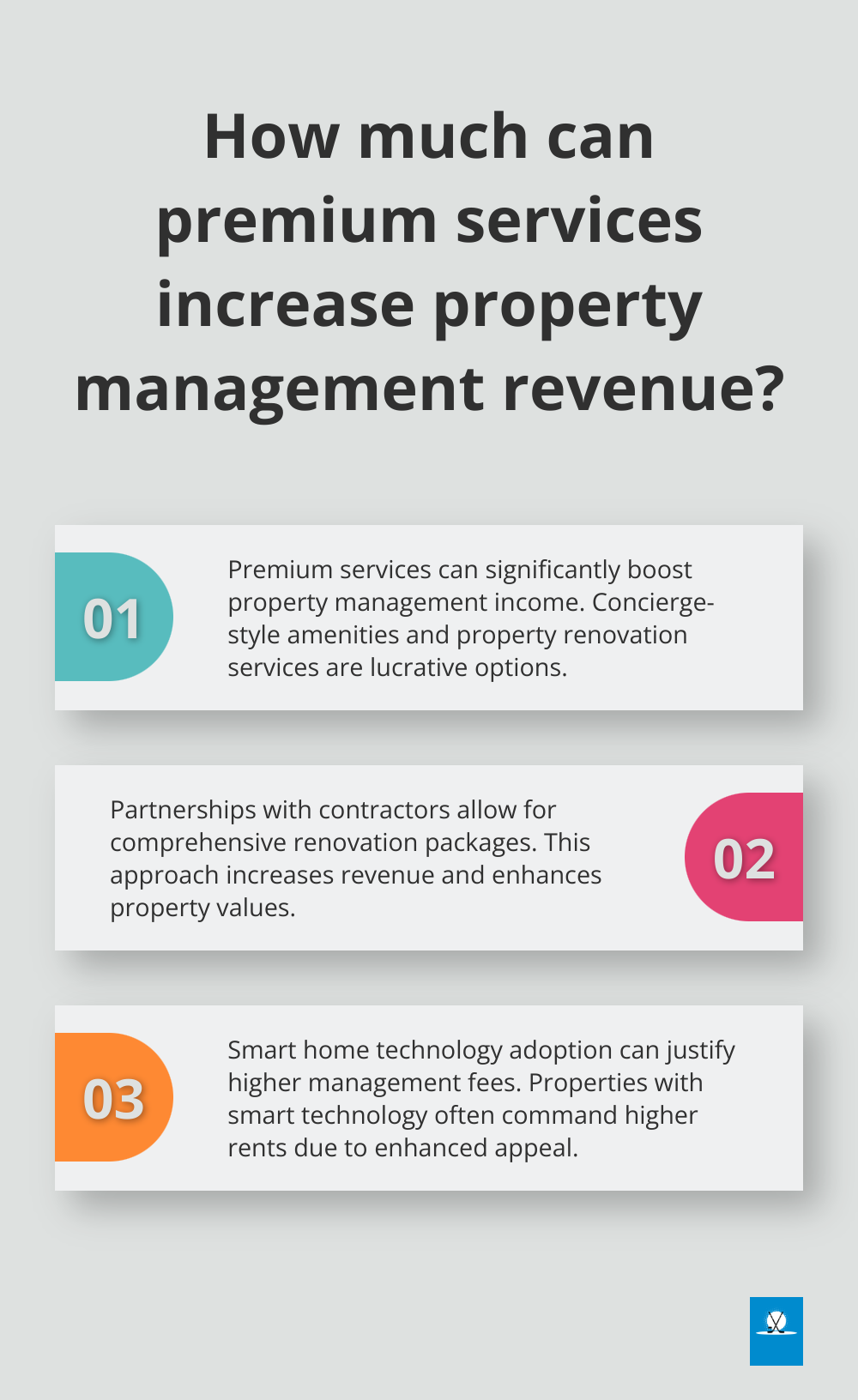

How Property Managers Can Boost Their Revenue

Offer Premium Services

Property managers can significantly increase their income by offering premium services. These include concierge-style amenities for high-end properties, such as arranging housekeeping, coordinating home repairs, or managing short-term rentals during vacancies. Offering premium services can help redefine property management revenue and position a company among the top performers in the industry.

Property renovation and improvement services present another lucrative option. Partnerships with trusted contractors allow property managers to offer comprehensive renovation packages to property owners. This approach not only increases revenue but also enhances property values, potentially leading to higher rents and management fees.

Leverage Technology for Efficiency

The right technology can dramatically improve operational efficiency, allowing property managers to handle more properties with the same resources. Property management software (such as Buildium or AppFolio) automates many time-consuming tasks including rent collection, maintenance requests, and financial reporting.

Smart home technology adoption in managed properties can also be a game-changer. Properties equipped with smart technology often command higher rents due to their enhanced appeal and functionality. This can justify increased management fees due to the added complexity of managing these systems.

Expand Your Portfolio Strategically

Portfolio growth directly increases revenue, but strategic expansion is key. Property managers should focus on properties that align with their expertise and operational capabilities. For instance, those who excel in managing single-family homes might find expansion into multi-family units or commercial properties requires additional resources and expertise.

Geographic expansion requires careful consideration. While it opens new markets, it also presents challenges. Careful planning and market research are essential when considering expansion to new areas.

Build Strong Owner Relationships

Strong relationships with property owners prove essential for long-term success and revenue growth. Regular, transparent communication about property performance, market trends, and improvement opportunities leads to increased trust and potentially more properties under management.

A robust reporting system that provides owners with clear, actionable insights about their properties not only justifies management fees but also positions the property manager as a valuable investment partner. Providing comprehensive reports to owners can significantly impact client retention and overall business success.

These strategies can help property managers significantly boost their revenue while enhancing value for both property owners and tenants. The next section will address common financial challenges in property management and provide practical solutions to overcome them.

Mastering Financial Hurdles in Property Management

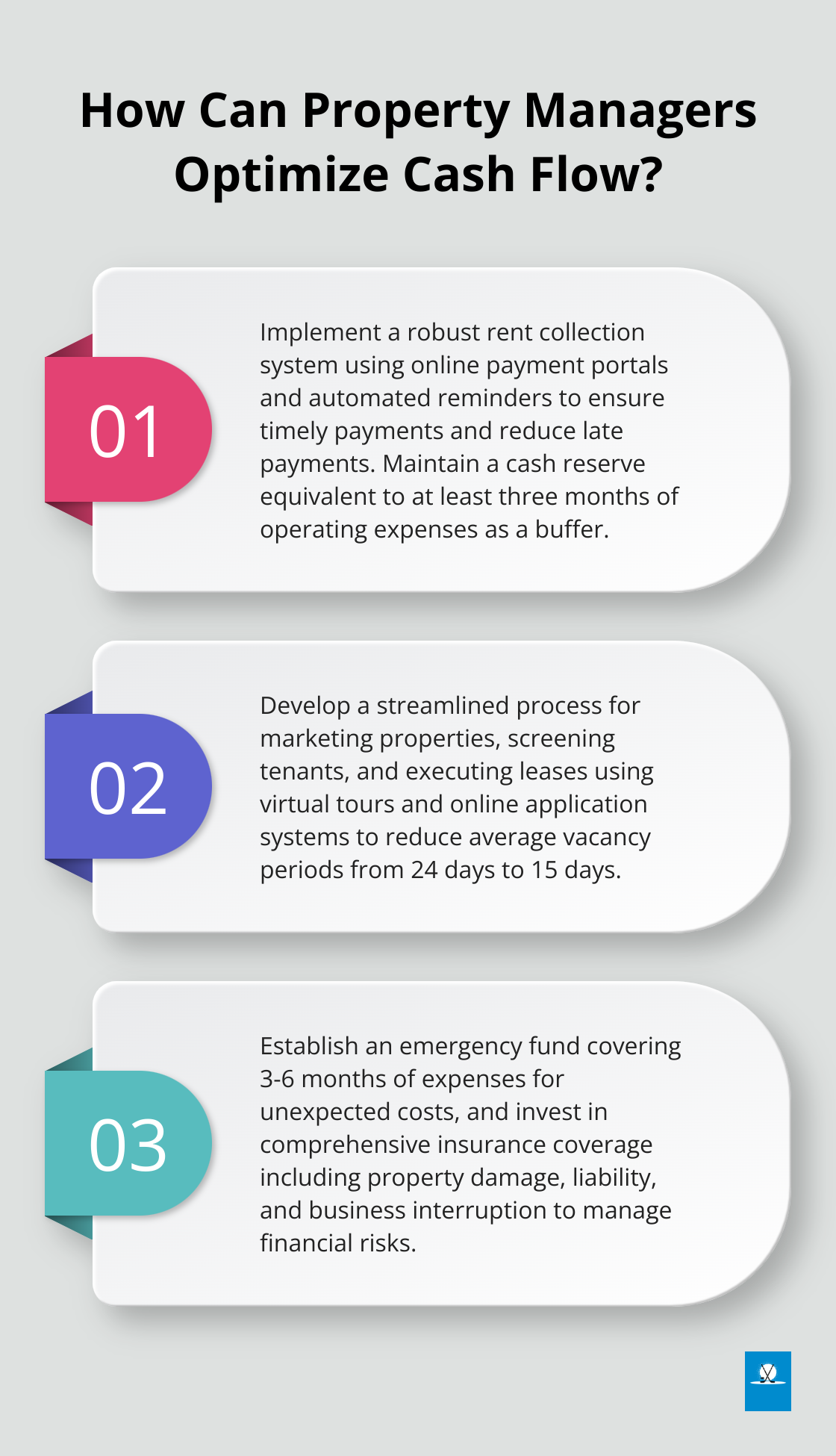

Stabilize Cash Flow

Cash flow management forms the foundation of any property management business. Irregular income patterns, coupled with consistent expenses, can create significant stress on finances. To combat this, implement a robust rent collection system. Online payment portals and automated reminders can help ensure timely payments and reduce the risk of late payments and disputes.

Negotiate favorable payment terms with vendors to align cash outflows with inflows, reducing strain on working capital. Maintain a cash reserve equivalent to at least three months of operating expenses to provide a buffer during lean periods.

Minimize Vacancy Impact

Vacancies pose a significant threat to a property management company’s financial health. The National Association of Residential Property Managers reports an average vacancy rate of 7% in the U.S. To reduce this impact, implement a proactive tenant retention program. This could include incentives for lease renewals, regular property improvements, and open communication with tenants.

When vacancies occur, act quickly. Develop a streamlined process for marketing properties, screening tenants, and executing leases. Many successful property managers use virtual tours and online application systems to reduce the time between tenants (some companies report reducing their average vacancy period from 24 days to just 15 days with these technologies).

Weather Unexpected Expenses

Unexpected expenses can quickly derail financial plans. Whether it’s a major repair, legal fees from a tenant dispute, or damage from a natural disaster, these costs can be substantial. Establish an emergency fund specifically for these situations. A general rule of thumb is to set aside about 3-6 months of expenses for unexpected costs.

Insurance serves as another critical tool for managing financial risk. Ensure comprehensive coverage that includes property damage, liability, and business interruption. While it might seem like an unnecessary expense, the right insurance policy can save your business from financial ruin in the face of a major incident.

Implement Robust Accounting Practices

Effective accounting practices underpin financial success in property management. Invest in a comprehensive property management software system that can handle everything from rent collection to expense tracking. These systems not only save time but also provide real-time financial insights that can inform decision-making.

Conduct regular financial audits. Perform monthly reconciliations and quarterly financial reviews. This practice helps catch errors early and provides a clear picture of your company’s financial health. Many successful property management companies also engage external accountants for annual audits, which can provide valuable insights and ensure compliance with tax regulations.

Final Thoughts

Property management business income offers diverse opportunities for entrepreneurs. Management fees, tenant placement, and value-added services form the core revenue streams. Property managers must optimize these channels and embrace technology to thrive in this competitive industry. The property management sector will surpass $26 billion by 2026, but success depends on adaptability and innovation.

Property managers who prioritize customer service and stay ahead of market trends will capitalize on this growth. They should focus on diversification, efficiency, and building strong relationships with property owners. Implementing robust accounting practices and maintaining adequate cash reserves will help navigate financial challenges (such as vacancies and unexpected expenses).

At Pro Hockey Advisors, we understand the importance of expert guidance in complex industries. While we specialize in professional hockey, the principles of strategic planning, financial management, and relationship building apply across various sectors. Property managers can build thriving, profitable businesses by applying these principles and staying informed about industry trends.