At Pro Hockey Advisors, we know that building diversified portfolios that outperform out-of-sample is a key goal for many investors. Diversification is a powerful strategy to manage risk and potentially enhance returns.

In this guide, we’ll explore the essential components and strategies for creating a well-balanced investment portfolio. We’ll cover everything from asset allocation to advanced techniques like factor investing, helping you make informed decisions about your financial future.

What Is Portfolio Diversification?

The Essence of Diversification

Diversification stands as a fundamental principle of intelligent investing. It involves spreading investments across various assets to mitigate risk. This strategy embodies the wisdom of not putting all your eggs in one basket, applied to your financial future.

Asset Allocation: The Foundation of Diversification

Asset allocation divides investments among different asset classes, typically including stocks, bonds, real estate, and cash. A seminal 1986 study found that in portfolios with broadly diversified holdings, the mix of assets will determine both the aggregate returns and their variability. This underscores the significant impact of how you distribute your money among different investment types, far outweighing the importance of individual stock selection or market timing.

Consider this: a portfolio with a 60/40 split between stocks and bonds has historically yielded an average annual return of 8.7%, with lower volatility than an all-stock portfolio. This balance allows investors to capture growth while providing a buffer against market downturns.

Global and Sector Diversification

Diversification extends beyond asset classes to include geographic and sector considerations. International investments offer growth opportunities and serve as a hedge against domestic economic slumps. For example, in 2022, while the S&P 500 experienced a decline of 18.11%, the MSCI Emerging Markets Index only fell by 2.5%, illustrating the potential advantages of global diversification.

Sector diversification involves investing across different industries. Technology stocks might thrive one year, while healthcare outperforms the next. Spreading investments across sectors reduces the risk of significant losses due to industry-specific downturns.

Risk Reduction and Return Enhancement

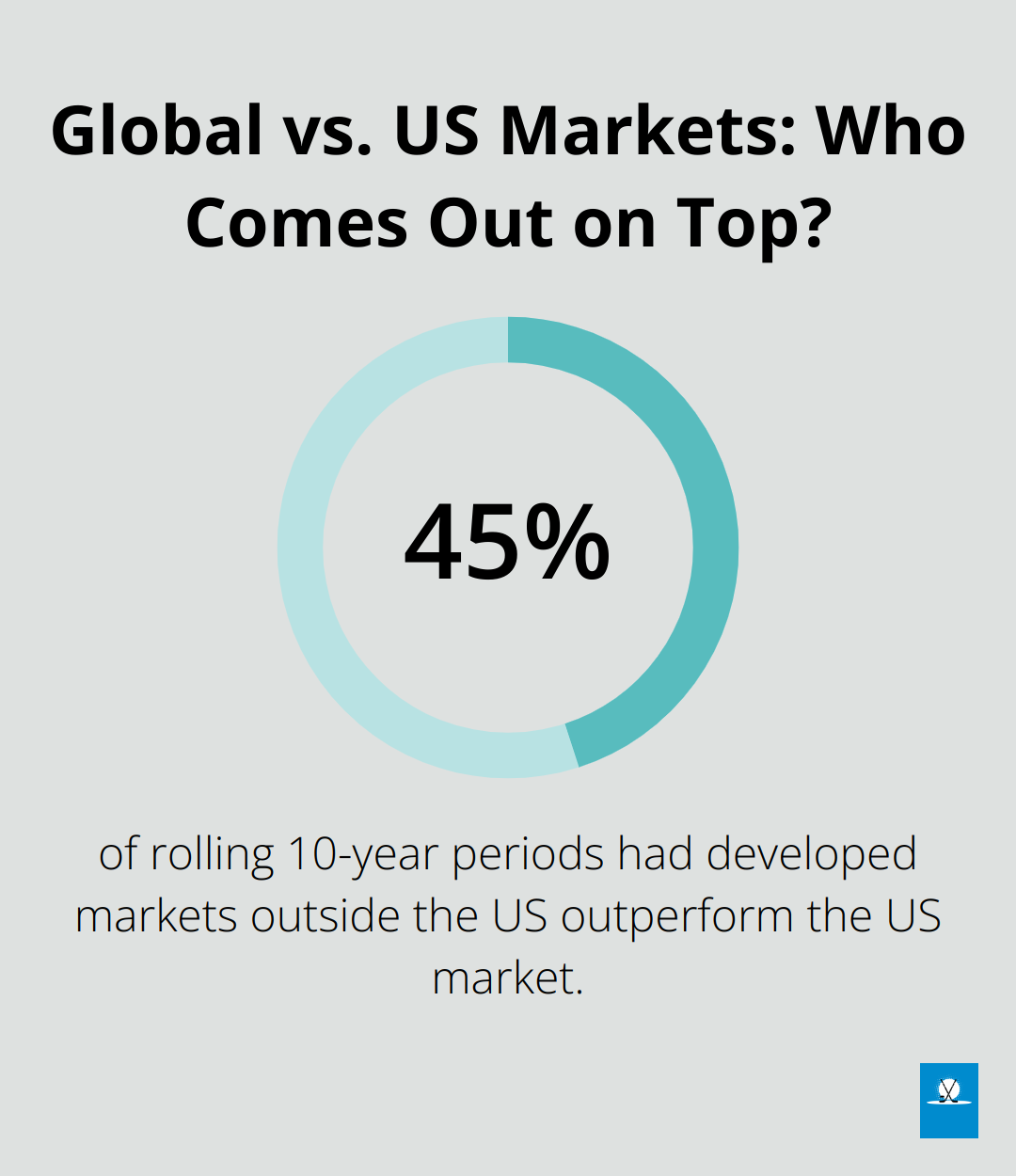

Diversification not only reduces risk but can also boost returns. Over 45% of rolling 10-year periods had developed markets outside the US outperform the US market, including 3 of the last 5 “full decades”. This data highlights the long-term benefits of a well-diversified approach.

The Pro Hockey Advisors Perspective

At Pro Hockey Advisors, we understand the importance of diversification in building resilient portfolios. Our approach to diversification helps clients in the volatile world of professional sports protect and grow their wealth. We spread investments across various asset classes, geographies, and sectors to create portfolios that can withstand market fluctuations and capitalize on global opportunities.

As we move forward, we’ll explore the key components that make up a truly diversified portfolio, including stocks, bonds, and alternative investments. Understanding these elements will provide you with the tools to construct a portfolio that aligns with your financial goals and risk tolerance.

What Makes a Truly Diversified Portfolio?

A well-diversified portfolio forms the foundation of successful investing. Let’s explore the key components that create a robust investment strategy.

Stocks: The Growth Engine

Stocks often drive portfolio growth. U.S. stocks have historically returned about 10% annually before inflation. However, diversification within stock holdings is essential.

Growth stocks, typically from companies that reinvest profits for expansion, can provide substantial returns but come with higher volatility. Value stocks are often more stable and may offer dividends. A mix of both balances a portfolio’s risk and return profile.

Market capitalization also matters. Large-cap stocks, like those in the S&P 500, offer stability and consistent returns. Small-cap stocks, while more volatile, have historically outperformed large-caps over extended periods.

Bonds: The Stabilizers

Bonds counterbalance stocks, provide income, and reduce overall portfolio volatility. Government bonds, particularly U.S. Treasuries, rank among the safest investments. Corporate bonds typically offer higher yields but increase risk. Municipal bonds can provide tax advantages for some investors.

The bond portion of a portfolio should align with risk tolerance and investment horizon. A common rule subtracts an investor’s age from 100 to determine the percentage of stocks in the portfolio, with the remainder in bonds. However, this serves only as a starting point and requires adjustment based on individual circumstances.

Alternative Investments: Diversification Boosters

Alternative investments further diversify portfolios and potentially enhance returns. Real Estate Investment Trusts (REITs) have historically provided strong returns and a hedge against inflation.

Commodities, such as gold or oil, can offer protection during times of high inflation or economic uncertainty. However, they should typically comprise only a small portion of a portfolio due to their volatility.

Hedge funds and private equity can provide sophisticated strategies and access to non-public markets, but they often come with high fees and minimum investment requirements. These suit high-net-worth individuals or institutional investors better.

Cash and Equivalents: The Safety Net

While cash doesn’t offer significant returns (especially in low-interest environments), it provides liquidity and stability. Money market funds and short-term government securities are common cash equivalents that offer slightly higher yields than savings accounts while maintaining high liquidity.

A general guideline suggests keeping 3-6 months of living expenses in cash or cash equivalents as an emergency fund. This can prevent forced selling of other assets during market downturns or personal financial crises.

Now that we’ve covered the building blocks of a diversified portfolio, let’s explore strategies to construct and manage these portfolios for optimal performance.

How to Build a High-Performing Diversified Portfolio

Tailor Asset Allocation to Your Risk Profile

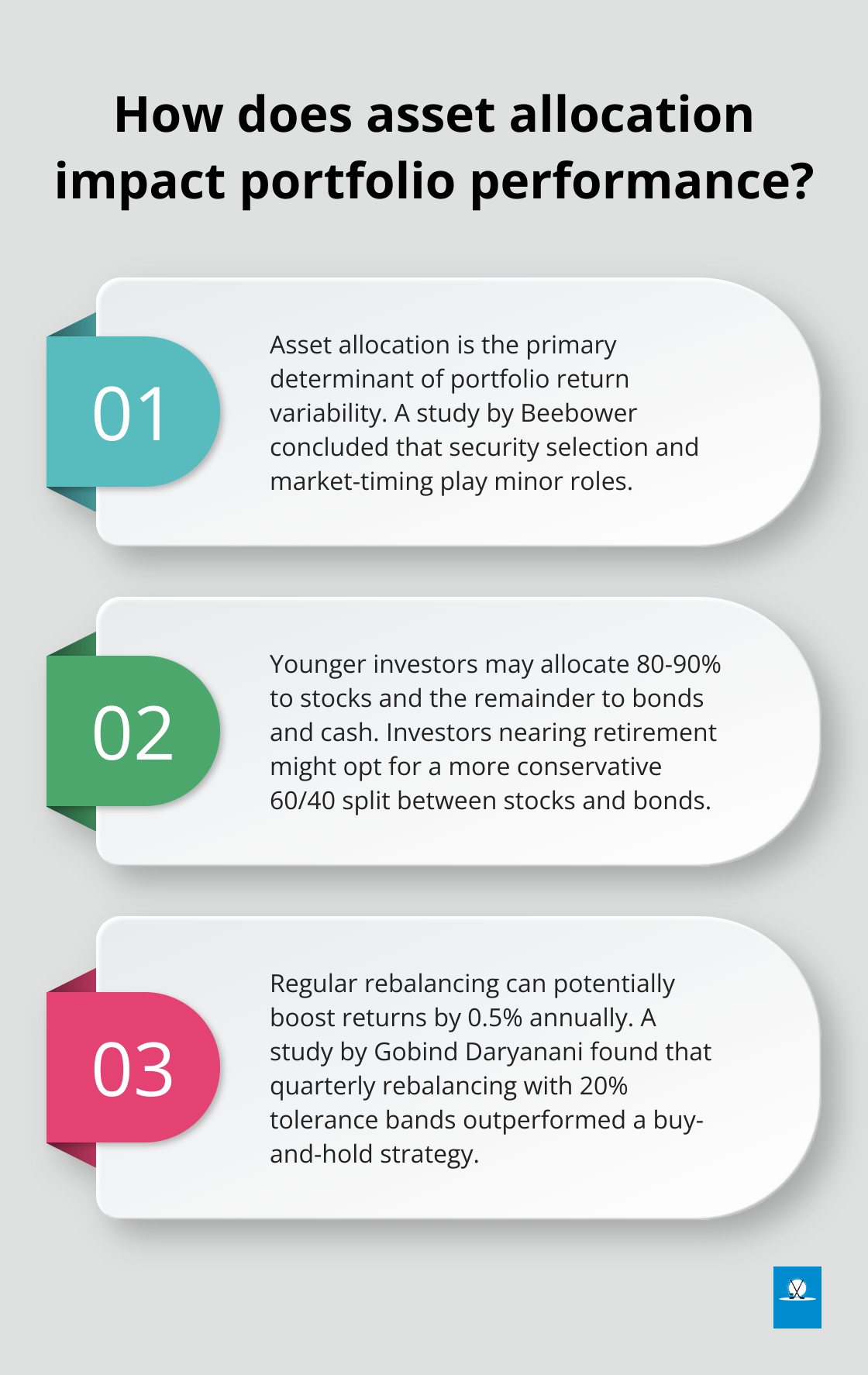

The first step in building an outperforming portfolio is to align your asset allocation with your risk tolerance and investment goals. A study by Beebower concluded that asset allocation is the primary determinant of a portfolio’s return variability, with security selection and market-timing playing minor roles. This underscores the importance of getting this fundamental aspect right.

For younger investors or those with a higher risk tolerance, a portfolio weighted more heavily towards stocks may be appropriate. For instance, a 25-year-old hockey player might allocate 80-90% to stocks and the remainder to bonds and cash. In contrast, a player nearing retirement might opt for a more conservative 60/40 split between stocks and bonds.

Implement Strategic Rebalancing

Regular rebalancing maintains your target asset allocation and can potentially boost returns. A study by Gobind Daryanani in the Journal of Financial Planning found that quarterly rebalancing with 20% tolerance bands resulted in an average 0.5% increase in annual returns compared to a buy-and-hold strategy.

We recommend rebalancing at least annually, or when asset allocations drift more than 5% from their targets. This approach helps capture gains from outperforming assets while reinvesting in undervalued ones.

Maximize Returns with Dollar-Cost Averaging

For athletes with regular income streams, dollar-cost averaging can be an effective strategy. This involves investing a fixed amount at regular intervals, regardless of market conditions. A Vanguard study showed that while lump-sum investing has historically outperformed in two-thirds of the cases, dollar-cost averaging can reduce the impact of volatility and the risk of investing at market peaks.

Setting up automatic investments from salaries ensures consistent contributions to portfolios throughout playing careers.

Enhance Performance with Factor Investing

Factor investing can give your portfolio an edge. This strategy involves targeting specific attributes or factors that have been shown to deliver higher returns over time. The most well-known factors include value, size, momentum, quality, and low volatility.

The Fama and French Three-Factor model expanded the CAPM to include size risk and value risk to explain differences in diversified portfolio returns.

Try to incorporate factor investing by including allocations to ETFs or mutual funds that target these specific factors. For example, a small-cap value fund might capture both the size and value premiums.

Adapt to Market Conditions

Successful portfolio management requires ongoing monitoring and adjustment. Economic cycles, geopolitical events, and changes in personal circumstances can all necessitate shifts in strategy.

The COVID-19 pandemic provided a stark example of the need for adaptability. Investors who rebalanced their portfolios during the March 2020 market downturn, shifting assets from bonds to stocks, saw significant gains as markets rebounded.

Continuous assessment of market conditions and adjustment of portfolios accordingly ensures they remain positioned for long-term success while navigating short-term market fluctuations.

Final Thoughts

Building diversified portfolios that outperform out-of-sample challenges investors but offers significant rewards. Effective diversification reduces risk, protects against market downturns, and enhances potential for steady long-term growth. Regular portfolio reviews and rebalancing ensure investments align with financial goals and risk tolerance as market conditions and personal circumstances change.

Every investor faces unique situations, making professional guidance valuable for navigating portfolio management complexities. Pro Hockey Advisors provides personalized financial planning and investment strategies for professional hockey players and industry stakeholders. Our expertise helps build robust, diversified portfolios designed to withstand market volatility and capitalize on growth opportunities.

Successful investing requires a long-term perspective and informed decision-making. Embracing diversification, staying informed, and seeking expert advice when needed position investors for long-term financial success. Take time to review your portfolio, consider your goals, and make informed decisions to secure your financial future.